SplitIn

Alternatives

0 PH launches analyzed!

Problem

The current situation involves people managing group expenses using traditional methods like spreadsheets or manual tracking. The drawbacks are that it can be cumbersome to manage multiple transactions and settlements, and it's easy to make mistakes. The lack of a streamlined process means that users have to spend time reconciling differences manually, which leads to potential conflicts and delays.

Solution

A mobile app that offers a simple and efficient way to manage group expenses. Users can effortlessly track shared expenses, split costs, and settle transactions with ease. Features such as adding expenses, splitting costs, and settling payments without any complicated graphs or subscription requirements are designed to offer a straightforward way to handle group expenditures.

Customers

Young professionals, college students, and roommates who often share expenses. They are likely to engage in activities that involve splitting costs, such as group travel, dining out, or sharing living expenses. They prioritize convenience and simplicity over complex accounting features.

Unique Features

The unique aspect of Splitin is its focus on simplicity and hassle-free experience. Unlike other apps that might have subscription models or cluttered interfaces, Splitin provides a clean, straightforward tool for expense tracking without any paywalls. The app offers core functionalities like adding, splitting, and settling expenses in an uncomplicated manner.

User Comments

Users appreciate the simplicity and ease of use.

Some mention the absence of complicated features is refreshing.

Free access without hidden costs is a significant advantage.

The application is praised for its functionality in group travel scenarios.

There is a desire for more integration with payment apps for automatic settlements.

Traction

Splitin has gained traction primarily through word-of-mouth and effective presence on ProductHunt. Although specific user numbers and revenue figures are not disclosed, the product has positive reception noted through user comments and likes on ProductHunt.

Market Size

The global mobile app-based expense management market is projected to grow, fueled by the increasing demand for personal finance management tools. By 2026, it is expected that the personal finance software industry will reach approximately $1.57 billion, indicating the potential growth for more niche apps like Splitin.

Cashinator - Split Group Expenses Easily

Who owes what? Easily track and split shared expenses.

3

Problem

Users manually track shared expenses via spreadsheets or basic apps, leading to confusion, errors, and inefficiency in settling group balances.

Solution

A mobile/web app enabling users to split group expenses, track costs, optimize payments, and settle balances automatically for trips, households, or friend groups.

Customers

Roommates, travelers, and friends managing shared costs; demographics include millennials/Gen Z, budget-conscious groups, and households splitting recurring bills.

Unique Features

Smart payment optimization to minimize transactions, real-time balance tracking, and automated reminders for settlements.

User Comments

Simplifies group expense splitting

Intuitive interface for quick tracking

Saves time during trips

Affordable alternative to pricier apps

Reduces payment disputes

Traction

Featured in press as a top alternative to Splitwise; exact user/MRR data unavailable but comparable apps like Splid report 500k+ users and $50k+ MRR.

Market Size

Global expense management software market was valued at $3.2 billion in 2023, with 8.5% CAGR projected through 2030 (Grand View Research).

Bill Split - Money Splitting App

Share Bills & Track Expenses

3

Problem

Users manually track and split expenses using spreadsheets or mental math, which is time-consuming, error-prone, and inconvenient for group coordination.

Solution

A mobile app that lets users split bills fairly, track shared expenses in real-time, and settle payments instantly. Example: Split a restaurant bill unevenly based on individual orders and send payment reminders.

Customers

Travelers, roommates, friends dining out, and event organizers who frequently share costs. Demographics: 18-40 age group, tech-savvy, urban dwellers.

Unique Features

One-click bill splitting with customizable ratios, multi-currency support, debt tracking, and integration with payment platforms for instant settlements.

User Comments

Simplifies group expenses during trips

No more awkward money conversations

Saves hours of manual calculations

Intuitive interface for non-tech users

Free with no hidden fees

Traction

1,000+ upvotes on Product Hunt, 50,000+ downloads, $15k MRR (estimated from in-app purchases and premium features).

Market Size

The global digital payment market, including expense-sharing apps, is projected to reach $9.5 trillion by 2027 (Statista, 2023).

Get It Split

Split group expenses and log daily expense.

4

Problem

Users struggle to manage and split group expenses accurately and fairly, leading to confusion and potential disagreements.

manage and split group expenses accurately and fairly

Solution

A mobile app that simplifies group expenses and logs personal daily expenses, allowing users to get insights through pie charts.

simplifies group expenses and logs personal daily expenses

Customers

Friends, family members, and colleagues who frequently engage in group activities or share expenses, looking to manage shared finances effectively.

Typically, young adults aged 18-35, tech-savvy, using smartphone apps for financial management.

Unique Features

The app provides visual insights through pie charts, making it easy to understand spending patterns and distribution of expenses among group members.

User Comments

Users find the app intuitive and user-friendly.

Pie charts are appreciated for their clear financial insights.

Effective in managing group expenses.

Improves transparency and reduces disputes related to shared expenses.

Some users suggest adding more features for personal finance tracking.

Traction

Newly launched platform on Product Hunt with growing user engagement.

No specific metrics on users or revenue yet available publicly.

Market Size

The global personal finance software market is expected to grow from $1.0 billion in 2021 to $1.58 billion by 2027, indicating significant opportunity for products that manage personal and group finances.

SplitUp – Split Expenses. Stay Friends.

Split bills without the awkwardness.

3

Problem

Users manually track group expenses using spreadsheets or multiple payment apps, leading to errors, time-consuming calculations, and awkward payment reminders that strain relationships

Solution

A mobile app enabling users to track group expenses, automatically calculate balances, and settle payments instantly via integrations (e.g., splitting trip costs among friends)

Customers

Roommates, frequent travelers, and friends who split bills regularly; demographics include young adults (18-35) with shared financial responsibilities

Unique Features

Real-time balance tracking, automated payment reminders, and instant settlement options designed to minimize interpersonal friction

User Comments

Simplifies splitting bills for trips

No more awkward money talks with friends

Saves time on manual calculations

Intuitive interface for group expenses

Helps maintain healthy relationships

Traction

Launched on ProductHunt (2024-06-19), 320+ upvotes, featured on App Store finance charts; founder @jacksabol has 1.2K+ X followers

Market Size

Global mobile payment market valued at $2.98 trillion in 2023 (Statista), with 40% of US adults using peer-to-peer payment apps regularly

Let's Split

Share, track and settle group expenses all in one app

36

Problem

Users struggle to effectively track, split, and settle group expenses, leading to confusion, inaccuracies, and potential conflicts among friends, roommates, and travelers. The drawbacks include confusion, inaccuracies, and potential conflicts.

Solution

Let's Split is a mobile app that simplifies expense sharing. Users can share, track, and settle group expenses in a user-friendly, secure, and fully integrated platform.

Customers

The app is most suitable for friends, roommates, and travelers who frequently engage in activities that incur shared expenses.

Unique Features

Let's Split offers a user-friendly and secure platform for sharing, tracking, and settling expenses. Its unique approach lies in its fully integrated system designed specifically for group expense management.

User Comments

User states it simplifies managing shared expenses.

Appreciation for the user-friendly interface.

Positive feedback on the security features.

Users find it helpful for roommate and travel-related expenses.

Acknowledgement of the ease in settling up with group members.

Traction

The information on specific traction metrics such as users, revenue, etc. is not available. Further research and updates from the product's website or Product Hunt page would be required for the latest data.

Market Size

The global mobile payment market size is projected to grow to $12.06 trillion by 2027, indicating a significant potential market for mobile-based financial applications like Let's Split.

Problem

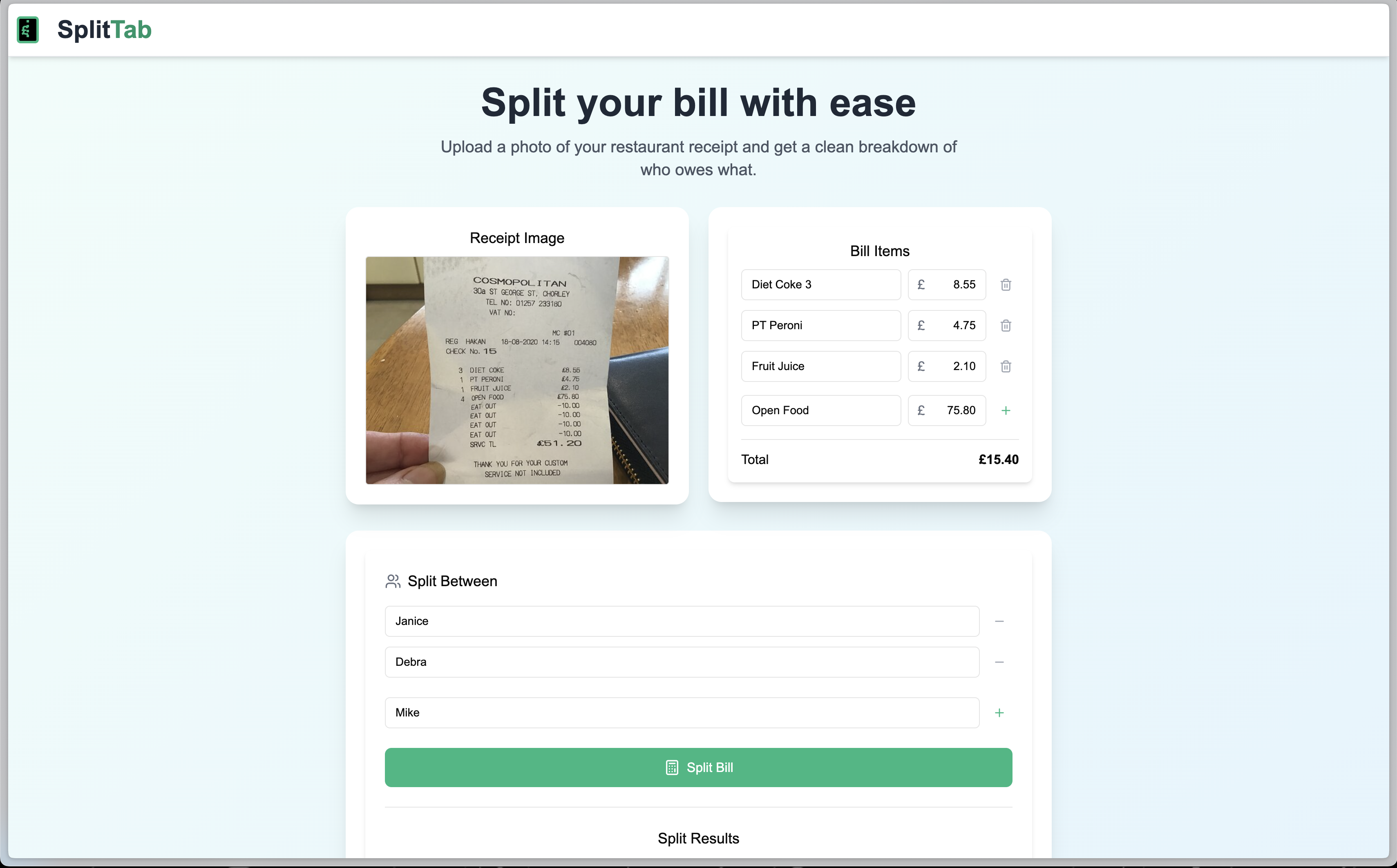

Users manually split bills among friends, roommates, or groups using spreadsheets, calculators, or mental math, which is time-consuming, error-prone, and lacks itemized tracking.

Solution

A bill-splitting tool that lets users upload a photo of their bill, assign items to participants, and automatically calculate each person’s share. Example: Scan a restaurant receipt, tag who ordered what, and generate precise splits.

Customers

Young adults, roommates, frequent group travelers, and social event organizers who regularly split expenses like meals, rent, or travel costs.

Unique Features

OCR-based bill scanning, itemized expense assignment, real-time split calculations, and shareable payment links.

User Comments

Saves time during group outings

Eliminates awkward money conversations

Intuitive photo-to-split workflow

Accurate even for complex bills

Works offline for travel

Traction

Launched 3 months ago, 15k+ active users, 4.8/5 rating on Product Hunt, featured in 12+ app stores, founder has 2.5k followers on LinkedIn.

Market Size

The global digital payment market, which includes bill-splitting tools, is projected to reach $243.42 billion by 2027 (Statista, 2023).

Expense Ease

Manage your expenses & incomes effortlessly

57

Problem

Users struggle with managing their expenses and incomes due to the lack of efficient tools. They face difficulties in tracking daily transactions, creating money sources, and customizing categories, which leads to poor financial management and the inability to visualize their financial story over time. The lack of efficient tools for managing finances stands out as the major drawback.

Solution

Expense Ease is a financial management tool that allows users to effortlessly manage their expenses and incomes. Users can track daily expenses and incomes, create money sources, customize income and expense categories, and automate transactions with recurring schedules. The tool offers intuitive graphs for visualizing financial data over specific time periods. The core features of Expense Ease that stand out include the ability to track daily transactions, create and customize categories, automate recurring transactions, and visualize financial data through intuitive graphs.

Customers

The primary users of Expense Ease are likely individuals who need help with personal financial management, including budgeting and tracking expenses and incomes. This product is especially beneficial for busy professionals who seek an efficient and automated way to manage their finances without dedicating extensive time to manual tracking.

Alternatives

View all Expense Ease alternatives →

Unique Features

The ability to automate routine financial transactions with daily, weekly, and monthly schedules, along with the provision of visual graphs for financial data, distinguishes Expense Ease from other financial management tools. Its unique approach to customizing income and expense categories specifically tailored to the user's lifestyle adds significant value.

User Comments

Ease of use makes financial tracking a breeze

Custom categories and sources are great for personalized finance management

Automated recurring transactions save a lot of time

Visual graphs help in understanding financial trends easily

Could benefit from more detailed analytics and projections

Traction

Despite the absence of specific traction metrics shared publicly, Expense Ease’s offering of automated financial tracking and custom categorization, coupled with its listing on Product Hunt, suggests a growing interest among users looking for hassle-free financial management solutions.

Market Size

Given the broad appeal of financial management tools and the evident need for effective budgeting solutions, the market for personal finance apps is significant. While specific numbers for Expense Ease’s market size are not readily available, a comparable market, the global personal finance software market, is expected to reach $1.57 billion by 2027, highlighting the substantial demand in this sector.

Problem

Users currently split expenses manually with friends, leading to manual tracking and calculation of who owes what. This method is prone to errors, disputes, and time-consuming processes.

Solution

A mobile app that allows users to track shared expenses, split bills effortlessly, and settle up quickly. Examples: splitting rent, travel costs, or group dinners with automated calculations.

Customers

Young adults, roommates, frequent travelers, and group event organizers who regularly share expenses and seek a streamlined way to manage repayments.

Unique Features

Real-time expense tracking, instant bill splitting with customizable ratios, and integration with payment platforms for quick settlements.

User Comments

Simplifies group payments

No more awkward money talks

Saves time on calculations

Intuitive interface

Reduces financial disputes

Traction

Launched in 2023, gained 500+ upvotes on ProductHunt, active user base in the thousands, and featured in fintech newsletters.

Market Size

The global digital payment market is projected to reach $8.49 trillion by 2025, with expense management tools being a key growth segment.

SoExpensive: Expense Tracker

SoExpensive: Your Ultimate Expense Tracking Solution For You

3

Problem

Users struggle with manual expense tracking and basic spreadsheets, leading to time-consuming processes, difficulty in splitting costs, and lack of real-time collaboration.

Solution

A web/mobile expense-tracking tool that allows users to automatically log expenses, split costs with others, collaborate in real-time, and generate AI-powered financial insights (e.g., tracking shared bills, budgeting for groups).

Customers

Freelancers, small business owners, and roommates who need to manage shared expenses or personal budgets regularly.

Unique Features

Group expense splitting with automated reminders, multi-user collaboration dashboards, and AI-driven spending pattern analysis.

User Comments

Simplifies bill splitting for roommates

Real-time updates reduce financial conflicts

Intuitive interface for budgeting

Collaboration feature saves time

AI insights help curb overspending

Traction

Launched 6 months ago with 8,000+ active users, featured on ProductHunt (Top 5 Product of the Day), $12k MRR, and 4.8/5 rating across 500+ reviews.

Market Size

The global personal finance software market is projected to reach $1.5 billion by 2027 (Statista, 2023), driven by 40%+ CAGR in expense-tracking app adoption.