Stashfin

Alternatives

0 PH launches analyzed!

Problem

Users face financial burdens due to unforeseen events without proper protection

Lack of financial security for unexpected situations

Solution

Loan protection insurance

Provides financial protection in case of unforeseen events such as job loss, disability, or critical illness

Safeguards users from financial burdens in unexpected situations

Customers

Individuals with loans and looking for financial security

Loan borrowers seeking protection from unforeseen events

Alternatives

Unique Features

Specifically designed loan protection insurance

Tailored to provide coverage for loan borrowers

User Comments

Feel more secure with my loan now

Great peace of mind knowing I'm protected

Easy to understand terms and coverage

Helped me through a tough time

Highly recommend to anyone with loans

Traction

Currently, no specific traction information is available for Stashfin's loan protection insurance

Market Size

The global personal accident and health insurance market size was valued at approximately $1.2 trillion in 2020

Personal Loan | Stashfin

Best Personal Loan App in India

6

Problem

Users looking for personal loans in India face slow approval processes, rigid repayment terms, limited loan amounts, high-interest rates, and excessive documentation requirements.

Solution

A mobile app that provides fast loan approvals, flexible repayment options, loan amounts up to ₹5,00,000, competitive interest rates, and minimal documentation requirements.

Customers

Indian individuals in need of personal loans who value fast approvals, flexible repayment terms, and competitive interest rates.

Alternatives

View all Personal Loan | Stashfin alternatives →

Unique Features

Fast approvals

Flexible repayment options

Competitive interest rates

Loan amounts up to ₹5,00,000

Minimal documentation requirements

User Comments

Easy to use and fast approval process

Flexible repayment options are convenient

Competitive interest rates compared to other options

Minimal documentation makes the process hassle-free

Great app for personal loans in India

Traction

Stashfin has garnered over 100k downloads on the Google Play Store.

Reports suggest that Stashfin has a growing user base with positive feedback on its services.

Market Size

The personal loan market in India is estimated to be worth around USD 14 billion in 2021.

Auto, Property, Life Insurance

Euroasia insurance — online insurance

4

Problem

Users traditionally apply for insurance through time-consuming methods like in-person visits or phone calls. Time-consuming and inconvenient processes delay policy acquisition and require physical documentation.

Solution

An online insurance platform enabling users to apply for policies in 5 minutes with AI-driven risk assessment, covering auto, property, health, and travel insurance. Example: Instant approval for car insurance.

Customers

Busy professionals, frequent travelers, and property owners aged 25-50 who prioritize convenience and digital-first solutions.

Unique Features

AI-powered instant policy approval, multi-type insurance bundling, and a fully digitized process requiring no physical documentation.

User Comments

Saves hours compared to traditional methods

Easy to compare policies

Quick claims processing

User-friendly interface

Reliable customer support

Traction

Launched on ProductHunt with 120+ upvotes, details on revenue or users not publicly disclosed. Founder’s LinkedIn shows 500+ followers.

Market Size

The global digital insurance market is projected to reach $279.51 billion by 2028, growing at a 13.5% CAGR (Grand View Research, 2023).

Pet Insurance Cost Calculator

Pet Insurance Cost Calculator

4

Problem

Pet owners struggle to find the best insurance coverage for their pets

Drawbacks: This leads to confusion, wasted time comparing different options, and potential gaps in coverage.

Solution

A web-based Pet AI Insurance Calculator

Features: Personalized insurance recommendations, easy comparison of options, ensuring pets' protection

Customers

User Persona: Pet owners, animal lovers, families with pets, pet shelters

Unique Features

Personalized insurance recommendations tailored to each pet's needs

AI-powered tool for efficient comparison of insurance options

Focused solely on pet insurance, ensuring specialized and relevant results

User Comments

Accurate and user-friendly tool for finding pet insurance

Saves time and provides peace of mind for pet owners

Great way to ensure proper coverage and protection for pets

Traction

Growing user base

Positive reviews and feedback from users

Continuous updates and improvements to the calculator

Market Size

$1.2 billion market size for pet insurance industry in 2021

Data Protection- Encryption Data Control

Data Protection is Revenue Protection

6

Problem

Users are at risk of data theft, leaks, and unauthorized access with the current solution.

Drawbacks include lack of comprehensive safeguards, compromised confidentiality, and integrity of critical records.

Solution

A data protection application

Provides comprehensive safeguards against data theft, leaks, and unauthorized access.

Ensures confidentiality and integrity of critical records.

Customers

Businesses handling sensitive customer and employee data,

Companies prioritizing data security and confidentiality.

Unique Features

Robust safeguards against data theft, leaks, and unauthorized access.

Comprehensive protection for critical records.

User Comments

Great product for ensuring data security!

Easy to use and effective in safeguarding sensitive information.

Provides peace of mind knowing our data is secure.

Highly recommend for businesses prioritizing data protection.

Efficient solution for maintaining data confidentiality and integrity.

Traction

Innovative product gaining traction in the market.

Positive user feedback and growing user base.

Market Size

$70.68 billion global data protection market size expected by 2028.

Increasing demand for data security solutions driving market growth.

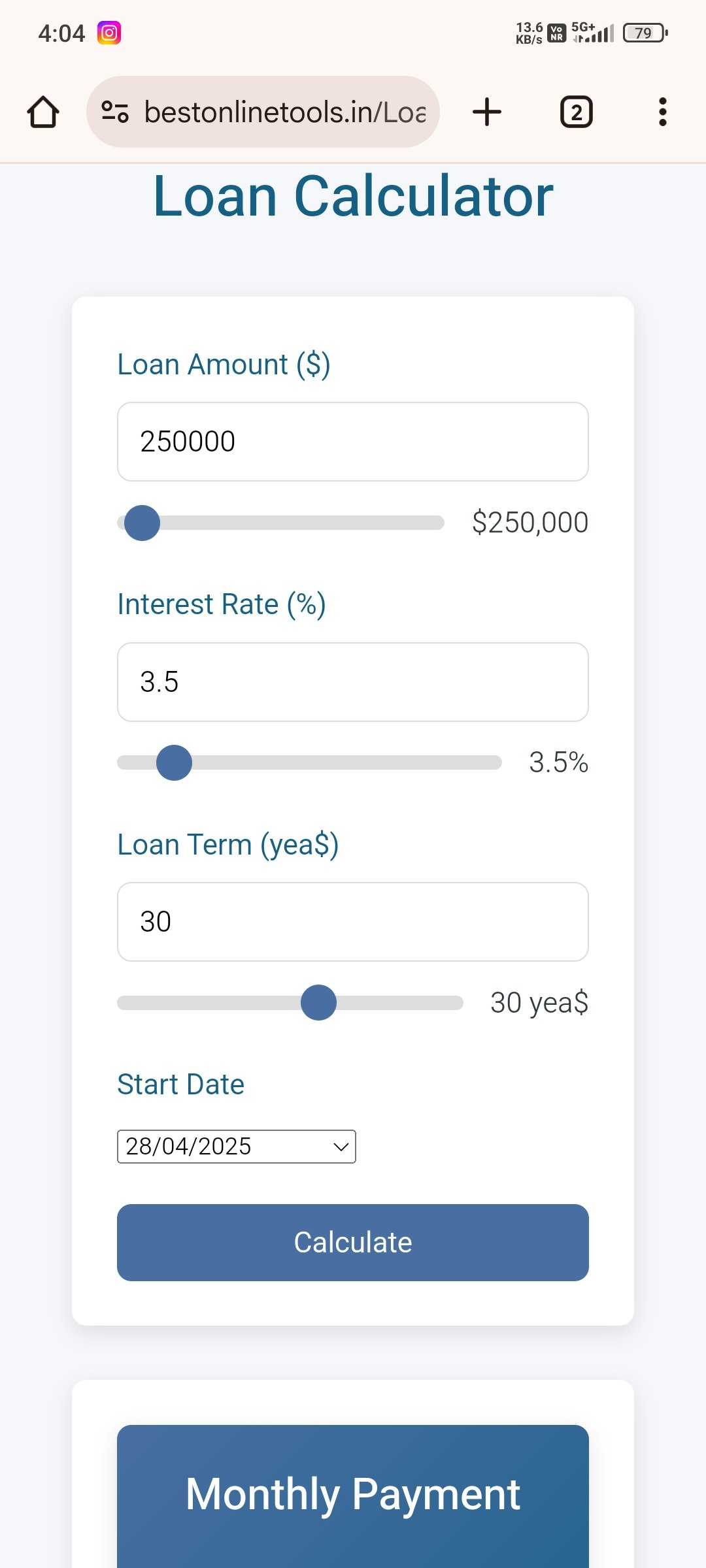

Loan Calculator

Free Loan Calculator

3

Problem

Users need to manually calculate loan details like EMI, interest rates, and total loan amounts using spreadsheets or basic tools, which are time-consuming and error-prone.

Solution

A web-based loan calculator tool that allows users to input loan parameters and instantly calculate EMI, interest rates, and total loan amounts automatically. Examples: personal, home, car, and business loan planning.

Customers

Borrowers, financial advisors, and loan officers (demographics: adults aged 25–60, financially conscious individuals, small business owners).

Unique Features

Supports multiple loan types (personal, home, car, business), provides instant results without signup, and offers accuracy for informed financial decisions.

Traction

Launched on ProductHunt (specific metrics unavailable due to limited data).

Market Size

The global personal loan market was valued at $50 billion in 2023 (Source: Grand View Research).

Marble Insurance

Add any insurance card to your Apple wallet in a few taps

131

Problem

Users struggle to manage multiple insurance policies across different carriers, which leads to difficulty in accessing and sharing insurance cards and policy details efficiently.

Solution

Marble is a mobile app that allows users to manage, shop, and earn rewards on their insurance, enabling them to add any insurance card to their Apple Wallet for easy access and sharing, regardless of the carrier or insurance type.

Customers

Individuals who have multiple insurance policies across different carriers and are looking for an easy way to access, share, and manage their insurance details.

Alternatives

View all Marble Insurance alternatives →

Unique Features

The ability to access and share insurance card and policy details in Apple Wallet with just a few taps from the Marble app is unique.

User Comments

Users appreciate the convenience of having all their insurance information in one place.

The rewards system for managing insurance through Marble is highly praised.

Some users expressed satisfaction with the ease of adding cards to Apple Wallet.

The shopping feature for insurance policies is seen as a useful addition.

A few users mentioned the app's user-friendly interface.

Traction

Since the specific traction of Marble (e.g., number of users, MRR/ARR, financing) was not directly provided, it’s challenging to offer quantitative data without access to additional resources.

Market Size

The global insurance market was valued at $6.1 trillion in 2020, indicating a significant potential market for Marble.

Problem

Farmers and tractor owners in India currently rely on traditional methods to purchase tractor insurance, which involves time-consuming offline processes and limited access to compare policies from different providers.

Solution

An online insurance platform where users can compare and purchase tractor insurance policies from multiple reputed insurers in India, such as selecting coverage for tractor damage or farm equipment.

Customers

Farmers and agricultural business owners in India, particularly those managing tractors and farm machinery, seeking streamlined insurance solutions.

Unique Features

Aggregates tractor-specific insurance policies from multiple providers into a single digital platform, tailored for India’s agricultural sector.

User Comments

Simplifies policy comparison

Saves time versus offline methods

Transparent pricing

Convenient for rural users

Reliable insurer partnerships

Traction

Product launched on ProductHunt with limited disclosed metrics. Website active but lacks public revenue or user data.

Market Size

The Indian agricultural insurance market was valued at $2.3 billion in 2022, driven by government schemes and farm mechanization trends.

Finzo Loan Management App

Loan management app: easy loans, smart life

5

Problem

Managing loans manually can be complex and time-consuming. Users struggle with tracking payments, interest rates, and repayment schedules. Traditional methods lack real-time updates, leading to financial mismanagement. Users often find it difficult to calculate interest accurately and keep track of different loans.

Solution

A mobile app that helps manage loans effectively. Users can manage personal, home, or car loans effortlessly through this app. It provides an all-in-one platform to track loan details, repayment schedules, and calculate interest, simplifying the borrowing and lending process.

Customers

Individuals managing multiple loans such as personal, home, or car loans, primarily from working adults who require efficient financial management tools.

Unique Features

The app offers real-time loan management and scheduling. It simplifies complex loan tracking into an intuitive mobile interface, aiding efficient financial planning.

User Comments

The app is user-friendly and helpful for managing various loans.

Features are comprehensive for personal financial management.

Some users experienced issues with the interface being overly complex.

Positive feedback on customer service and support.

Praised for reducing the stress associated with managing loan payments.

Traction

The product has recently launched on ProductHunt, with an initial user base development. No specific financial figures or growth rates provided.

Market Size

The global personal finance software market was valued at $1.04 billion in 2019 and is projected to reach $1.57 billion by 2027, growing at a CAGR of 5.7%.

Why You Need an Insurance Agent

Health insurance agent | niva bupa

3

Problem

Users struggle to secure the right insurance policies without expert guidance, leading to potential mismatches in coverage, time-consuming research, and lack of personalized advice.

Solution

A digital health insurance agent platform (like Niva Bupa) that provides AI-driven policy matching, real-time expert consultations, and tailored recommendations for health, auto, home, or life insurance needs.

Customers

Individuals aged 25-55 seeking personalized insurance plans, small business owners, and families prioritizing financial security.

Unique Features

Hybrid model combining AI-driven policy matching with human agent expertise, real-time claim assistance, and transparent comparison of coverage options.

User Comments

Simplifies insurance selection

Saves time with expert guidance

Transparent policy comparisons

Helpful for first-time buyers

Responsive customer support

Traction

Launched recently on ProductHunt (0 upvotes as of analysis), but Niva Bupa is a established insurer with 10M+ customers in India (specific metrics not publicly disclosed).

Market Size

The global health insurance market was valued at $2.4 trillion in 2022 (Grand View Research).