What is Defi lending platform development?

Advanced DeFi lending platform development with automated smart contract logic, immutable ledger technology, and multi-layered security audits for trustless and efficient financial services.

Problem

Users developing DeFi lending platforms face high development costs, security vulnerabilities, and inefficient yield management solutions due to manual smart contract coding and lack of integrated auditing.

Solution

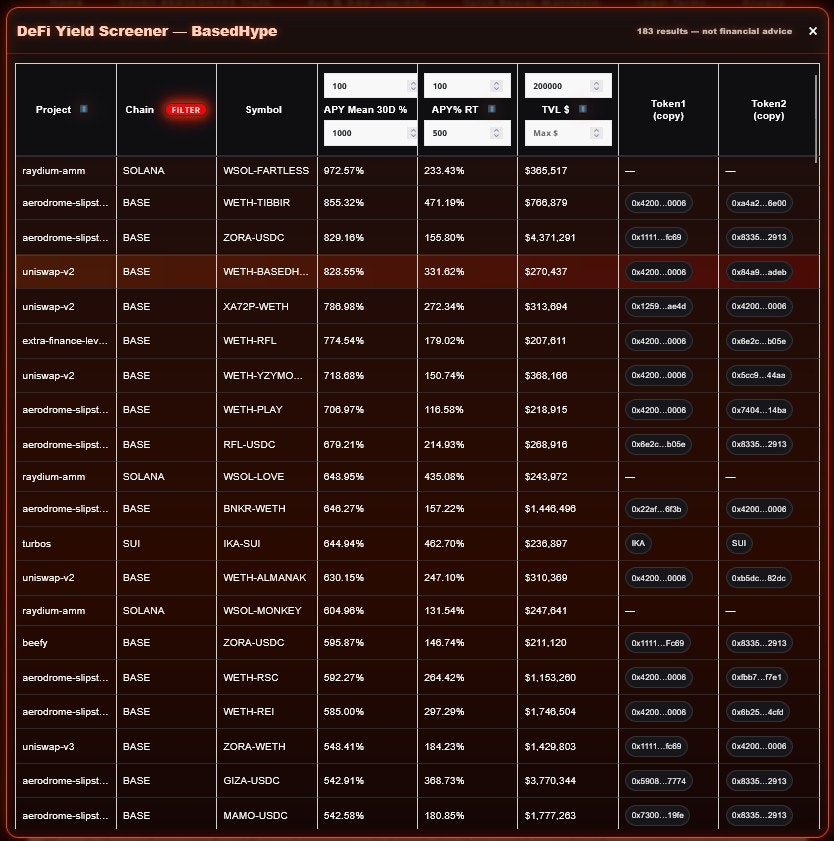

A DeFi lending platform development tool offering pre-built automated smart contract logic, immutable ledger integration, and yield optimization features. Users can deploy secure, customizable lending platforms with multi-layered security audits and real-time yield strategies.

Customers

Fintech developers, blockchain startup founders, and DeFi entrepreneurs seeking scalable, compliant lending solutions.

Unique Features

Combines yield optimization algorithms with automated smart contract logic and mandatory security audits, reducing manual coding and risk exposure.

User Comments

Saves months of development time

Audits boosted investor trust

Yield features outperformed competitors

Easy integration with existing DeFi ecosystems

No security breaches post-launch

Traction

Exact metrics unspecified, but ProductHunt listing indicates active traction in the DeFi market. Comparable platforms like Aave have >$5B TVL.

Market Size

The global DeFi lending market is projected to reach $13.61 billion by 2028 (Source: Fortune Business Insights, 2023).