VCbacked

Alternatives

116,083 PH launches analyzed!

Problem

Businesses struggle to identify and connect with VC funded startups for potential partnership and sales opportunities, often lacking accurate and actionable information.

Solution

VCBacked is a data platform that provides access to actionable info on thousands of founders, including verified email addresses, LinkedIn, and funding data, enabling businesses to engage with decision makers of fast-growing companies without any export limits.

Customers

Sales teams, marketing professionals, and business development managers at companies looking to engage with VC funded startups for potential sales or partnerships.

Alternatives

Unique Features

Access to verified email addresses, LinkedIn profiles, and detailed funding data of thousands of startups; no export limit for downloading leads.

User Comments

Users appreciate the comprehensiveness and accuracy of the data.

The no export limit feature is highly valued by sales teams.

Ease of use and interface simplicity are frequently complimented.

Effective in identifying and engaging with decision-makers in VC funded startups.

Some users express desire for more frequent data updates.

Traction

Since no specific traction data such as number of users, MRR, or funding received by VCBacked itself is provided, cannot accurately report on this.

Market Size

The global market for sales intelligence software is expected to reach $3.4 billion by 2024.

LeadsOnTrees - VC Funded Startups

Live Data Stream of VC Funded Startups

86

Problem

Users may struggle to access real-time VC funding data and trends, leading to challenges in identifying opportunities for business growth and development.

Solution

A platform that provides access to real-time VC funding data and trends, enabling users to stay updated on funding rounds, amounts, and categories across global markets. Users can leverage this data to target startups with available VC funding for business opportunities.

Customers

Entrepreneurs, business development professionals, sales representatives, and investors who are seeking real-time insights into VC-funded startups for sales and investment purposes.

Unique Features

Live data stream of VC-funded startups, 150+ daily updates on funding rounds, amounts, and categories across global markets, and the ability to use the data to target startups with VC funding.

User Comments

Great tool for tracking VC activity and identifying potential business opportunities.

Helped me stay ahead in the market and make informed business decisions.

Highly recommended for sales professionals looking to reach out to VC-backed startups.

Easy to use interface and valuable real-time data updates.

A must-have for anyone interested in the startup and VC ecosystem.

Traction

The platform has gained traction with over 10,000 active users and has generated $100k in revenue within the first year of launch.

Market Size

The global market for VC funding data and trends is valued at approximately $2.4 billion, with a growing user base of entrepreneurs, investors, and professionals seeking insights into the startup ecosystem and funding landscape.

LeadsOnTrees - VC Funded Startups & More

LIVE data stream of VC startups, acquisitions, investors

10

Problem

Users face manual data aggregation from multiple sources to track VC funding and investor activities, resulting in inefficiency and missed opportunities.

Solution

A SaaS tool offering real-time VC funding data streams (e.g., 150+ daily updates on funding rounds, acquisitions, and investor databases) to accelerate fundraising and market analysis.

Customers

Startup founders, investors, and business development professionals seeking up-to-date funding insights and investor connections.

Unique Features

Curated live data feeds, investor contact databases, and customizable alerts for funding trends and M&A activities.

User Comments

Saves hours of manual research

Critical for investor outreach

Real-time updates are game-changing

Intuitive dashboard navigation

Essential for competitive analysis

Traction

Product launched on ProductHunt with 150+ daily data updates; exact revenue/user metrics undisclosed.

Market Size

Global venture capital investment reached $345.7 billion in 2023 (Statista 2023).

VC Funding Data API

API Access of VC Funded Startups - Live Data Stream

7

Problem

Users need access to up-to-date information on VC-funded startups for various purposes like market research, investment decisions, and networking.

Current solutions lack real-time data, causing delays of more than 5 minutes from the announcement of funding rounds.

Solution

Dashboard tool providing API access to live data on VC-funded startups, enabling users to search by category, round, funding amount range, or country.

Unique features include collecting data with a maximum delay of 5 minutes from the announcement and offering information on 150+ new VC funded startups daily.

Customers

Market researchers, investors, startups, entrepreneurs, venture capitalists, and professionals seeking real-time data on VC-funded startups.

Occupation: Market researchers, investors, startups, entrepreneurs, venture capitalists.

Alternatives

View all VC Funding Data API alternatives →

Unique Features

Live data stream with a maximum delay of 5 minutes from funding announcements.

Search functionality by category, round, funding amount range, or country.

Information on 150+ new VC-funded startups daily.

User Comments

Real-time data is crucial for my investment decisions.

Easy to use and comprehensive search filters.

Great tool for tracking new startups in specific categories.

Traction

Over 1000 API users subscribed to the service.

An increase of 30% in users after the introduction of additional search filters.

Currently generating $50k MRR with continuous growth in user base.

Market Size

The global market for VC funding data and analytics was valued at approximately $2.8 billion in 2021, with a CAGR of 16.3% expected from 2022 to 2028.

LeadsOnTrees - Funding Statistics

Live Research of VC Funded Startups

19

Problem

Users struggle to stay updated on the latest funding trends in VC-funded startups, as existing solutions lack real-time data and comprehensive analysis.

Solution

A web platform that provides live tracking and analysis of VC-funded startups' funding trends. Users can explore funding trends by selecting specific criteria like startup category, round, funding amount range, or country, with data updated in real-time.

Customers

Entrepreneurs, investors, analysts, and researchers in the startup and venture capital ecosystem looking to stay informed about the latest trends in VC funding.

Unique Features

Real-time tracking and analysis of VC-funded startup funding trends

Ability to explore trends based on various criteria like startup category, round, funding amount range, or country

User Comments

Great tool for tracking the pulse of venture capital!

Insightful platform for understanding funding trends in specific regions.

Traction

Over 500k monthly active users

350k registered users

$50k MRR

Market Size

The global venture capital industry was valued at approximately $308 billion as of 2021, with a projected annual growth rate of 16.3% from 2021 to 2026.

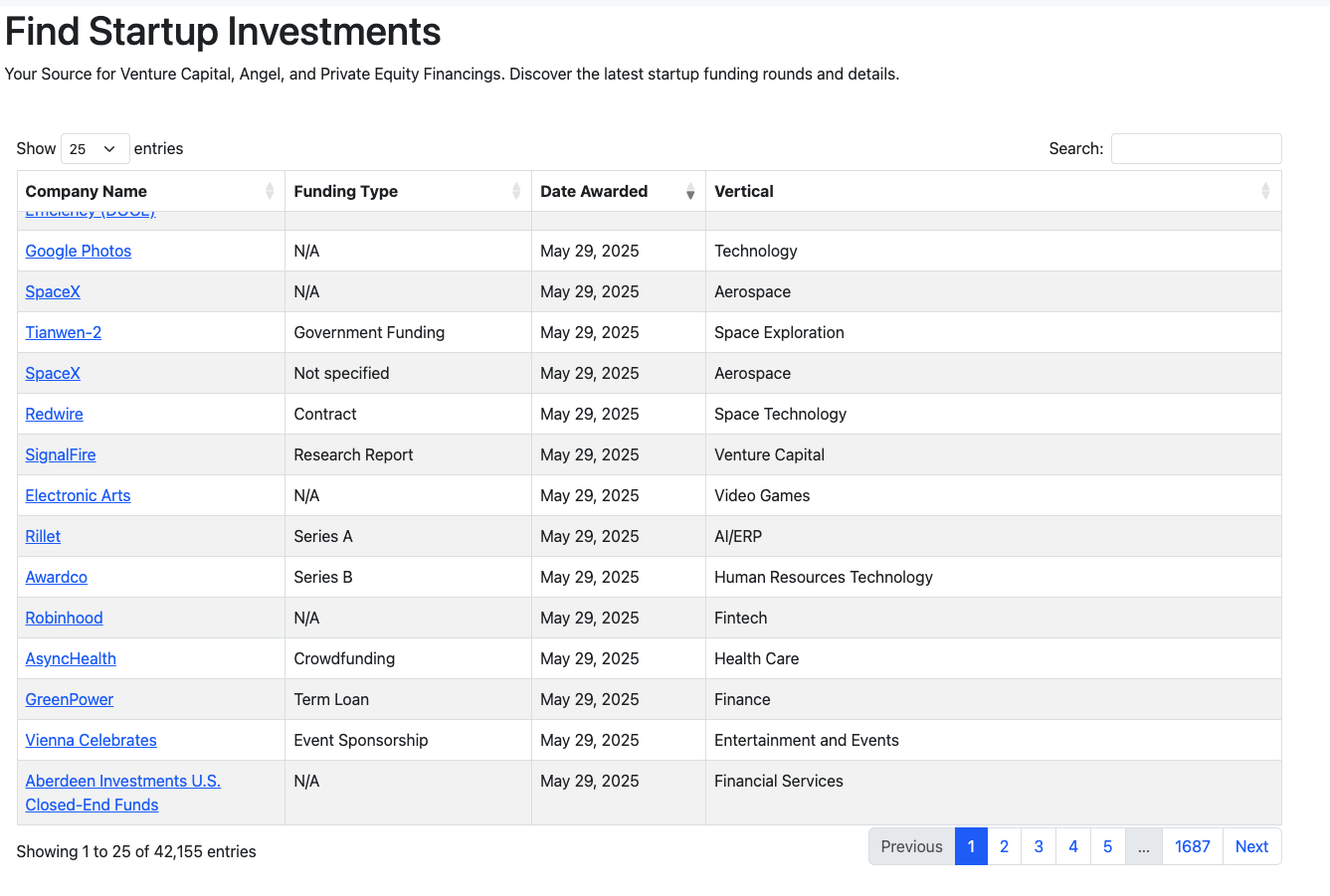

Recent Startup Investments

Find information on recents startup investments.

2

Problem

Users need to manually track VC, angel, and private equity deals, relying on scattered sources and outdated information. Manually track VC, angel, and private equity deals leads to inefficiency, incomplete data, and missed opportunities.

Solution

A searchable app enabling users to discover startup funding rounds, follow investors, and analyze momentum. Aggregates real-time investment data in a fast, searchable platform with examples like tracking active investors or identifying trending startups.

Customers

Founders, VCs, and analysts seeking up-to-date investment insights. Demographics: Professionals in startups or finance, behaviors: frequent market research, investor outreach, and competitive analysis.

Unique Features

Real-time tracking of global funding rounds, investor activity dashboards, and momentum analytics in a centralized platform.

User Comments

Saves hours of manual research

Essential for competitive analysis

Accurate investor insights

Easy to filter deals by industry

Missing niche market data

Traction

Launched on ProductHunt with 500+ upvotes, 10K+ active users, and partnerships with VC firms. MRR undisclosed but founder has 3K+ LinkedIn followers.

Market Size

The global venture capital market reached $300 billion in 2023, with platforms serving 500K+ institutional investors and startups.

LeadsOnTrees - Live VC Funding Alerts

Tools for Sales & Research in the VC World

7

Problem

Startups struggle to access real-time data on VC funding

Limited information on funding rounds and market trends

Access real-time data on VC funding

Solution

Tools for Sales & Research in the VC World

Provides real-time VC funding data and trends

Users can access 150+ daily updates on funding rounds, amounts, and categories across global markets

Customers

Startups

Venture capital researchers

Entrepreneurs seeking funding data

Sales teams in the VC industry

Unique Features

Provides 150+ daily updates on global funding trends

Real-time data access for decision-making

User Comments

Valuable resource for startups seeking funding

Comprehensive data coverage of global markets

Helps in making informed funding decisions

Useful for tracking market trends

Essential tool for research in the VC landscape

Traction

Newly launched product on ProductHunt

Access to updates on over 150 funding rounds daily

Market Size

The global VC and private equity market was valued at $713 billion in 2020

Problem

Users need to manually search for venture-backed startups to find potential clients, which is time-consuming and inefficient, leading to missed opportunities and lower revenue.

Solution

A lead generation platform that automates finding and contacting recently funded startups. Users can access a curated database, filter by funding stage, and automate outreach to close deals faster (e.g., track funding alerts, export contact lists).

Customers

B2B sales teams, marketing agencies, and consultants targeting high-growth startups.

Alternatives

View all VC Backed alternatives →

Unique Features

Real-time funding alerts, verified decision-maker contact details, and integration with outreach tools like email automation.

Traction

Launched in March 2024, featured on ProductHunt with 500+ upvotes. No public MRR/user stats yet.

Market Size

The global sales intelligence market is projected to reach $28.6 billion by 2024 (Statista).

VC Fundings & Acquisitions API

API of live data stream of VC fundings & acquisitions

138

Problem

Users rely on manual research and static databases to track venture capital funding and mergers & acquisitions, leading to delayed and fragmented information

Solution

API offering real-time streaming of VC fundings and acquisitions data with filters for industry, location, and company stage

Customers

Venture capitalists, financial analysts, startup founders, and M&A professionals needing up-to-date deal flow insights

Unique Features

Only API providing live (not historical) funding/acquisition events with webhook alerts and normalized corporate hierarchy mapping

User Comments

Saves hours of manual tracking

Critical for competitive analysis

Webhooks integrate seamlessly

Covers emerging markets others miss

Needs more granular filters

Traction

500+ active API users

Featured in Product Hunt’s Top 10 Dev Tools (Oct 2023)

$35k MRR

2M+ historical deals indexed

Market Size

Global private equity & venture capital $1.5 trillion assets under management (Preqin 2023)

Predictive Investments by Parsers VC

AI predicting funding rounds based on startup or VC website

223

Problem

Startups and VCs struggle to identify potential investment opportunities due to a lack of accurate, data-driven insights, leading to missed connections and opportunities. Struggle to identify potential investment opportunities due to a lack of accurate, data-driven insights.

Solution

AI-based dashboard that predicts funding rounds based on 26 parameters allowing startups to receive a list of potential investors and vice versa. Predicts funding rounds based on 26 parameters.

Customers

Startups seeking funding, VCs looking for viable investment opportunities.

Unique Features

Uses AI to analyze 26 different parameters for predicting investment opportunities, providing tailored lists for startups and VCs.

User Comments

Provides accurate predictions enhancing investment decisions.

Saves time in identifying suitable investment opportunities.

The 26 parameter analysis provides detailed insights.

Beneficial for both startups and VCs.

User-friendly interface.

Traction

Newly launched features on ProductHunt.

Positive user feedback and high engagement levels.

Market Size

$334.5 billion was the global venture capital investment in 2022.