Free Self-Employed Tax Calculator

Tax calculation for self-employed professionals in Portugal

# Tax AssistantWhat is Free Self-Employed Tax Calculator?

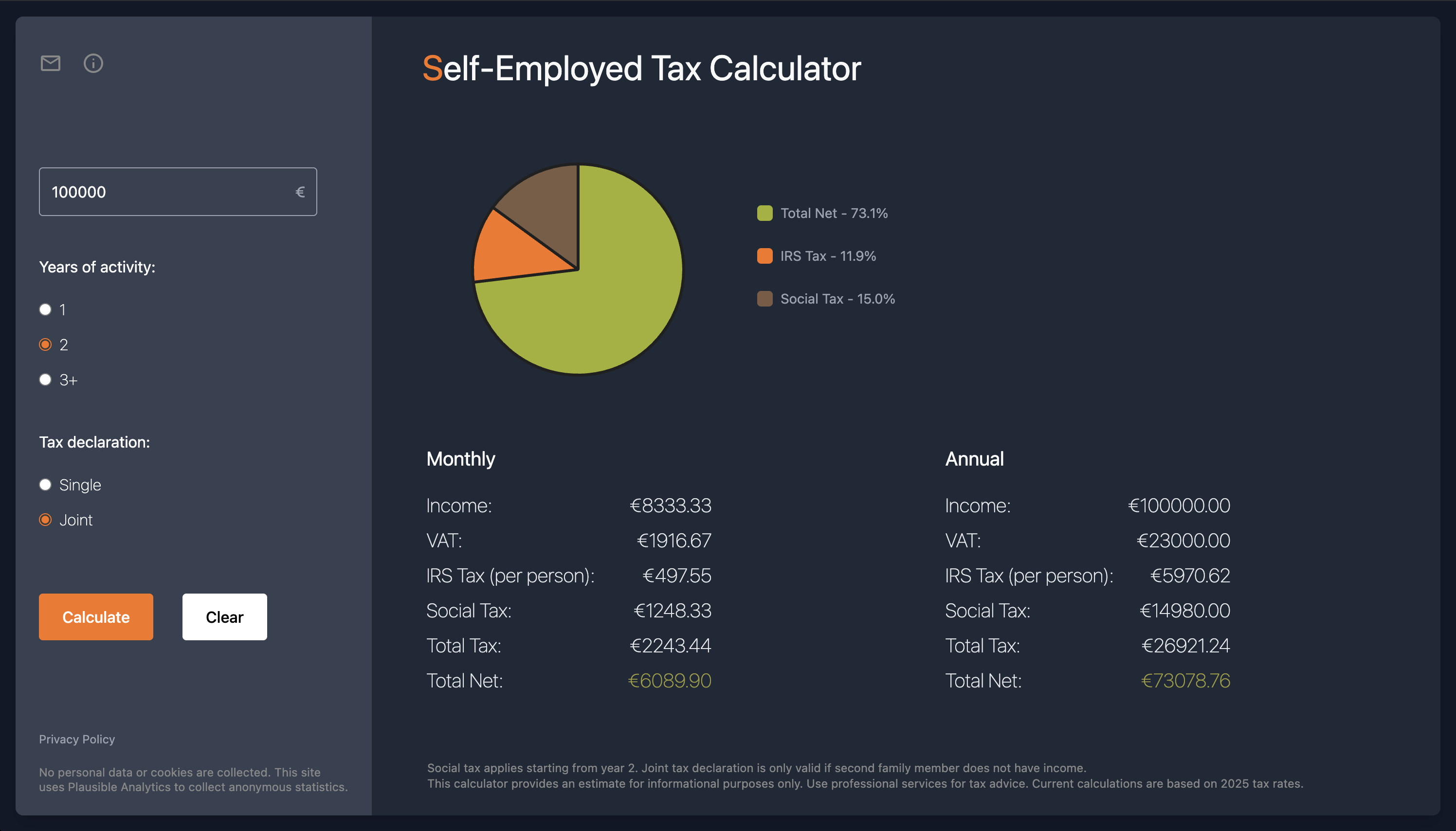

An easy-to-use, privacy-friendly tax calculator for self-employed people in Portugal (Recibos Verdes). Instantly calculates IVA, IRS, and Social Security contributions with up-to-date rules. Perfect for freelancers, remote workers, and digital nomads.

Problem

Self-employed professionals in Portugal manually calculate taxes (IVA, IRS, Social Security) using spreadsheets or outdated methods, leading to time-consuming processes, errors, and non-compliance risks.

Solution

A web-based tax calculator tool enabling users to instantly compute taxes with up-to-date rules, input income/expenses, and receive accurate IVA, IRS, and Social Security calculations tailored to Portugal’s Recibos Verdes system.

Customers

Freelancers, remote workers, and digital nomads in Portugal, particularly self-employed individuals (e.g., consultants, designers, developers) managing irregular income streams.

Unique Features

Privacy-focused (no data storage), real-time tax rule updates, and Portugal-specific customization for Recibos Verdes.

User Comments

Saves hours on tax calculations

Accurate and user-friendly interface

Essential for Portuguese freelancers

Free alternative to expensive accountants

Regularly updated with legal changes

Traction

Launched on ProductHunt (exact metrics unspecified), targets Portugal’s ~700k self-employed workers.

Market Size

Portugal’s self-employed workforce comprises ~700,000 individuals, with freelancers contributing significantly to its €23B freelance economy (2023 estimates).