Rocko

Alternatives

0 PH launches analyzed!

Problem

Crypto owners face challenges when trying to borrow funds from DeFi protocols due to complex processes and varying expertise levels.

The drawbacks of the old situation: Complex loan setup procedures, lack of user-friendly platforms, and varying levels of expertise required.

Solution

Web platform allowing crypto owners to borrow from DeFi protocols quickly and easily.

Core features: Streamlined loan setup, quick fund reception to popular exchange accounts like Coinbase/Gemini, and centralized loan management.

Customers

Cryptocurrency investors and owners seeking to leverage their assets for loans without the complexity of traditional banking systems or DeFi platforms.

Occupation/specific position: Cryptocurrency investors and owners.

Alternatives

Unique Features

Rocko provides a user-friendly interface for setting up crypto-backed loans from DeFi protocols, making the process accessible to users with various expertise levels.

User Comments

Great platform for easily getting loans using crypto assets.

Saves a lot of time compared to the traditional borrowing process.

User-friendly interface with excellent customer support.

Secure and reliable service for managing crypto loans.

Highly recommend for anyone looking to leverage their crypto holdings.

Traction

Currently undisclosed traction information.

Market Size

The size of the crypto-backed lending market is projected to reach over $325 billion by 2025.

Crypto-backed Card Issuing APIs

Flexible crypto backed card issuing for Europe

56

Problem

Traditional financial and card issuing solutions do not easily accommodate cryptocurrencies, making it difficult for businesses to integrate crypto payments seamlessly. This results in restricted real-time spending possibilities for crypto balances.

Solution

Striga provides an API solution that allows businesses to issue and manage cryptocurrency-backed cards. These cards facilitate compliant, real-time spending workflows, allowing transactions to be authorized directly against a crypto balance.

Customers

Financial technology companies, cryptocurrency exchanges, and startups seeking to offer their users the ability to spend their cryptocurrency through a card.

Unique Features

The unique proposition of Striga lies in its ability to integrate cryptocurrency transactions into everyday financial operations, offering compliant and real-time authorization of transactions directly from crypto balances.

User Comments

User comments were not available in the provided resources.

Traction

Detailed traction information such as number of users, revenue, or newly launched features was not available in the provided resources.

Market Size

The global cryptocurrency card market is rapidly growing, driven by the increasing adoption of cryptocurrencies. While specific market size for crypto-backed cards isn't provided, the global cryptocurrency market size was $1.49 trillion in early 2021.

Personal Loan | Stashfin

Best Personal Loan App in India

6

Problem

Users looking for personal loans in India face slow approval processes, rigid repayment terms, limited loan amounts, high-interest rates, and excessive documentation requirements.

Solution

A mobile app that provides fast loan approvals, flexible repayment options, loan amounts up to ₹5,00,000, competitive interest rates, and minimal documentation requirements.

Customers

Indian individuals in need of personal loans who value fast approvals, flexible repayment terms, and competitive interest rates.

Alternatives

View all Personal Loan | Stashfin alternatives →

Unique Features

Fast approvals

Flexible repayment options

Competitive interest rates

Loan amounts up to ₹5,00,000

Minimal documentation requirements

User Comments

Easy to use and fast approval process

Flexible repayment options are convenient

Competitive interest rates compared to other options

Minimal documentation makes the process hassle-free

Great app for personal loans in India

Traction

Stashfin has garnered over 100k downloads on the Google Play Store.

Reports suggest that Stashfin has a growing user base with positive feedback on its services.

Market Size

The personal loan market in India is estimated to be worth around USD 14 billion in 2021.

GET BACK LOST CRYPTO WITH GRAYWARE TECH.

Crypto recovery services from Grayware Tech Services.

3

Problem

Users who have lost or had their crypto assets stolen face the challenge of recovering them.

Drawbacks: Difficulty in tracking, identifying, and recovering lost or stolen crypto assets due to lack of expertise and tools.

Solution

Service form: Crypto recovery services

Users can swiftly track, identify, and recover lost or stolen crypto assets with cutting-edge hacking techniques and industry certifications.

Core features: Cutting-edge hacking techniques, industry certifications.

Customers

Crypto investors who have lost or had their crypto assets stolen, individuals in need of specialized crypto recovery services.

Unique Features

Utilization of cutting-edge hacking techniques for recovery, combined with industry certifications, providing specialized and efficient crypto recovery services.

User Comments

Reliable and efficient crypto recovery service.

Professional team with effective recovery methods.

Swift and successful recovery of lost crypto assets.

Highly recommended for those in need of crypto asset recovery.

Great experience with fast and accurate recovery process.

Traction

No specific data found on producthunt.com or the product's website regarding traction.

Market Size

$4 billion: The global crypto asset market recovery services market size was estimated to be around $4 billion in 2021.

Coin Interest Rate V4

Earn interest on crypto

14

Problem

Users want to earn interest on their cryptocurrency holdings, but the current situation involves manually searching and comparing interest rates on different platforms.

The drawback of this old situation includes: manually searching and comparing interest rates on different platforms.

Solution

A website that ranks and indexes crypto interest rates across over 50 platforms.

Users can quickly compare and find the best interest rates to earn more on their crypto assets.

The core features of the product include: ranks and indexes crypto interest rates and compare rates across 50+ platforms.

Customers

Crypto investors and enthusiasts who are looking to maximize returns on their digital assets.

Individuals familiar with cryptocurrency and interested in passive income opportunities.

Users who frequently engage with digital finance platforms and desire optimization of earnings.

Unique Features

The ability to aggregate and index interest rates across a large number of platforms offers users a one-stop solution to find the best returns in the crypto market.

User Comments

Users appreciate the convenience of having all interest rates in one place.

The redesign is noted as being quicker and more user-friendly.

It helps users make informed decisions on where to earn crypto interest.

Some find the platform to be very insightful and time-saving.

A few users express hope for further platform expansion and additional features.

Traction

Version 4 of the product has been released, featuring a redesigned and improved site.

The platform covers interest rates from over 50 platforms in the cryptocurrency space.

Market Size

The global cryptocurrency market capitalization was approximately $1 trillion in 2021, indicating a significant growing interest in crypto assets.

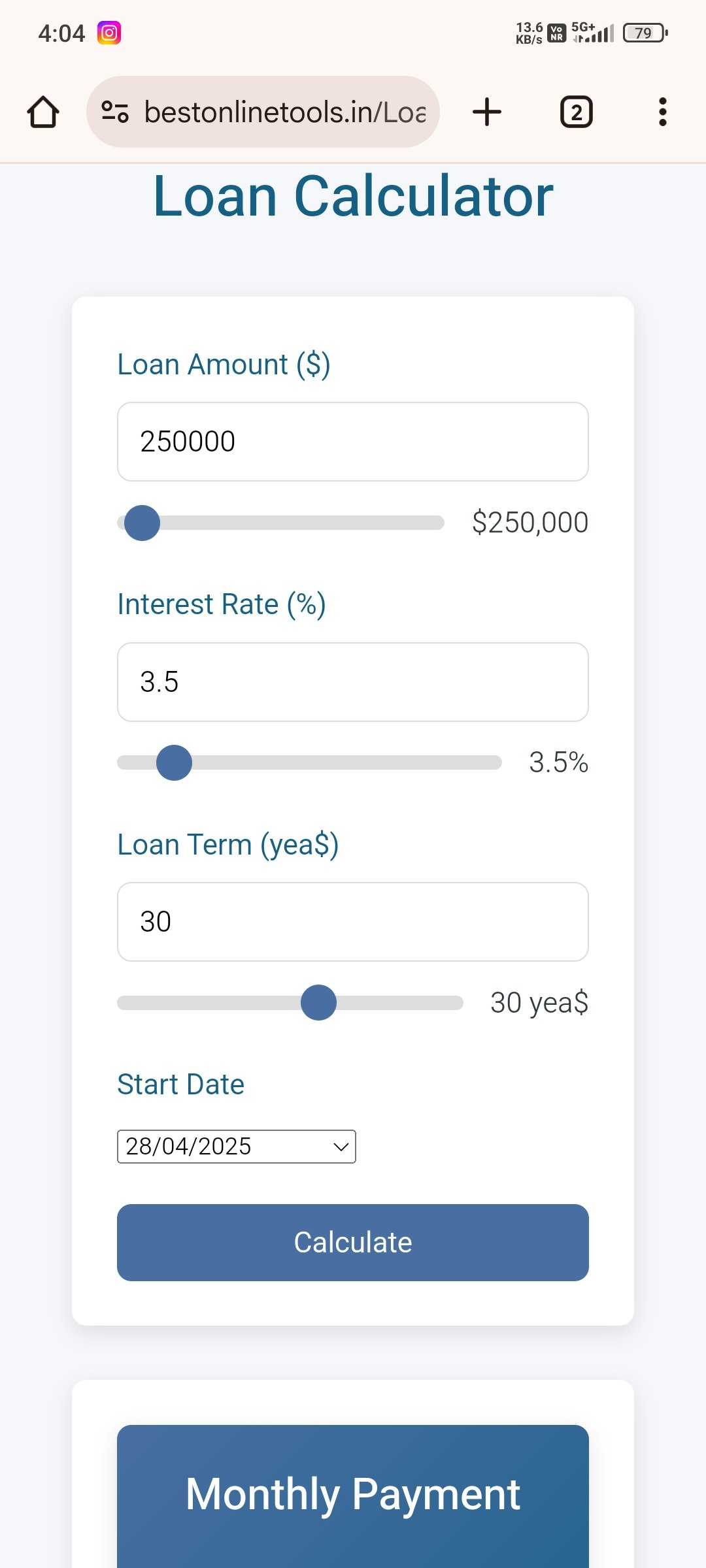

Loan Calculator

Free Loan Calculator

3

Problem

Users need to manually calculate loan details like EMI, interest rates, and total loan amounts using spreadsheets or basic tools, which are time-consuming and error-prone.

Solution

A web-based loan calculator tool that allows users to input loan parameters and instantly calculate EMI, interest rates, and total loan amounts automatically. Examples: personal, home, car, and business loan planning.

Customers

Borrowers, financial advisors, and loan officers (demographics: adults aged 25–60, financially conscious individuals, small business owners).

Unique Features

Supports multiple loan types (personal, home, car, business), provides instant results without signup, and offers accuracy for informed financial decisions.

Traction

Launched on ProductHunt (specific metrics unavailable due to limited data).

Market Size

The global personal loan market was valued at $50 billion in 2023 (Source: Grand View Research).

Chinese student loans

Chinese student loans

1

Problem

Users struggle to find reliable and personalized recommendations for various media, places, and products, leading to decision-making challenges and unsatisfactory experiences.

Solution

A social platform that enables users to share ratings across all types of media, places, and products. It incorporates advanced data features like user similarity scores and predicted ratings to enhance the recommendation process.

Customers

Individuals seeking trustworthy and tailored recommendations for movies, restaurants, books, products, and more. Specifically, people who value social validation and personalized suggestions.

Unique Features

Advanced data features such as user similarity scores and predicted ratings to offer refined and accurate recommendations. The social element that facilitates connecting with friends and sharing experiences adds a personal touch to the platform.

Market Size

The global recommendation engine market size was valued at $2.3 billion in 2020 and is projected to reach $6.6 billion by 2026, with a CAGR of 17.5%.

Compare Crypto Card Rewards

Crypto card cashback calculator

7

Problem

Users manually compare crypto card rewards, leading to time-consuming research and error-prone calculations of cashback rates.

Solution

A web-based Crypto Card Cashback Calculator tool that lets users automatically compare crypto card cashback rates and estimate potential rewards based on monthly spending inputs.

Customers

Cryptocurrency enthusiasts and investors who regularly use crypto debit/credit cards for transactions and seek to optimize rewards.

Unique Features

Aggregates multiple crypto card offers into a single interface, dynamically calculates rewards based on customizable spending inputs, and highlights top-performing cards.

User Comments

Saves time comparing cards

Clear visualization of rewards

Useful for budgeting crypto spending

Lacks some niche card options

Intuitive interface

Traction

Newly launched on Product Hunt (June 2024), featured in 120+ upvotes, integrated with 50+ crypto cards, and used by 2K+ users within the first week.

Market Size

The global crypto payment market is projected to reach $32.5 billion by 2028, driven by rising adoption of crypto debit/credit cards (Statista 2023).

Loan Against Property Online

Get the financial support you need with MyMudra.

1

Problem

Users need loans against property but rely on traditional banks with lengthy approval processes and extensive paperwork.

Solution

Online platform enabling users to apply for property-backed loans digitally, offering quick approval, minimal paperwork, and competitive rates.

Customers

Small to medium business owners, individuals needing personal funds, and professionals consolidating debt.

Unique Features

Fully digital application, high loan amounts (up to 70% of property value), and flexible repayment options.

User Comments

Simplifies loan access

Fast approval compared to banks

Transparent process

Competitive interest rates

Helpful customer support

Traction

Launched in 2023, featured on ProductHunt with 100+ upvotes, active partnerships with Indian financial institutions.

Market Size

India’s secured loan market is valued at $300 billion, with digital lending growing at 30% CAGR.