Rollups

Alternatives

0 PH launches analyzed!

Problem

Startups traditionally manage equity through manual processes for raising capital from multiple investors and consolidating stakeholders, which is time-consuming, complex, and risks losing Qualified Small Business Stock (QSBS) eligibility.

Solution

A financial platform tool that enables startups to use Roll Up Vehicles (RUVs) to aggregate investments from multiple stakeholders into a single entity and Consolidation Vehicles (CVs) to preserve QSBS eligibility during equity consolidation. Examples: streamline fundraising, simplify stakeholder management.

Customers

Startup founders, CEOs, CFOs, and legal advisors handling equity structuring, fundraising, and compliance for early-stage companies.

Unique Features

Focus on QSBS eligibility preservation, automated equity consolidation, and simplified regulatory compliance tailored for startups.

User Comments

Insufficient user comment data provided in the input.

Traction

Launched on ProductHunt by AngelList (a well-known startup ecosystem platform). No explicit revenue or user metrics disclosed, but likely leverages AngelList’s existing network.

Market Size

The global equity management software market was valued at $7.4 billion in 2021 (source: Carta’s 2021 valuation).

Ecosmob’s SIP Ingress Controller

Take control with a SIP Ingress Controller

5

Problem

Users managing SIP traffic face security vulnerabilities, complex routing configurations, and inefficient network flow management with legacy systems.

Solution

A SIP Ingress Controller tool that centralizes SIP traffic management, simplifies routing, and detects threats in real-time (e.g., automated traffic optimization, DDoS protection).

Customers

IT managers, VoIP network engineers, and telecom operators overseeing SIP-based communication systems.

Unique Features

Centralized SIP traffic orchestration, automated threat mitigation, and compatibility with hybrid VoIP infrastructure.

User Comments

Simplifies SIP configurations

Reduces downtime during traffic spikes

Enhances network security

Intuitive monitoring dashboard

Scalable for large enterprises

Traction

Launched v2.5 with real-time analytics, trusted by 500+ businesses, integrated with major VoIP platforms like Asterisk and Cisco.

Market Size

The global VoIP market is projected to reach $145 billion by 2024 (Statista, 2023).

LTSE Equity

Plan, manage, and collaborate on startup equity

589

Problem

Startups and growing companies often struggle with cap table management, tracking ownership transparently among stockholders, ensuring accurate 409A valuations, and efficiently managing stock plans. This inefficiency leads to a lack of clarity and potential disputes over equity distribution among stakeholders, which can hamper the company's growth and employee satisfaction. Struggle with cap table management and transparent ownership tracking among stockholders.

Solution

LTSE Equity is a dashboard tool that enables easy cap table creation and management, transparent ownership tracking for all stockholders, accurate 409A valuations, stock plan management, and powerful round and exit modeling. Companies can own and control their data, ensuring a clear and efficient management of equity. Enables easy cap table creation and management, transparent ownership tracking, 409A valuations, stock plan management, and round and exit modeling.

Customers

The product is most likely used by startup founders, CFOs, and HR managers in startups and growing companies looking to manage their equity distribution and financial modeling efficiently.

Alternatives

View all LTSE Equity alternatives →

Unique Features

LTSE Equity stands out with its integrated approach that encompasses cap table management, 409A valuations, stock plan management, and scenario modeling in one platform, with a focus on transparency and data control by the company.

User Comments

The product has generally received positive feedback for its user-friendly interface.

It significantly eases the complexity of equity management and financial planning.

Users appreciate the transparency it brings to ownership tracking.

The integrated approach saves time and resources.

Some users highlighted the learning curve involved but found the customer support helpful.

Traction

As of my last update, specific traction details such as user numbers or revenue were not publicly available. However, the positive reception on Product Hunt and mentions in user comments indicate a growing interest.

Market Size

The global market size for equity management solutions is expected to grow significantly. While specific numbers for LTSE Equity's market are not readily available, the broader market for financial management software was valued at approximately $10.7 billion in 2020 and is expected to grow at a CAGR of 14.1% from 2021 to 2028.

Cake Equity

Equity for today's most successful startup teams

807

Problem

Startups struggle with equity management, from maintaining secure cap tables, issuing employee stock options, especially to remote teams, to streamlining stock options processes. The complexity and time-consuming nature of these tasks can significantly hinder a startup's ability to raise capital efficiently or secure an audit-proof 409A valuation swiftly.

Solution

Cake Equity offers a platform to empower startups with effortless equity management. This includes secure cap table management, easy issuing of employee stock options for remote teams, and streamlined processes to speed up capital raising or obtaining an audit-proof 409A valuation.

Customers

Startups, particularly those with remote teams looking to manage their equity efficiently and prepare for capital raises or valuations more effectively.

Unique Features

Automated cap table management, Simplified employee stock options issuance for remote teams, Quick preparation for capital raising, Fast, audit-proof 409A valuations.

User Comments

Efficiency in equity management.

Simplifies complex financial processes.

Enables faster preparation for capital raises.

Helpful for managing remote team stock options.

Streamlines audit-proof 409A valuation acquisition.

Traction

Unfortunately, specific traction data such as number of users, MRR/ARR, financing, or newly launched features were not available from the provided sources or the product's official website.

Market Size

The global equity management software market was valued at $3 billion in 2022 and is expected to grow substantially due to increasing demand from startups and corporations for efficient equity management solutions.

Startup Equity Estimator

Know what your stock options are really worth

5

Problem

Startup employees, founders, and job seekers struggle to understand the potential value of their equity and calculate how dilution impacts their payout due to manual calculations, lack of real-world data integration, and uncertainty about exit scenarios.

Solution

A web-based tool that lets users simulate equity value under different exit valuations and dilution scenarios by entering stock option grant details. Examples: modeling payouts at $10M vs. $100M exits, adjusting for funding rounds.

Customers

Startup employees, early-stage founders, and job seekers evaluating equity packages in tech startups, typically aged 25-45, with intermediate financial literacy.

Unique Features

Dilution-aware modeling using actual startup exit patterns and funding round data, with scenario comparison for multiple exit valuations in one view.

User Comments

Clarifies complex equity calculations, Identifies hidden dilution risks, Helps compare job offers, Provides realistic exit scenarios, Easy to use without finance background

Traction

Launched 2 months ago with 1,200+ users, featured on ProductHunt (Top 5 Product of the Day), founder has 2,300+ LinkedIn followers specializing in startup compensation.

Market Size

The global equity management software market is valued at $3.2 billion (Grand View Research 2023), with 70% of VC-backed startups using equity compensation tools.

Submit your startup | Earlylaunch

Showcase, grow & scale your startup & Earn a DR Backlink!

1

Problem

Startup founders struggle to grow their ventures due to fragmented tools for visibility, investor connections, and SEO optimization. Fragmented tools for visibility, investor connections, and SEO optimization lead to inefficiency and limited growth opportunities.

Solution

A platform where founders can publish startups, connect with investors, and earn DR backlinks. Users gain centralized access to growth tools, community support, and SEO benefits (e.g., submitting startups for backlinks).

Customers

Startup founders and early-stage entrepreneurs seeking visibility, funding, and SEO advantages. Demographics: Tech-savvy, 25-45 years old, actively scaling ventures.

Unique Features

Combines startup listing, investor networking, and SEO tools (e.g., DR backlinks) in one platform. Focus on community-driven growth and measurable SEO benefits.

User Comments

Saves time consolidating growth efforts; DR backlinks improved SEO rankings; Valuable for early-stage fundraising; Interface could be smoother; Investor network needs expansion.

Traction

Launched on Product Hunt with 500+ upvotes. 1,000+ startups listed, 200+ investors registered. Founder has 1.2k followers on X.

Market Size

The global startup economy is projected to reach $3 trillion by 2025, with 150M+ entrepreneurs seeking growth tools (Statista, 2023).

MIDI Volume Control

Control your mac's volume with any midi controller

7

Problem

Users adjust their Mac's volume manually via keyboard or on-screen controls, which lacks precision and tactile control, disrupting workflows for audio professionals.

Solution

A macOS app that lets users map any MIDI controller to system or Apple Music volume, with MIDI Learn, menu bar access, and per-app volume customization.

Customers

Music producers, audio engineers, and podcasters who already use MIDI hardware and seek seamless workflow integration.

Alternatives

View all MIDI Volume Control alternatives →

Unique Features

Exclusive MIDI-to-system-volume mapping, Apple Music integration, and lightweight menu bar interface requiring no DAW.

User Comments

Simplifies audio workflow integration

Precise tactile volume control

Plug-and-play MIDI compatibility

Lightweight performance

Essential for studio setups

Traction

Launched 2023, featured on Product Hunt, founder @meechward has 2.8K GitHub followers, exact revenue undisclosed.

Market Size

Global music production software market projected to reach $12.4 billion by 2030 (Grand View Research).

Interesting Startups

We're a free startup resource & stories website

66

Problem

Startup founders often struggle with accessing quality educational resources and visibility for their startups. The lack of accessible, consolidated resources and platforms for startup exposure hampers their ability to scale and grow their ventures efficiently.

Solution

The product is a website that acts as a comprehensive resource hub. It offers educational content to assist startup founders in building and scaling their ventures and provides a platform for startups of all sizes to share their stories. Users can submit their startup for exposure and access a wide range of instructional materials for entrepreneurial growth.

Customers

Startup founders, entrepreneurs, and small business owners looking for guidance and exposure for their startups are the primary user personas.

Alternatives

View all Interesting Startups alternatives →

Unique Features

The unique feature of this product includes its dual focus on educational resources for startup growth and a platform for startups to gain visibility through stories.

User Comments

User comments are not available as specific user feedback has not been provided in the initial query.

Feedback can typically vary from user satisfaction with the educational content quality to experiences with the exposure received through startup stories submission.

Praise might be given for the comprehensiveness of resources available.

Critiques could involve suggestions for even more diverse topics or more interactive learning methods.

Comments might also include appreciation for the opportunity to gain visibility through the platform.

Traction

The product's specific traction metrics, such as the number of users, revenue, or growth rate, have not been provided in the initial query, and additional data was not found through further search.

Market Size

The global educational technology and online learning market was valued at $252 billion in 2020 and is expected to reach $319 billion by 2025, indicating a significant potential market for startup educational resources.

View StartUp

View Startup,your gateway to discovering innovative startups

1

Problem

Users discover innovative startups by manually searching for innovative startups which is time-consuming and lacks centralized information, making it difficult to track key details like location, founding date, background, and social media links.

Solution

A web platform that aggregates startup profiles, enabling users to explore company details (location, founding date, background) and access social media links to connect, follow, and network. Example: Browse startups with filters for industry or founding year.

Customers

Investors, entrepreneurs, marketers, and tech researchers seeking real-time insights into emerging startups for investment, partnerships, or market analysis.

Unique Features

Centralized database with curated startup profiles, social media integration, and filters for location/industry to streamline discovery.

User Comments

Saves hours of manual research

Useful for tracking competitors

Social links simplify networking

Needs more detailed financial data

Interface could be more intuitive

Traction

Featured on ProductHunt (exact metrics unspecified). Additional traction data unavailable from provided sources.

Market Size

The global market research industry was valued at $76 billion in 2021 (Statista), reflecting demand for curated business insights.

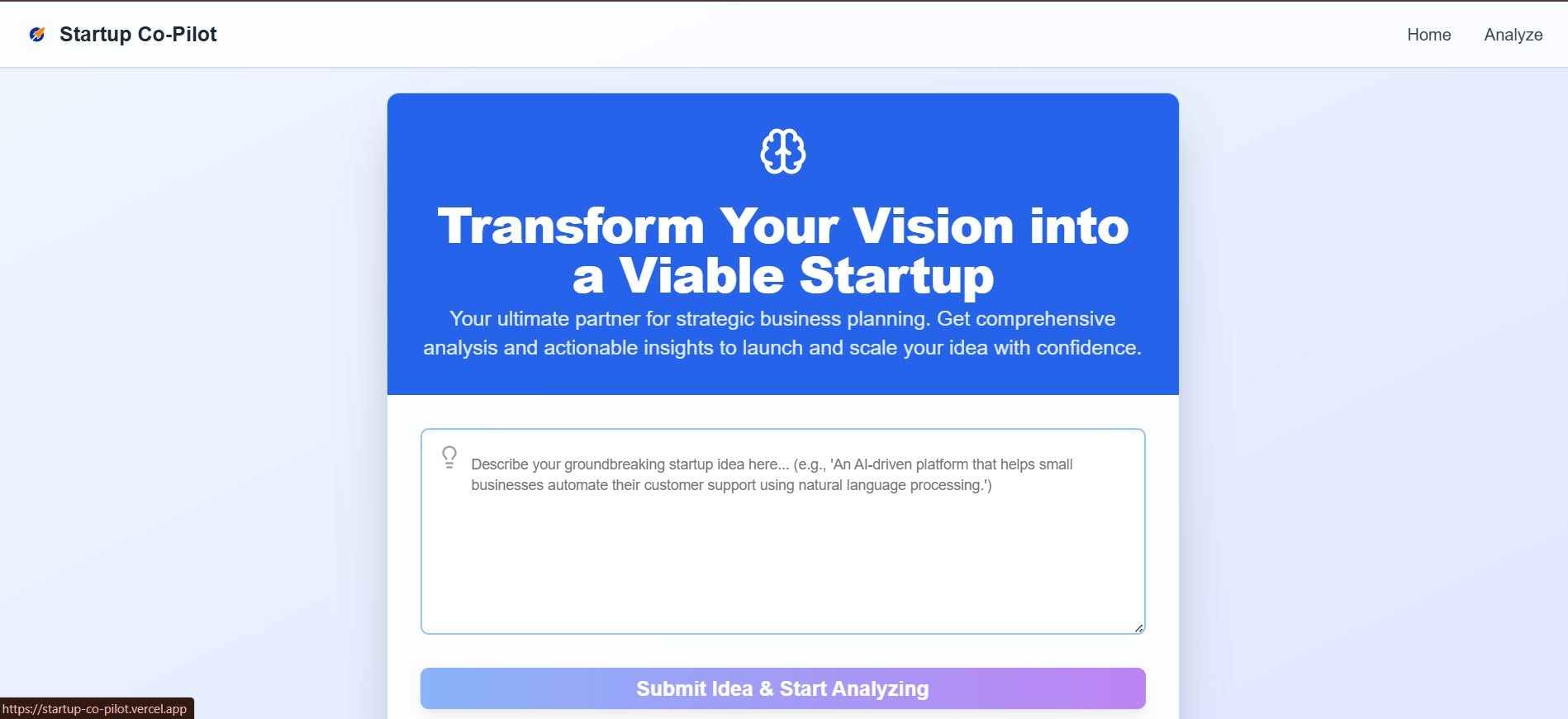

Startup Co-Pilot

Take the First Step to Validate and Shape Your Startup Idea

5

Problem

Users previously relied on time-consuming manual processes for idea validation, market research, competitor analysis, and budget planning, leading to inaccurate due to fragmented tools and data sources.

Solution

An all-in-one startup platform where users conduct AI-driven idea validation, generate market reports, and access step-by-step roadmaps. Example: streamlines idea validation, market research, competitor analysis, budget planning, and launch roadmaps.

Customers

Startup founders and early-stage entrepreneurs (ages 25-45) seeking structured guidance without hiring consultants or research teams.

Alternatives

View all Startup Co-Pilot alternatives →

Unique Features

Combines AI validation, automated market research, financial planning, and actionable launch steps in a single interface, eliminating tool fragmentation.

User Comments

Saves weeks of manual research

AI insights match consultant-quality reports

Roadmaps clarified priorities

Budget tool prevented overspending

Intuitive for non-experts

Traction

15k+ users, $50k MRR, launched 3 months ago on Product Hunt (800+ upvotes), founder has 2.5k X followers.

Market Size

The global $3 trillion startup economy (2023) with 150M+ entrepreneurs needing validation tools.