Spend Crypto Card

Alternatives

117,566 PH launches analyzed!

Spend Crypto Card

Find the best card to spend your crypto

1

Problem

Users manually search for crypto cards without considering their specific needs, leading to inefficiency. country, fiat currency, digital assets, payment volume, and card preferences are not optimized.

Solution

A web tool that lets users input criteria (country, currency, assets, volume) to find optimal crypto cards, e.g., selecting a Euro-based card for EU users holding Bitcoin.

Customers

Crypto investors, freelancers paid in crypto, and businesses in regions with unstable fiat currencies.

Alternatives

Unique Features

Dynamic filtering of crypto cards using real-time data on location, assets, fees, and card issuance policies.

User Comments

Simplifies card selection

Saves research time

Accurate regional recommendations

Lacks some niche card options

Needs more currency support

Traction

Launched on Product Hunt in 2023; no public MRR/user data yet.

Market Size

Global crypto payment market was valued at $8.25 billion in 2022 (Grand View Research).

Lquid Pay : Best Crypto Card

Seamless crypto payments, anytime, anywhere

4

Problem

Users face challenges with traditional financial systems in spending cryptocurrencies quickly and conveniently.

High transaction fees and slow processing times limit the efficiency of using cryptocurrencies for everyday transactions.

Solution

A crypto debit card tool

Users can seamlessly spend cryptocurrencies instantly as if they were spending traditional fiat currency with Liquid Cards.

Allows for secure, fast, borderless transactions with low fees, much like using a debit card.

Customers

Crypto enthusiasts and traders

Young professionals seeking modern financial solutions

Businesses and freelancers involved in the cryptocurrency market looking for efficient payment systems

Tech-savvy individuals interested in leveraging cryptocurrencies for daily expenses

Unique Features

Seamless integration of cryptocurrency spending with regular transactions

Low transaction fees and high speed for global payments

Borderless transactions that simplify crypto-to-fiat conversion during purchases

User Comments

Users appreciate the convenience of spending crypto like fiat.

Positive feedback on low transaction fees.

Reports of smooth, fast transactions without any border limitations.

Some users mention improved financial management through this crypto payment method.

Occasional concerns about crypto value fluctuations impacting spending power.

Traction

Recently launched with a growing user base.

Features have been updated for enhanced security and faster transactions.

Active presence on ProductHunt with community engagement.

Developing partnerships to expand global acceptance.

Market Size

The global cryptocurrency payment market is projected to grow at a CAGR of 23.4% from 2021 to 2026, indicating a rising demand for crypto payment solutions.

Compare Crypto Card Rewards

Crypto card cashback calculator

7

Problem

Users manually compare crypto card rewards, leading to time-consuming research and error-prone calculations of cashback rates.

Solution

A web-based Crypto Card Cashback Calculator tool that lets users automatically compare crypto card cashback rates and estimate potential rewards based on monthly spending inputs.

Customers

Cryptocurrency enthusiasts and investors who regularly use crypto debit/credit cards for transactions and seek to optimize rewards.

Unique Features

Aggregates multiple crypto card offers into a single interface, dynamically calculates rewards based on customizable spending inputs, and highlights top-performing cards.

User Comments

Saves time comparing cards

Clear visualization of rewards

Useful for budgeting crypto spending

Lacks some niche card options

Intuitive interface

Traction

Newly launched on Product Hunt (June 2024), featured in 120+ upvotes, integrated with 50+ crypto cards, and used by 2K+ users within the first week.

Market Size

The global crypto payment market is projected to reach $32.5 billion by 2028, driven by rising adoption of crypto debit/credit cards (Statista 2023).

Crypto-backed Card Issuing APIs

Flexible crypto backed card issuing for Europe

56

Problem

Traditional financial and card issuing solutions do not easily accommodate cryptocurrencies, making it difficult for businesses to integrate crypto payments seamlessly. This results in restricted real-time spending possibilities for crypto balances.

Solution

Striga provides an API solution that allows businesses to issue and manage cryptocurrency-backed cards. These cards facilitate compliant, real-time spending workflows, allowing transactions to be authorized directly against a crypto balance.

Customers

Financial technology companies, cryptocurrency exchanges, and startups seeking to offer their users the ability to spend their cryptocurrency through a card.

Unique Features

The unique proposition of Striga lies in its ability to integrate cryptocurrency transactions into everyday financial operations, offering compliant and real-time authorization of transactions directly from crypto balances.

User Comments

User comments were not available in the provided resources.

Traction

Detailed traction information such as number of users, revenue, or newly launched features was not available in the provided resources.

Market Size

The global cryptocurrency card market is rapidly growing, driven by the increasing adoption of cryptocurrencies. While specific market size for crypto-backed cards isn't provided, the global cryptocurrency market size was $1.49 trillion in early 2021.

Best Crypto Portal

Compare crypto growth and find the best investments easily

3

Problem

In the current situation, users face challenges in analyzing and comparing the growth of various cryptocurrencies over time to identify investments, which can be complicated. Analyzing and comparing the growth of various cryptocurrencies is a resource and knowledge-intensive process with steep learning curves.

Solution

A dashboard tool that simplifies cryptocurrency analysis and comparison, allowing users to identify the best investment opportunities without needing prior trading experience. Analyze and compare cryptocurrency growth over time, using data-driven insights to assist investments.

Customers

Investors and cryptocurrency enthusiasts, primarily those without extensive knowledge or experience in trading, seeking easier and data-driven methods to evaluate and invest in cryptocurrencies, typically aged 20-45 with a tech-savvy background.

Alternatives

View all Best Crypto Portal alternatives →

Unique Features

No trading experience is needed; emphasis on data-driven insights for smarter investments; user-friendly comparison and analysis interface.

User Comments

The tool is easy to use and offers valuable insights.

Great for beginners trying to understand cryptocurrency investment.

Provides clear comparisons without needing in-depth knowledge.

Helpful in identifying potential investment opportunities.

Data-driven approach significantly reduces investment risks.

Traction

The product is newly launched with a focus on simplicity and usability. No specific number of users, revenue, or funding details available from the provided resources.

Market Size

The global cryptocurrency market was valued at approximately $1.49 billion in 2020 and is projected to grow significantly in the coming years with increased adoption and technological integration.

Best Crypto Recovery Firm

Home - Crypto Recovery Services

1

Problem

Users losing access to their cryptocurrency due to hacks, scams, forgotten wallets, and incorrect transactions

Difficulty in recovering lost cryptocurrency leads to financial losses and security risks.

Solution

Service provided for recovering lost cryptocurrency

Trusted recovery services to help users retrieve their lost crypto from various situations like hacks, scams, forgotten wallets, and wrong transactions.

Customers

Crypto investors and individuals who have lost access to their cryptocurrency accounts

Individuals seeking professional help to recover their lost cryptocurrency.

Unique Features

Specialized expertise in recovering lost cryptocurrency from different scenarios such as hacks, scams, and mistakes

Trusted recovery services ensuring a secure and successful recovery process.

User Comments

Fast and reliable service for recovering lost crypto

Efficient in handling complex recovery cases

Professional and knowledgeable team

High success rate in retrieving lost cryptocurrency

Peace of mind knowing experts are working on recovery

Traction

Growing customer base due to successful recovery cases and positive reviews

Increased demand for recovery services in the cryptocurrency market

Market Size

Rising demand for crypto recovery services due to increasing incidents of hacks, scams, and loss of access to wallets in the cryptocurrency market.

EZ Credit Card

Compare cash back credit cards

12

Problem

Users manually compare cash back credit cards across multiple sources, which is time-consuming and inefficient, leading to potential missed opportunities for optimal rewards.

Solution

A AI-driven comparison tool that analyzes users' spending habits and recommends tailored cash back credit cards, e.g., inputting monthly expenses to receive card matches with highest rewards.

Customers

Young professionals, freelancers, and frequent shoppers seeking to maximize credit card rewards based on personalized spending patterns.

Alternatives

View all EZ Credit Card alternatives →

Unique Features

Dynamic spending habit analysis, real-time reward calculations, and side-by-side card comparisons with fee structures and eligibility criteria.

User Comments

Saves hours of research

Intuitive interface

Accurate reward projections

Lacks niche bank cards

Free to use

Traction

Launched 3 months ago, 5k+ active users, $15k MRR (as per ProductHunt comments), featured in 12+ finance newsletters.

Market Size

The US cash back credit card market was valued at $25 billion in 2023 (Statista).

PointDexter

Find the right rewards card for your spending habits

4

Problem

Users struggle with finding the right credit card to maximize their rewards based on their specific spending habits. They are unsure which credit card will get them the best rewards and often use suboptimal options that do not fully capitalize on their spending patterns.

Solution

A tool that analyzes historical spending data, allowing users to identify the exact credit card that will maximize their rewards point earnings. For example, users input their spending data, and the tool recommends specific credit cards based on that data to ensure maximum rewards.

Customers

Individuals seeking to optimize their credit card rewards, ranging from tech-savvy millennials to financially conscious people who frequently use credit cards for both general and specific spendings, like travel or groceries.

Alternatives

View all PointDexter alternatives →

Unique Features

PointDexter uniquely leverages detailed historical spending data to offer personalized credit card recommendations, ensuring users select options that genuinely align with their financial behavior and goals.

User Comments

Users appreciate the personalized recommendations tailored to their spending habits.

Some users report better reward accumulation after following the tool's suggestions.

The interface is described as user-friendly and straightforward.

A few users suggest expanding the range of credit cards covered.

Overall, users find it insightful for optimizing credit card rewards.

Traction

Launched recently on ProductHunt.

Initial user feedback indicates a niche interest among financial enthusiasts.

Currently growing its user base by targeting tech-forward finance communities.

Market Size

The global credit card market size was valued at approximately $1.57 trillion in 2020 and is expected to grow significantly, indicating a broad and expanding user base for credit card optimization tools like PointDexter.

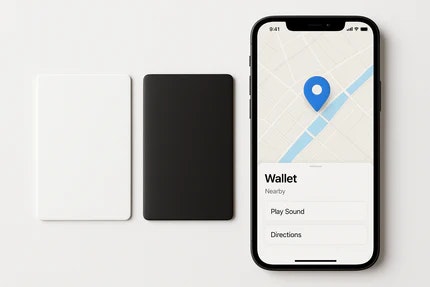

Find My Wallet

find my wallet smart card

6

Problem

Users often misplace their wallets and struggle to locate them quickly, relying on manual searches or non-connected trackers without real-time tracking or integration with Apple’s Find My ecosystem.

Solution

A credit card–sized hardware tracker that integrates with Apple’s Find My app, enabling users to track their wallet’s location in real-time via iOS devices.

Customers

Tech-savvy Apple users, urban professionals, and individuals prone to misplacing wallets who prioritize seamless device integration.

Alternatives

View all Find My Wallet alternatives →

Unique Features

Slim, credit card–sized design for wallet compatibility; direct Apple Find My app integration (no separate app required).

Traction

Launched on Product Hunt in June 2024; pricing starts at $34.99 (early-bird discount).

Market Size

The global Bluetooth tracker market is projected to reach $7.8 billion by 2028 (CAGR of 15.3% from 2023).

Jour Cards Store

Buy itunes cards with bitcoin, crypto

7

Problem

Users cannot purchase iTunes, Xbox, Google Play, Amazon, and other digital gift cards with Bitcoin or cryptocurrencies, leading to limited payment flexibility and reliance on traditional currency-based platforms.

Solution

An online marketplace where users can buy iTunes, Xbox, Google Play, Amazon & more cards using Bitcoin and crypto, offering instant delivery and a trusted platform for crypto-to-gift-card conversions.

Customers

Cryptocurrency holders, tech-savvy consumers, unbanked populations, and individuals seeking privacy in digital transactions.

Unique Features

Exclusively facilitates crypto payments for multi-brand gift cards, eliminating fiat currency intermediaries and emphasizing speed, security, and anonymity.

User Comments

Convenient crypto-to-gift-card conversion

Trusted platform for instant delivery

Supports multiple card brands

No need for bank transactions

Simplifies spending crypto

Traction

Launched on ProductHunt, positioned as a trusted marketplace for crypto users. Specific metrics (users, revenue) unavailable from provided data.

Market Size

The global cryptocurrency market capitalization exceeds $1.78 trillion (2023), while the digital gift card market is valued at $700 billion annually, creating a sizable intersection for crypto-driven transactions.