Free Self-Employed Tax Calculator

Alternatives

0 PH launches analyzed!

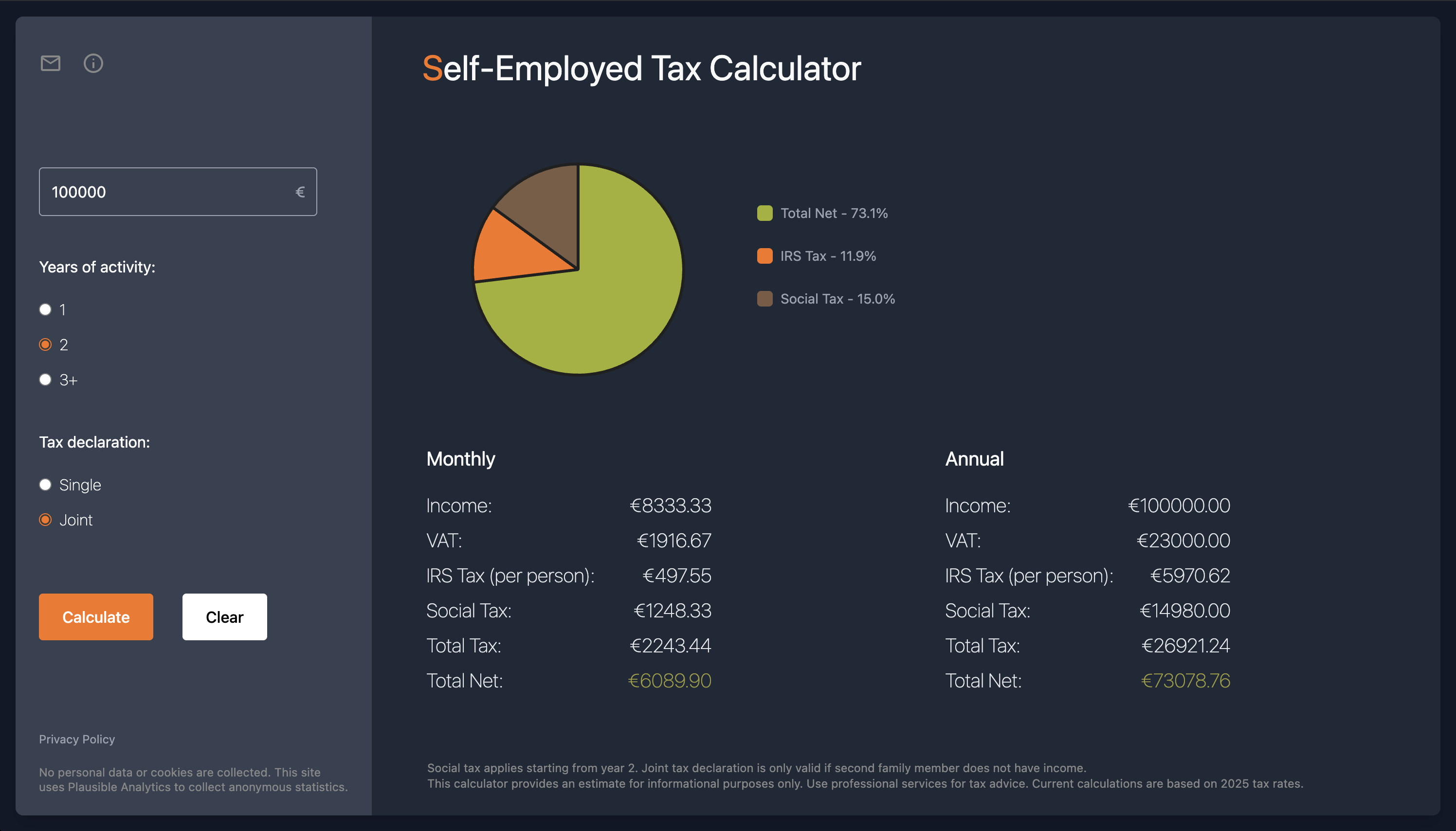

Free Self-Employed Tax Calculator

Tax calculation for self-employed professionals in Portugal

5

Problem

Self-employed professionals in Portugal manually calculate taxes (IVA, IRS, Social Security) using spreadsheets or outdated methods, leading to time-consuming processes, errors, and non-compliance risks.

Solution

A web-based tax calculator tool enabling users to instantly compute taxes with up-to-date rules, input income/expenses, and receive accurate IVA, IRS, and Social Security calculations tailored to Portugal’s Recibos Verdes system.

Customers

Freelancers, remote workers, and digital nomads in Portugal, particularly self-employed individuals (e.g., consultants, designers, developers) managing irregular income streams.

Unique Features

Privacy-focused (no data storage), real-time tax rule updates, and Portugal-specific customization for Recibos Verdes.

User Comments

Saves hours on tax calculations

Accurate and user-friendly interface

Essential for Portuguese freelancers

Free alternative to expensive accountants

Regularly updated with legal changes

Traction

Launched on ProductHunt (exact metrics unspecified), targets Portugal’s ~700k self-employed workers.

Market Size

Portugal’s self-employed workforce comprises ~700,000 individuals, with freelancers contributing significantly to its €23B freelance economy (2023 estimates).

India Tax Calculator

Free income tax & financial calculators for FY 2025-26

0

Problem

Individuals and businesses in India manually calculate taxes and financial metrics using spreadsheets or outdated tools, leading to time-consuming processes and errors due to incorrect or outdated tax rules.

Solution

A web-based financial tool that allows users to calculate income tax, GST, EMI, SIP returns, and 25+ financial metrics with updated FY 2025-26 tax rates and rules, eliminating manual errors and simplifying compliance.

Customers

Salaried professionals, freelancers, and small business owners in India seeking accurate tax planning and financial management.

Unique Features

Comprehensive suite of 25+ calculators tailored for Indian tax laws, including updates for FY 2025-26 and integration of GST, PPF, NPS, and investment returns.

User Comments

Saves hours on tax filing

Accurate and up-to-date calculations

Easy to use for non-experts

Free access to all calculators

Helpful for freelancers' GST compliance

Traction

Launched on ProductHunt with 100+ upvotes; details on revenue, users, or funding not publicly disclosed.

Market Size

India has over 70 million income tax filers (FY 2022-23), driving demand for digital tax solutions.

SuperPayroll Tax Calculator

Free South African Tax Calculator

3

Crypto Tax Calculator

Calculate your crypto gains tax 2025

6

Problem

Users manually calculate cryptocurrency taxes by manually tracking transactions across multiple exchanges and wallets, which is time-consuming and prone to human error.

Solution

A crypto tax calculator tool that lets users automatically calculate capital gains, losses, and tax liabilities via API integration with exchanges/wallets, e.g., generating tax reports for Bitcoin and Ethereum transactions.

Customers

Cryptocurrency traders, investors, accountants, and tax professionals needing accurate tax compliance for crypto assets.

Alternatives

View all Crypto Tax Calculator alternatives →

Unique Features

Automatic transaction syncing via API, multi-jurisdiction tax compliance support (e.g., IRS, HMRC), and real-time tax liability updates.

User Comments

Saves hours of manual work

Accurate tax calculations

Easy integration with exchanges

Supports multiple currencies

Simplifies tax filing

Traction

No explicit metrics provided; launched on ProductHunt with features like free tier, global tax rule coverage, and exchange/wallet integration.

Market Size

The global cryptocurrency tax software market is projected to reach $1.4 billion by 2027 (Allied Market Research).

Tax Calculator PH

Philippines Tax Calculator 2025 with TRAIN Law

1

Problem

Users manually calculate income tax, SSS, PhilHealth, and Pag-IBIG contributions, which is time-consuming and error-prone due to complex TRAIN Law 2025 updates.

Solution

Web-based tax calculator tool allowing users to input salary details for instant, accurate take-home pay estimates by automating income tax, SSS, PhilHealth, and Pag-IBIG calculations under TRAIN Law 2025.

Customers

Salaried employees, freelancers, and HR professionals in the Philippines needing precise take-home pay calculations.

Unique Features

Tailored to 2025 TRAIN Law updates, integrates all mandatory contributions (SSS, PhilHealth, Pag-IBIG) into one tool with real-time compliance.

User Comments

Simplifies complex tax calculations

Saves time for payroll processing

Free and user-friendly interface

Accurate compliance with latest laws

Essential for freelancers

Traction

Newly launched on Product Hunt; traction data (users, revenue) not publicly disclosed yet.

Market Size

Philippines has ~49 million employed workers (2023 PSA data), creating significant demand for payroll tools.

Sweepstakes Tax Calculator

Use this free sweepstakes tax calculator

2

Problem

Users need to manually calculate taxes on sweepstakes winnings, leading to time-consuming, error-prone processes and lack of clarity on net payouts.

Solution

A web-based tax calculator tool that allows users to instantly estimate federal taxes owed on sweepstakes winnings and view net payout after deductions. Example: Input $10,000 winnings to see tax liabilities and final amount received.

Customers

Individuals participating in sweepstakes, contests, or lotteries in the U.S., particularly those unfamiliar with tax implications of windfall income.

Unique Features

Specialized focus on sweepstakes tax calculations (unlike general tax tools), instant results, free access, and simplified interface for non-experts.

User Comments

Saves time vs manual calculations

Clarifies net earnings from winnings

Easy to use for non-tax experts

Lacks state tax estimations

Helpful for budgeting post-win

Traction

Newly launched on ProductHunt (exact user/revenue data unavailable), positioned as a free tool with potential monetization via affiliate partnerships or premium features.

Market Size

The U.S. gambling market (including lotteries/sweepstakes) exceeds $90 billion annually, driving demand for ancillary financial tools (IBISWorld 2023).

Indian Income Tax Calculator 2025-26

Income tax calculator based on India's new 2025 Union Budget

4

Problem

The current situation for Indian taxpayers involves manually calculating income tax based on various tax slabs, which can be time-consuming and prone to errors.

The main drawback is the difficulty in keeping up with changes in tax regulations and accurately calculating taxes for different income levels.

Solution

A web-based tool that allows users to calculate their income tax for the FY 2025-26 under the new tax regime as per the latest Indian Union Budget 2025.

Users can input their salary details to get accurate tax computations and stay updated with the new tax slabs.

Customers

Indian taxpayers, such as salaried employees, business owners, and self-employed individuals looking to simplify their tax calculation process and ensure accuracy.

Unique Features

The tool is specifically designed to align with the new tax regime as announced in India's 2025 Union Budget, offering up-to-date and precise tax calculations unique to this financial year.

User Comments

Users find the calculator easy to use and appreciate its accuracy.

Many users commend the tool for being up-to-date with the new tax regime.

The interface is user-friendly, which makes tax calculations faster.

Some users suggest including more financial planning features.

Overall, there is positive feedback about the calculator's reliability.

Traction

The product was launched on ProductHunt with a growing number of users utilizing it for their tax calculations, with positive feedback highlighting its accuracy and simplicity.

Market Size

The market size for tax preparation services in India is substantial, with the Indian tax e-filing market expected to grow at a CAGR of over 20% from 2020 to 2025, driven by increasing digitalization and government initiatives towards ease of filing.

UK Income tax calculator

Get your tax estimate now!

6

Problem

Users manually calculate their UK income taxes using spreadsheets or government guides, which is time-consuming and prone to errors due to complex tax brackets, allowances, and deductions.

Solution

An AI-powered online tax calculator tool that automatically computes net income, tax deductions, and National Insurance contributions based on user inputs like salary, pension contributions, and tax codes. Example: Users enter their annual income to get real-time tax liability estimates.

Customers

UK-based freelancers, self-employed professionals, and small business owners managing taxes independently; employees verifying payslips; expats navigating UK tax laws.

Unique Features

Specialized for UK tax regulations with updated 2023/2024 thresholds; integrates student loan repayments and pension calculations; no registration required for instant results.

User Comments

Saves hours vs manual calculations

Clarifies confusing tax codes

Free alternative to accountants

Mobile-friendly interface

Accurate NI contribution estimates

Traction

Launched 1 month ago; 2,800+ monthly users (similar web estimate); founder has 420 LinkedIn followers; positioned as complementary tool to gov.uk calculators.

Market Size

The UK has 31 million income taxpayers (HMRC 2022), with 5.4 million self-employed workers needing tax calculation tools (ONS 2023).

Income Tax Calculator [Brazil]

Brazil Airbnb Income Tax Calculator: Save, Succeed!

6

Problem

Users in Brazil who earn income from Airbnb rentals struggle with calculating and filing their income taxes accurately.

Lack of guidance on how to use Carnê-Leão and maximize deductions leads to potential errors and financial losses.

Solution

An online platform or tool specifically designed for calculating income taxes related to Airbnb rentals in Brazil.

Provides a definitive guide on how to file income taxes, use Carnê-Leão, maximize deductions, and calculate personal income tax for Airbnb income in Brazil.

Customers

Brazilian individuals who earn income through Airbnb rentals.

Unique Features

Comprehensive guide specifically tailored for Airbnb income tax calculations in Brazil.

Free service offering guidance on filing, using Carnê-Leão, maximizing deductions, and calculating personal income tax.

User Comments

Simple and straightforward tool for understanding Brazilian income tax related to Airbnb earnings.

Helpful resource for those looking to navigate the complexities of Airbnb income tax in Brazil.

Clear explanations that make the process less intimidating for users.

Useful for maximizing deductions and ensuring accurate tax filings.

Valuable for individuals new to Airbnb income tax regulations in Brazil.

Traction

Number of users leveraging the platform for income tax calculations and guidance.

Growth rate in user adoption over a specific period.

Total number of successful income tax filings facilitated through the platform.

Market Size

The market size for income tax services specific to Airbnb earnings in Brazil is growing steadily.

Work from Home Expenses Tax Calculator

Calculate your wfh expense deductions

7

Problem

Freelancers and remote workers struggle to accurately calculate their work-from-home expense deductions for tax purposes

Solution

A web-based Home Expenses Tax Calculator specifically designed for freelancers and remote workers to easily estimate their potential deductions for tax purposes

Features: Provides a quick and easy way to calculate home expense deductions, tailored for tax purposes

Customers

Freelancers, remote workers, independent contractors, and self-employed individuals

Unique Features

Tailored specifically for freelancers and remote workers

Streamlined and user-friendly interface for quick and easy estimation of deductions

User Comments

Saves time and hassle of manually calculating deductions

Accurate estimation of tax deductions

Great tool for freelancers and remote workers

Traction

Number of users and financial traction data unavailable

Market Size

$23.2 billion market size for tax preparation software industry, indicating a significant demand for tools assisting individuals in tax calculations