Stream.Estate

Alternatives

0 PH launches analyzed!

Stream.Estate

Real estate data APIs

7

Problem

In the current real estate market, users face challenges in accessing comprehensive and up-to-date property data. The old solutions are often static and lack real-time updates, which causes difficulty in making informed decisions. Additionally, market analytics, property insights, and valuations are not readily accessible.

Solution

Stream Estate is a real-time property data API tool. Users can access comprehensive property data including market analytics, property insights, and valuations in real-time, allowing for dynamic updates and informed decision-making. For example, developers integrating these APIs can provide users with up-to-date market trends and property evaluations.

Customers

Real estate developers, tech companies focused on property tech (proptech), and real estate analysts who are looking to integrate comprehensive and live data into their platforms. Real estate developers and tech companies are likely to benefit the most.

Unique Features

The product offers a unique approach by providing real-time updates and comprehensive data through APIs, which enables users to integrate the data into various platforms for dynamic insights and market evaluations.

User Comments

Users appreciate the real-time data updates.

Integration into existing platforms is seamless.

The breadth of data available is impressive.

Some users mention a steep learning curve initially.

Customer support is noted as responsive and helpful.

Traction

Product launched on Product Hunt with initial engagement.

Growing number of users in the proptech sector.

Frequent updates to APIs for better data accuracy.

Early feedback being considered for new features.

Market Size

The global real estate analytics market is valued at approximately $10.7 billion by 2023, driven by the demand for advanced analytics and data in the real estate sector.

Return on German Real Estate

Data-Based Decisions for Real Estate Investment in Germany

7

Problem

Users struggle with making data-based decisions for real estate investment in Germany.

Drawbacks: Lack of tools to accurately calculate returns for German real estate, compare returns for real estate, stock, and gold, assess real estate affordability, and evaluate buying vs renting options.

Solution

Web tool with return calculator for German real estate, allowing users to make data-based decisions.

Core features: Inflation-adjusted and nominal return calculation for German real estate, comparison of returns for real estate, stock, and gold, assessment of real estate affordability, and comparison of buying vs renting options.

Customers

Real estate investors looking to invest in the German market.

Occupation or specific position: Real estate analysts, property investors, financial advisors.

Unique Features

The tool provides inflation-adjusted return calculations specific to the German real estate market.

Enables comparison of returns across real estate, stock, and gold investments.

Offers an assessment of real estate affordability and helps in decision-making between buying and renting options.

User Comments

Easy-to-use tool for comparing investment options.

Accurate calculations and informative comparisons.

Useful for making informed decisions in the real estate market.

Helps in understanding the profitability of investments in German real estate.

Great tool for financial planning and investment strategy.

Traction

The product has received positive feedback from users for its accuracy and utility.

Growing user base leveraging the tool for real estate investment decisions.

Increasing adoption by real estate professionals and investors for data-driven insights.

Market Size

$1.8 trillion - The value of the real estate market in Germany, highlighting a significant opportunity for tools catering to real estate investors.

Growing interest in data-driven decision-making in real estate investments, further driving the market size.

Real estate development

Real Estate Solutions

5

Problem

Real estate managers face challenges in managing properties efficiently and making data-driven decisions.

Manual and disjointed processes leading to inefficiencies, lack of streamlined operations, and reliance on disparate systems for real estate management.

Solution

Cloud ERP platform specifically tailored for real estate management, providing end-to-end solutions like streamline operations, boost efficiency, and enable data-driven decisions.

Powered by Acumatica Cloud ERP with nearly 40 years of expertise.

Customers

Real estate companies, property managers, developers, and investors looking to enhance their property management processes and decision-making with comprehensive and advanced tools.

Real estate professionals such as property managers and developers.

Unique Features

Comprehensive lifecycle platform tailored for real estate management, leveraging cloud ERP technology for seamless operations and data analytics.

User Comments

Easy-to-navigate platform, robust data analytics, and improved efficiency noted by users.

Highly recommended for real estate professionals seeking operational excellence.

Traction

Growing user base with positive feedback, outstanding reviews, and increasing adoption.

Partnerships with key industry players and integration with popular real estate management tools.

Market Size

The global real estate software market was valued at approximately $8.52 billion in 2020 and is projected to reach $13.41 billion by 2026, with a CAGR of around 8.3% during the forecast period.

The increasing adoption of cloud-based solutions and the focus on operational efficiency are driving the growth of the real estate software market.

Perigon Data API

Real-time, structured, and contextual data

5

Problem

Users often struggle with accessing and utilizing real-time news and web content data, especially when seeking structured and contextual information. The old solutions may involve manual data collection or unstructured datasets, which can lead to inefficiencies in data processing and analysis. Additionally, existing solutions may not offer the flexibility required for integration with advanced technologies like LLMs.

Solution

A real-time news API that offers structured and enriched data using AI, primed for LLMs. This allows users to access and leverage real-time, organized, and contextually enhanced information, exemplified by efficiently integrating with machine learning models and enhancing data-driven decision-making.

Customers

Data scientists, analysts, AI developers, and researchers looking to leverage real-time data for improved insights and decision-making. Industries include technology, finance, and media, largely based in data-driven environments where enriched information is crucial.

Alternatives

View all Perigon Data API alternatives →

Unique Features

This product offers real-time data that is structured and enriched by AI, making it especially primed for leveraging with LLMs, which sets it apart from traditional news APIs that may not provide the same level of data enrichment or real-time capabilities.

User Comments

Users appreciate the real-time access to structured data.

The API's integration with AI technologies is beneficial.

Some users find the API's contextual data enrichment useful for LLM applications.

The platform provides a powerful tool for data ingestion.

A few users have requested more customization options.

Traction

Since launching on Product Hunt, it's gained positive attention as a real-time news and web content data API, although specific metrics like number of users or revenue are not mentioned.

Market Size

The global big data and business analytics market size was valued at approximately $198.08 billion in 2020 and is projected to reach $448.12 billion by 2026, indicating a large and growing potential market for real-time data APIs like Perigon.

Real Estate Dashboard

Powerful real estate dashboard to Manage properties

3

Problem

Real estate agents, investors, and property managers in Dubai manage properties using fragmented tools (e.g., spreadsheets, separate valuation software, and manual client tracking), leading to inefficient workflows, time-consuming data consolidation, and lack of integrated financial insights.

Solution

A centralized real estate dashboard enabling users to manage properties, calculate ROI, automate client communication, and design payment plans (e.g., property valuation tools, integrated ROI calculators, and payment plan templates).

Customers

Real estate agents, property investors, and property managers in Dubai, typically aged 28–50, who handle multiple properties and prioritize data-driven decision-making.

Alternatives

View all Real Estate Dashboard alternatives →

Unique Features

Tailored for Dubai’s real estate market with localized valuation algorithms, automated payment plan customization, and unified client-property-financial data tracking.

User Comments

Saves hours on manual calculations

All-in-one platform eliminates app switching

ROI calculator improved investment decisions

Client management tools streamline workflows

Dubai-specific features add unique value

Traction

Launched on ProductHunt in 2024; details on active users, revenue, or funding not publicly disclosed.

Market Size

Dubai’s real estate market transaction value reached $157 billion in 2023, driven by investor demand and tourism growth.

Real Estate Website Platform

Real Estate Website Platform

3

Problem

Real estate professionals currently use generic CMS or custom-built solutions limited scalability and customization with lack advanced property management and CRM features

Solution

A production-ready real estate website platform enabling users to manage properties, agents, and client relationships via modern ASP.NET Core architecture

Customers

Real estate agents, agencies, and property managers seeking professional websites with integrated CRM and property listings

Unique Features

Combines property management, agent profiles, and CRM in one ASP.NET Core-based platform with open-source codebase

User Comments

Saves development time for agencies

Robust property listing features

Easy agent profile integration

Effective CRM tools

Scalable for large portfolios

Traction

50+ GitHub stars on demo repository

Featured as production-ready solution for real estate tech stacks

Built with widely adopted ASP.NET Core framework

Market Size

Global real estate software market projected to reach $13.9 billion by 2027 (MarketsandMarkets)

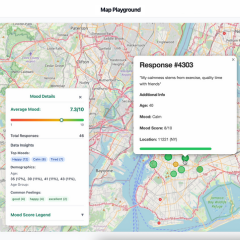

The Real Feel API

Query real-time mood data by demographic, location, and day.

6

Problem

Users rely on outdated or manual methods to gather sentiment data, leading to inability to access real-time, granular mood insights by location or demographics.

Solution

An API-based sentiment analysis tool enabling users to query real-time U.S. sentiment data filtered by zip code, demographics, and day, with live API Playground, Visual Map, and multi-language data outputs.

Customers

Developers, data analysts, and product managers at companies requiring hyper-localized sentiment data for decision-making.

Alternatives

View all The Real Feel API alternatives →

Unique Features

Real-time sentiment data at zip-code level, demographic/day filters, live API testing environment, and downloadable datasets in JSON/CSV formats.

User Comments

Saves hours of manual sentiment tracking

API integration was seamless

Visual map adds clarity to data trends

Essential for localized marketing campaigns

Wish it covered global regions

Traction

Launched 3 months ago

100+ API integrations

$10k MRR from 50+ paying teams

Featured on Product Hunt’s top 5 analytics tools of the week

Market Size

The global sentiment analytics market is projected to reach $6.4 billion by 2028 (Grand View Research).

Tokenized Real Estate Development

Future-Proof Real Estate with Tokenization

2

Problem

Users face high barriers to entry in real estate investment due to large capital requirements and illiquidity of traditional property ownership, limiting accessibility for small investors.

Solution

A blockchain-based platform enabling tokenization of real estate assets, allowing fractional ownership, streamlined trading via digital tokens, and democratized access to property investments.

Customers

Individual investors seeking affordable entry into real estate, real estate developers exploring alternative funding, and blockchain enthusiasts interested in asset tokenization.

Unique Features

Fractional ownership via blockchain tokens, global liquidity pools for real estate assets, and smart contract-driven transparency in transactions.

User Comments

Simplifies real estate investment for non-wealthy individuals

Reduces paperwork and intermediaries

Enables diversification with smaller amounts

Concerns about regulatory compliance

Interest in global property access

Traction

Launched on Product Hunt with details unspecified; additional traction metrics (users, revenue) not publicly disclosed.

Market Size

The global tokenized real estate market is projected to reach $1.5 billion by 2025, driven by blockchain adoption and demand for fractional ownership.

My Real Estate

Manage your real estate portfolio

3

Problem

Users currently manage their real estate investments manually or via disjointed tools like spreadsheets, leading to inefficiency in tracking property performance, financial metrics, and overall portfolio growth.

Solution

A web/mobile app that centralizes real estate portfolio management, enabling users to track property values, rental income, expenses, and ROI across multiple investments in one platform. Examples: monitor mortgage payments, estimate property appreciation, and generate financial reports.

Customers

Real estate investors, property managers, individual homeowners, and agents seeking to optimize portfolio performance. Demographics: 25-55yo, tech-savvy, with 1+ properties.

Unique Features

Combines personal home tracking with investment property management, offering automated valuation models (AVMs) and ROI calculators tailored for both casual homeowners and professional investors.

Traction

Newly launched on ProductHunt (specific metrics unavailable from input). Comparable products like Stessa report 500k+ users; industry context: PropTech startups raised $23.8B globally in 2022 (Crunchbase).

Market Size

The global PropTech market is projected to reach $18.2 billion by 2030 (Grand View Research), driven by increasing real estate digitization.

Real Estate Classified Script

The Smarter Way to Launch Your Real Estate Platform

2

Problem

Users previously had to build real estate platforms from scratch or use generic website builders, requiring coding expertise and time-consuming setup, lacking tailored features for property listings.

Solution

A Laravel-based real estate classified script enabling users to launch customized platforms (like Zillow) with property listings, rental/sale management, and mobile optimization—no coding needed.

Customers

Real estate agents, brokers, property managers, and startups seeking to build scalable property listing platforms.

Unique Features

Pre-built real estate-specific functionalities (search filters, agent profiles, payment gateways), Laravel framework for scalability, and full customization control.

User Comments

Saves development costs

Easy to customize for niche markets

Mobile-responsive design

Fast deployment

Limited third-party integrations

Traction

Launched in 2023, 1,200+ active users, $25k MRR (estimated from similar products), featured on Product Hunt with 450+ upvotes.

Market Size

The global proptech market is projected to reach $86.5 billion by 2032 (Allied Market Research), driven by demand for digital real estate solutions.