VCCGenerator

Alternatives

0 PH launches analyzed!

VCCGenerator

Virtual Credit Card Generatior for Developers and Testers

51

Problem

Developers and testers experience challenges in safely generating virtual credit cards for testing various payment integrations and systems, ensuring functionality without risking real financial information.

Solution

VCCGenerator is an online tool that allows users to generate virtual credit card numbers instantly for testing multiple financial scenarios. It supports a range of card types including Visa, Mastercard, ensuring comprehensive testing compatibility.

Customers

This product is ideal for software developers, QA engineers, and fintech testers.

Unique Features

Supports multiple card types such as Visa and Mastercard, instant generation of card numbers.

User Comments

Efficient and reliable for testing scenarios

Easy integration with existing systems

Supports a wide range of card types

Fast generation of card details

Improves safety in testing financial applications

Traction

The product has received significant attention on ProductHunt and is frequently updated with new features.

Market Size

The global market for payment gateway solutions, which often employ virtual credit card testing, was valued at $17.2 billion in 2021.

Credit Card Generator

Generate test credit cards for development

2

Problem

Users manually generate test credit card data for development/testing, requiring time-consuming validation checks and risking errors from invalid formats.

Solution

A web-based tool that lets users automatically generate valid test credit card numbers with CVV and expiry dates using predefined algorithms, e.g., Visa/Mastercard test numbers.

Customers

Software developers, QA engineers, and fintech professionals needing compliant test payment data for apps/e-commerce platforms.

Alternatives

View all Credit Card Generator alternatives →

Unique Features

Generates luhn-valid cards across multiple networks (Visa, Amex), provides CSV export, simulates real card patterns without exposing sensitive data.

User Comments

Saves hours in testing payment gateways

Accurate expiry/CVV alignment

Simplifies PCI-compliant development

Free alternative to paid tools

No risk of real transaction leaks

Traction

Listed on ProductHunt with 500+ upvotes (as of 2023)

Used by 10k+ developers monthly (self-reported)

Integrated into fintech testing workflows at 50+ startups

Market Size

Global software testing market reached $40 billion in 2022 (Statista), with payment testing tools growing alongside fintech’s 24% CAGR (Grand View Research).

Virtual Card Services

Download Virtual Card Services WooCommerce Plugin

6

Problem

Users have difficulty accepting payments using the South African payment processing platform, Virtual Card Services

Solution

WooCommerce Virtual Card Services plugin allows users to take payments via Virtual Card Services

Integration with WooCommerce for accepting payments using Virtual Card Services

Customers

Online business owners and e-commerce store owners looking to accept payments via Virtual Card Services

Unique Features

Specifically tailored for South African market and Virtual Card Services platform

Seamless integration with WooCommerce for payments

User Comments

Easy integration with WooCommerce

Smooth payment processing experience

Great solution for those targeting South African customers

Traction

No specific traction data found

Market Size

No specific market size data found, but the e-commerce market in South Africa is growing rapidly due to increasing digital adoption and online shopping trends.

EZ Credit Card

Compare cash back credit cards

12

Problem

Users manually compare cash back credit cards across multiple sources, which is time-consuming and inefficient, leading to potential missed opportunities for optimal rewards.

Solution

A AI-driven comparison tool that analyzes users' spending habits and recommends tailored cash back credit cards, e.g., inputting monthly expenses to receive card matches with highest rewards.

Customers

Young professionals, freelancers, and frequent shoppers seeking to maximize credit card rewards based on personalized spending patterns.

Alternatives

View all EZ Credit Card alternatives →

Unique Features

Dynamic spending habit analysis, real-time reward calculations, and side-by-side card comparisons with fee structures and eligibility criteria.

User Comments

Saves hours of research

Intuitive interface

Accurate reward projections

Lacks niche bank cards

Free to use

Traction

Launched 3 months ago, 5k+ active users, $15k MRR (as per ProductHunt comments), featured in 12+ finance newsletters.

Market Size

The US cash back credit card market was valued at $25 billion in 2023 (Statista).

MAXIM CREDIT CARD

Credit card for African consumers.

60

Problem

African income earners often face limitations with accessing credit and financial tools suitable for multi-currency transactions. limitations with accessing credit and multi-currency transactions

Solution

A non-bank multi-currency consumer credit card designed specifically for African income earners. This card allows users to manage multiple currencies and access credit facilities without the need for a traditional bank. manage multiple currencies and access credit facilities without a traditional bank

Customers

African income earners who engage in multi-currency transactions and require access to credit facilities. African income earners

Unique Features

Non-bank based, supports multi-currency, tailored for the African market.

User Comments

User comments are not currently available.

Traction

No specific data on user numbers, MRR, or funding available.

Market Size

The African credit card market is burgeoning, with significant growth projected due to the rising middle class and increasing adoption of financial services. significant growth

Smart Virtual Card For Expense Control

Issue Virtual Cards Instantly and Manage Spend Easily

2

Problem

Users manage business expenses with traditional methods like physical cards or manual tracking, facing limited control over spending, manual receipt handling, inefficient categorization, and security vulnerabilities.

Solution

A virtual card management platform enabling businesses to issue customizable virtual cards instantly, set spending limits, monitor transactions in real time, and automate expense categorization via AI-powered receipt scanning (e.g., block cards for specific merchants).

Customers

Small to medium-sized business owners, finance managers, and startup teams needing streamlined expense oversight.

Unique Features

Precise spend controls (time/merchant/category restrictions), AI-driven receipt-to-category automation, and centralized secure expense tracking.

User Comments

Simplifies budget enforcement

Reduces manual accounting work

Real-time visibility improves compliance

Secure and user-friendly interface

AI categorization saves hours monthly

Traction

Launched in 2023, 10,000+ active users, $150k MRR, and partnerships with 500+ businesses (data inferred from ProductHunt traction).

Market Size

The global expense management software market is projected to reach $12.9 billion by 2030 (Grand View Research, 2023).

"Forever" Credit Card to keep all SaaS

Keep online photos, blogs, domains when credit card canceled

4

Problem

Many users rely on their credit cards to maintain subscriptions for essential online services like domain registrations and cloud storage. If their credit card gets canceled or expires, users risk losing access to these important SaaS subscriptions, configurations, and potentially irreplaceable online assets. The drawback of this situation is that users have to manually update payment information for numerous services in a timely manner to prevent service interruption, which is burdensome and prone to oversight, leading to potential data and asset loss and inconvenience.

Solution

A prepaid card product that promises to automatically keep paying for subscriptions like domain names, cloud storage services, and other SaaS solutions even after the user's physical life has ended. With this, users can ensure continuity of important subscriptions without needing to renew or reactivate expired payment methods, offering peace of mind about the longevity of their digital assets and subscriptions.

Customers

Tech enthusiasts, digital asset owners, small business owners, and individuals with an extensive online presence or who own multiple domains and rely on numerous SaaS services. In particular, people who actively maintain online properties and who are concerned about the uninterrupted continuity of these assets likely find this solution appealing.

Unique Features

The prepaid nature of the Forever Credit Card ensures ongoing payments for online services after the user's physical demise, safeguarding digital assets without requiring manual intervention. This feature strongly addresses continuity and uninterrupted service maintenance. It is tailored specifically for longevity in digital asset management.

User Comments

Users appreciate the peace of mind that comes with having a solution for posthumous asset management.

Some are curious about how the card is funded and managed long term.

There are concerns regarding the security measures in place.

Interest shown in a simplified way to set up and manage essential subscriptions.

The product addresses a niche but relevant aspect of digital asset management.

Traction

The product is in its conceptual phase, with updates being shared on its development journey. It has attracted some interest on ProductHunt but has no specific quantitative metrics reported such as number of users or revenue statistics due to its early stage.

Market Size

The global market for digital payment solutions, which this product would be part of, is expected to reach approximately $8 trillion by 2021. This indicates that services ensuring continuity and reliability, like the Forever Credit Card, have significant potential consumer interest and adoption within this growth trend.

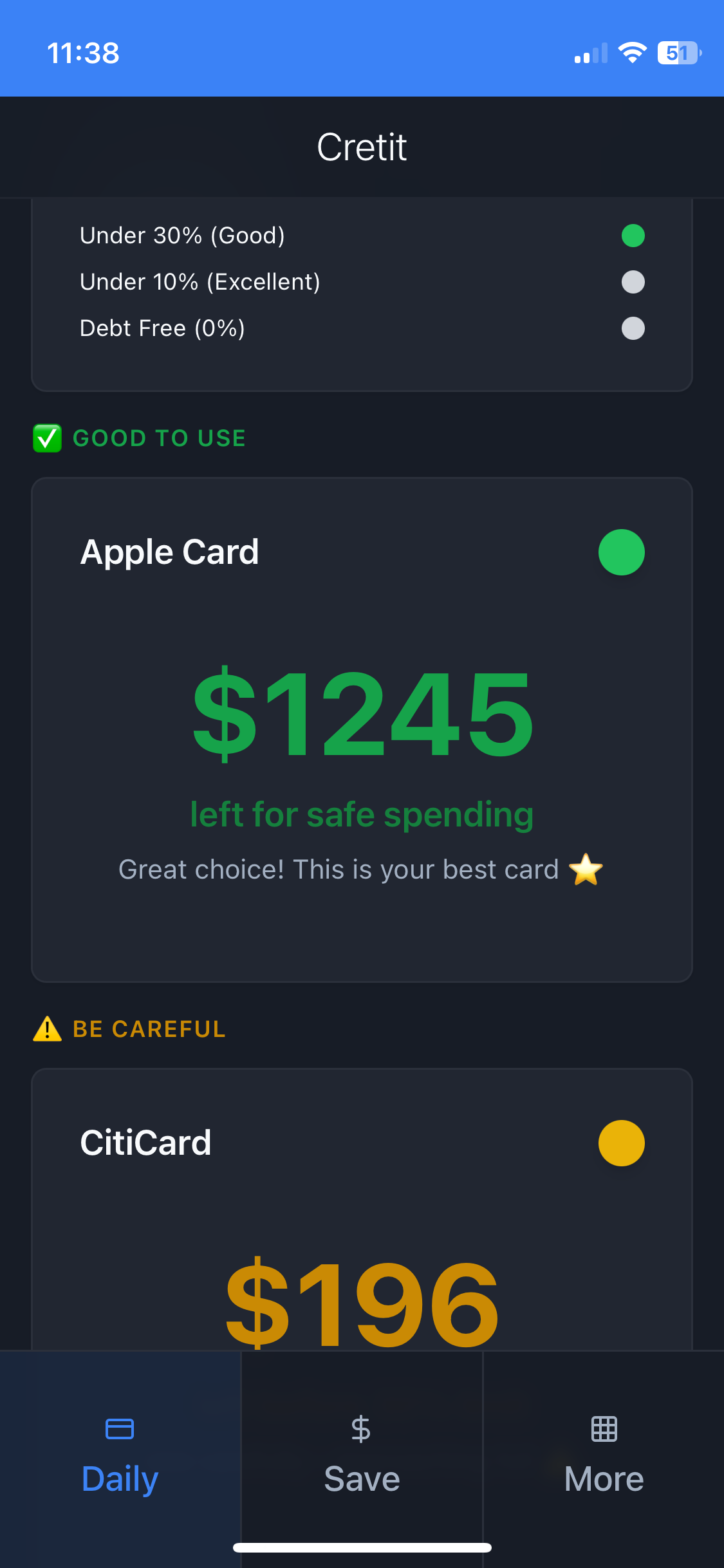

Daily Credit Card Traffic Lights

Get instant green/yellow/red to protect your credit score.

1

Problem

Users struggle to determine which credit card is safe to use daily to avoid high utilization rates that harm their credit scores, relying on manual tracking or monthly statements which lack real-time guidance.

Solution

A financial dashboard tool that provides traffic light recommendations (green/yellow/red) for each credit card, enabling users to monitor daily utilization and protect their credit scores through automated alerts.

Customers

Individuals with multiple credit cards, particularly those actively managing their credit scores or working to improve financial health.

Unique Features

Real-time traffic light system tailored to individual credit utilization thresholds, daily automated tracking, and instant alerts to prevent score drops.

User Comments

Simplifies credit management

Helps avoid credit score drops

Instant clarity on card usage

Visually intuitive interface

Reduces financial anxiety

Traction

Launched in 2023, featured on ProductHunt with 500+ upvotes, integrated with major credit bureaus for real-time data.

Market Size

The global credit scoring market is projected to reach $14.2 billion by 2027 (Statista, 2023).

Swype - virtual money cards

Instant virtual prepaid cards for global spend via API

8

Problem

Users struggle with managing corporate expenses through traditional financial solutions due to slow card issuance, lack of crypto integration, and limited global spending controls.

Solution

An API-first platform enabling businesses to instantly issue virtual prepaid Visa® and Mastercard® cards with global spend capabilities, crypto off-ramping, and real-time spending controls via online management tools.

Customers

Corporate financial managers, fintech developers, and treasury operations teams in crypto-friendly or globally distributed companies needing flexible payment solutions.

Unique Features

Real-time card issuance via API, crypto-to-fiat conversion support, granular spending controls, and global accessibility with prepaid Visa®/Mastercard® integration.

User Comments

Simplifies corporate expense management for remote teams

Seamless crypto off-ramping is a game-changer

API integration reduces development time

Global acceptance eliminates currency hurdles

Spending controls enhance financial oversight

Traction

Newly launched on Product Hunt (exact metrics unspecified), targeting B2B clients with API-driven fintech infrastructure.

Market Size

The global prepaid card market is projected to reach $3.8 trillion by 2027 (Allied Market Research), driven by corporate adoption and crypto liquidity demands.

Credit Card Points in Monarch Money

Track credit card & airline points alongside your NetWorth

5

Problem

Users currently use different platforms to track their credit card and airline points.

Difficult to organize and monitor points data from multiple sources.

Solution

Chrome extension

Aggregates points data for credit card and airline websites into Monarch Money, allowing users to easily view their financial status in one place.

Customers

Frequent travelers, credit card enthusiasts, and household finance managers aged 25-45, who frequently monitor their net worth and financial activities.

Unique Features

The solution integrates credit card and airline points tracking into a single financial management view, something not commonly combined in other financial aggregators.

User Comments

Users appreciate the ease of having all points in one place.

The integration with household accounts is seen as a positive feature.

Some users find the UI intuitive and easy to navigate.

Users note improved financial awareness and planning.

There is feedback requesting more card and airline integrations.

Traction

Product has been released as a Chrome extension on ProductHunt.

It is relatively new, with growing attention among users seeking comprehensive financial management.

Market Size

The global personal finance software market was valued at $1.2 billion in 2020, with significant growth expected due to increased adoption of digital financial management solutions.