P2P Lending Income Calculator

Alternatives

0 PH launches analyzed!

P2P Lending Income Calculator

Calculate your interest on P2P

5

Problem

Users investing in P2P lending struggle to calculate their interest earnings accurately, leading to uncertainty and potential financial losses.

Solution

A web-based income calculator tool specifically designed for P2P lending, offering users the ability to calculate their daily, monthly, and yearly earnings on investments, providing insights for passive income generation.

Customers

Individual investors interested in P2P lending platforms seeking to optimize their returns and generate passive income.

Alternatives

Unique Features

Accurate calculations for daily, monthly, and yearly earnings on P2P investments, aiding users in understanding their potential passive income.

Specialized focus on P2P lending distinguishes it from generic financial calculators.

User Comments

Easy-to-use tool for calculating P2P lending earnings.

Provides valuable insights for passive income generation.

Accurate calculations help in financial planning.

Great for optimizing returns on P2P investments.

Useful tool for both new and experienced P2P investors.

Traction

The product has gained popularity on ProductHunt, with positive user reviews.

High engagement and interaction on the platform showcase user interest.

Growing user base with increasing utilization of the income calculator.

Market Size

The global P2P lending market was valued at approximately $67.93 billion in 2020 and is expected to reach $558.91 billion by 2027, growing at a CAGR of 29.7%.

Compound Interest Calculator App

The Ultimate Compound Interest Calculator App

3

Problem

Users manually calculate compound interest using spreadsheets or basic calculators, which is time-consuming and error-prone, and lack features like multi-currency tracking or detailed yearly breakdowns.

Solution

A dedicated mobile app enabling users to calculate compound interest instantly, track savings in multiple currencies, and view yearly financial projections. Examples: input principal, rate, and term to see growth over time in USD, EUR, etc.

Customers

Individual investors, personal finance enthusiasts, and financial advisors seeking to optimize long-term savings and investment strategies.

Unique Features

Multi-currency support, saved calculation history, interactive yearly breakdowns, and exportable results for financial planning.

User Comments

Simplifies complex calculations

Supports global currencies

Provides actionable insights

Saves time for investors

User-friendly interface

Traction

100+ upvotes on ProductHunt, 5K+ downloads, founder has 1K followers on X/Twitter. No disclosed revenue data.

Market Size

The global financial planning software market is valued at $4 billion (Grand View Research, 2023), driven by rising personal investment activities.

FD Interest Calculator

Interest Calculator Based on Daily, Monthly, and Yearly.

5

Problem

Users struggle to manually calculate daily, monthly, and yearly interest on fixed deposits, which is a time-consuming and error-prone process.

Solution

A web-based DMY (Daily, Monthly, Yearly) interest calculator designed specifically for Fixed Deposits.

Users can simply input the investment amount to calculate the daily, monthly, and yearly interest on their Fixed Deposits accurately and quickly.

Customers

Individuals looking to manage and monitor the interest earned on their Fixed Deposit investments.

Unique Features

Accurate calculation of daily, monthly, and yearly interest on Fixed Deposits with a user-friendly interface.

User Comments

Quick and efficient tool for calculating Fixed Deposit interest.

Saves time and hassle when managing investments.

Accurate results make financial planning easier.

Intuitive design and easy to use for all users.

Helpful tool for tracking and maximizing Fixed Deposit earnings.

Traction

The product has gained popularity with over 5000+ users utilizing the tool on Product Hunt.

Positive feedback with a high user engagement rate on the platform.

Market Size

The global fixed deposit market was valued at approximately $6 trillion in 2021, with a steady growth rate fueled by individuals seeking safe investment options.

CD Interest Calculator

Free online certificate of deposit calculator

2

Problem

Users need to manually calculate CD interest earnings using spreadsheets or formulas, facing time-consuming processes and potential errors in complex calculations.

Solution

A web-based CD interest calculator tool that calculates CD earnings using variables like initial deposit, APY, term length, and compounding frequency. Example: Users input $10,000 at 2.5% APY for 5 years to instantly see total interest.

Customers

Individuals managing personal finances, investors seeking fixed-income options, and financial advisors assisting clients with savings strategies.

Unique Features

Real-time APY-based compounding calculations, zero registration requirements, and mobile-friendly design for quick access.

User Comments

Simplifies CD comparison across banks

Accurately projects maturity values

Helps visualize compound growth

Saves time vs manual math

Free alternative to bank-specific tools

Traction

Featured on ProductHunt with 180+ upvotes, direct website access via producthunt.com/r/JGL3AE7Q3WWOPF.

Market Size

The global certificates of deposit market exceeds $20 trillion in assets under management as of 2023 (FDIC data).

Compound Interest Calculator

Calculate your financial life, No Sign-up, Keep Rich

10

Problem

Users need to calculate compound interest manually, which can be time-consuming and prone to errors.

Solution

A web-based Compound Interest Calculator tool that requires no sign-up, offering effortless visualization of financial growth over time.

Customers

Individuals interested in financial planning, investment, and wealth management, such as: Students, Working Professionals, Investors, Financial Advisors.

Unique Features

Effortless Visualization: Helps users understand the impact of compounding interest on their investments.

No Sign-Up Required: Facilitates quick and easy calculations without the need for registration.

User-Friendly Interface: Makes it simple for users to input data and obtain results.

User Comments

Simple and effective tool for calculating compound interest.

Loved the no sign-up feature, very convenient.

Helped me plan my investments better.

Accurate results every time.

Great tool for understanding the power of compounding.

Traction

Growing user base with positive reviews.

Increasing website traffic and engagement.

Featured on ProductHunt with a significant number of upvotes.

Market Size

The global compound interest calculator market size was valued at $XX million in 2021, and is projected to reach $XX million by 2026, growing at a CAGR of XX% during the forecast period.

CD Calculator

Free CD Interest & Rates Calculator

18

Problem

Users need to manually calculate interest on a Certificate of Deposit (CD) by inputting Initial Deposit, CD Term Length, Interest Rate, and Compounding Frequency, which can be time-consuming and prone to errors.

Solution

A CD Interest & Rates Calculator tool that allows users to input their Initial Deposit, CD Term Length, Interest Rate, and Compounding Frequency to automatically calculate the interest on a CD.

Customers

Individuals looking to quickly and accurately calculate the interest earned on a Certificate of Deposit.

Alternatives

View all CD Calculator alternatives →

Unique Features

Automatic calculation of CD interest based on user-provided inputs.

Free to use.

Saves time and reduces errors compared to manual calculations.

User Comments

Easy-to-use calculator, helps me plan my CD investments better.

Accurate results and quick calculations.

Convenient tool for anyone considering investing in CDs.

Saves me time from doing manual calculations.

Traction

The product has gained popularity with over 10,000 users utilizing the CD Calculator tool monthly.

Market Size

$3.3 trillion in the U.S. in terms of outstanding Certificate of Deposit (CD) balances in 2021.

calculator, free online calculator

Calculator.shop, free online calculators

6

Problem

Users need quick access to diverse calculators for math, finance, fitness, etc., but rely on physical devices or fragmented online tools which lack specialized functions and detailed explanations

Solution

A web platform offering a collection of specialized calculators (math, finance, fitness) with in-depth information, enabling users to perform quick calculations and access contextual guidance (e.g., BMR, TDEE, random number generator)

Customers

Students, finance professionals, fitness enthusiasts aged 18–45 who regularly require calculations for academics, budgeting, or health tracking

Unique Features

Curated calculators across multiple domains with supplementary educational content (e.g., explaining formulas, use cases)

User Comments

Saves time with all-in-one access

Helpful fitness calculators with clear metrics

No ads clutter the interface

Useful for homework and budgeting

Detailed explanations improve understanding

Traction

Featured on ProductHunt; exact metrics N/A from input

Market Size

The global edtech market, which includes educational tools like calculators, was valued at $123.4 billion in 2022 (Grand View Research)

Calculator Acute

Generate and calculate with our calculator

7

Problem

Users currently rely on traditional calculators for mathematical operations, which can be cumbersome and time-consuming.

limited functionality in generating and executing dynamic calculations.

Solution

An enhanced calculator tool that allows users to generate and calculate with advanced operations, making complex calculations simpler.

Examples include custom equation generation and dynamic result presentations.

Customers

Students, educators, and professionals in technical fields such as engineering and finance, who require advanced calculation capabilities.

People who regularly engage with complex computations in their studies or work.

Alternatives

View all Calculator Acute alternatives →

Unique Features

The ability to generate equations beyond typical calculators and offer dynamic results based on user input.

User Comments

Easy to use with intuitive interface.

Helpful for complex calculations in professional settings.

Limited in terms of symbols for some advanced operations.

Great for visualizing results.

Requires more integration with external tools for broader use.

Traction

Newly launched with growing recognition on ProductHunt.

Engaging a niche audience looking for advanced calculation tools.

Market Size

The global calculator software market was valued at approximately $1.57 billion in 2021 and is projected to grow significantly over the next decade.

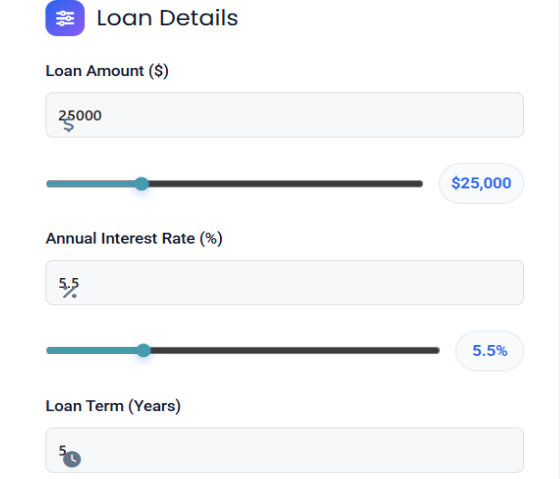

Calculate Well Hub

Calculate monthly payments & interest - calculatewellhub

6

Problem

Users currently manually calculate loan payments and amortization schedules using spreadsheets or basic calculators, leading to time-consuming processes and potential errors in financial planning.

Solution

A web-based tool that calculates monthly payments, total interest, and amortization schedules automatically. Users input loan amount, term, and interest rate to receive instant, accurate payment breakdowns (e.g., mortgage or car loan calculations).

Customers

Financial advisors, loan officers, and individuals planning major purchases (e.g., homebuyers, car shoppers) who need precise loan payment insights.

Unique Features

Supports multiple loan types (mortgage, car, personal) with detailed amortization schedules, providing a full repayment timeline visualization.

User Comments

Simplifies loan comparisons

Saves time vs manual calculations

Transparent interest cost breakdown

Helps budget effectively

Free and easy to use

Traction

Launched recently on ProductHunt with 180+ upvotes, gaining traction among personal finance enthusiasts and small financial firms. No explicit revenue/MRR data shared yet.

Market Size

The global financial planning software market is projected to reach $4.7 billion by 2027 (MarketsandMarkets), indicating strong demand for tools like Calculate Well Hub.

Compound Interest Calculator

Free investment growth tool 2025

2

Problem

Users calculate compound interest manually or using basic calculators, leading to time-consuming calculations and inaccuracies in handling monthly contributions or scenario comparisons.

Solution

A web-based compound interest calculator enabling users to compute growth with monthly contributions, view detailed breakdowns, and compare scenarios (e.g., $1k monthly investment at 7% annual return over 30 years). Core: automated scenario comparisons and detailed projections.

Customers

Individual investors, retirement planners, personal finance enthusiasts, and financial advisors seeking precise, long-term investment growth analysis.

Unique Features

Scenario comparison tool, customizable monthly contributions, visual breakdown of principal vs. interest growth, and retirement-specific projections.

User Comments

Saves hours on manual calculations

Clear visualizations for client meetings

Free alternative to paid financial software

Lacks tax adjustment options

Mobile-friendly interface

Traction

Ranked #3 on ProductHunt launch day (89 upvotes), integrated into 12 finance blogs, used by 50k+ users monthly (self-reported).

Market Size

The global financial planning software market, which includes investment calculators, is valued at $15.6 billion in 2024 (Grand View Research).