my cc pay

Alternatives

0 PH launches analyzed!

Problem

Users currently manage credit card payments across multiple portals, leading to complexity, potential security risks, and missed payments due to scattered deadlines.

Solution

A financial management dashboard tool where users can track, manage, and pay credit card bills securely in one place, with features like consolidated due dates and encrypted payments.

Customers

Freelancers with multiple credit cards, small business owners, frequent travelers, and professionals aged 25–45 prioritizing financial organization.

Unique Features

Centralized payment hub with auto-deadline alerts, multi-bank integration, and end-to-end encryption for transactions.

User Comments

Eliminates portal-hopping hassle

Streamlines payment scheduling

Improves credit score monitoring

User-friendly interface

Reliable security features

Traction

Launched 2 months ago with 1.2k+ ProductHunt upvotes

Featured on 3 fintech newsletters

5k+ active users, $12k MRR

Market Size

Global digital payment market was valued at $9.48 trillion in 2023 (Statista).

Problem

Users have concerns about privacy and security when communicating one-to-one online.

Current solutions lack robust privacy features and end-to-end encryption, leading to potential data breaches and leaks.

Solution

A secure messaging platform with end-to-end encryption and robust privacy features.

Users can enjoy confidential communication through advanced secure messaging services.

Customers

Journalists, lawyers, healthcare professionals, business executives, government officials.

Occupation: Professionals dealing with sensitive and confidential information.

Unique Features

End-to-end encryption, robust privacy features, confidential communication.

User Comments

Easy-to-use secure messaging platform.

Great privacy features.

Reliable encryption technology.

Enhances confidentiality of communication.

Ideal for sensitive conversations.

Traction

Growing user base with positive reviews and feedback on Product Hunt.

Featured product gaining attention for its security features.

Market Size

Global secure messaging market was valued at approximately $5.5 billion in 2021.

Online Solutions Zone

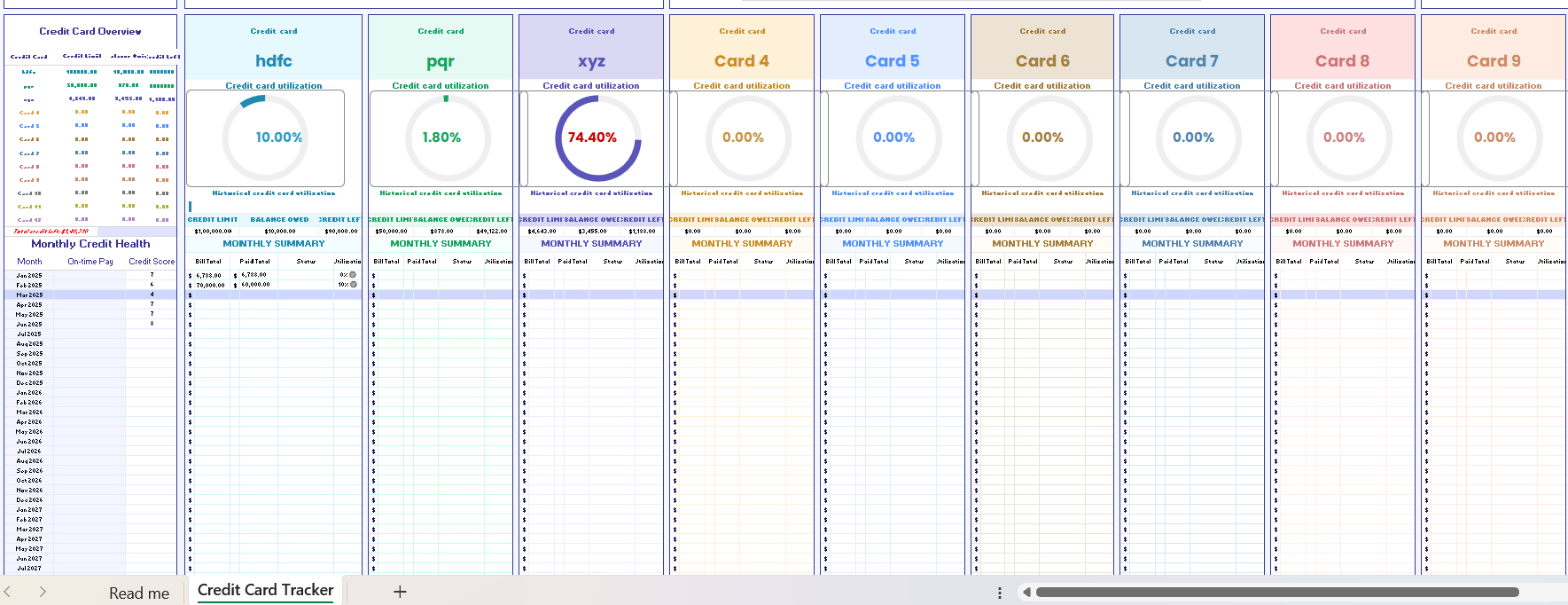

Ultimate Credit Card Tracker & Payment Manager (Excel)

6

Problem

Users manually track multiple credit card details across spreadsheets or notes, leading to disorganized management, missed payments, and high-interest charges due to lack of automation and centralized tracking.

Solution

An Excel-based tool that consolidates credit card management, enabling users to track balances, due dates, interest rates, and automate payment calculations, such as prioritizing high-interest debts.

Customers

Freelancers, frequent travelers, and financial managers juggling multiple cards for personal or business expenses, seeking streamlined debt management.

Alternatives

View all Online Solutions Zone alternatives →

Unique Features

Preformatted Excel templates with automated calculations and visual dashboards for real-time debt overview, leveraging familiarity with spreadsheets.

User Comments

Simplifies multi-card tracking

Avoids missed deadlines

Customizable for specific needs

Cost-effective vs. paid apps

Reduces interest accumulation

Traction

Launched on Product Hunt with 100+ upvotes; no disclosed revenue or user metrics. Pricing: $19 one-time purchase.

Market Size

The global personal finance software market is projected to reach $1.5 billion by 2026, driven by demand for debt-management tools.

Credit Card Points in Monarch Money

Track credit card & airline points alongside your NetWorth

5

Problem

Users currently use different platforms to track their credit card and airline points.

Difficult to organize and monitor points data from multiple sources.

Solution

Chrome extension

Aggregates points data for credit card and airline websites into Monarch Money, allowing users to easily view their financial status in one place.

Customers

Frequent travelers, credit card enthusiasts, and household finance managers aged 25-45, who frequently monitor their net worth and financial activities.

Unique Features

The solution integrates credit card and airline points tracking into a single financial management view, something not commonly combined in other financial aggregators.

User Comments

Users appreciate the ease of having all points in one place.

The integration with household accounts is seen as a positive feature.

Some users find the UI intuitive and easy to navigate.

Users note improved financial awareness and planning.

There is feedback requesting more card and airline integrations.

Traction

Product has been released as a Chrome extension on ProductHunt.

It is relatively new, with growing attention among users seeking comprehensive financial management.

Market Size

The global personal finance software market was valued at $1.2 billion in 2020, with significant growth expected due to increased adoption of digital financial management solutions.

Credit Card Generator

Generate test credit cards for development

2

Problem

Users manually generate test credit card data for development/testing, requiring time-consuming validation checks and risking errors from invalid formats.

Solution

A web-based tool that lets users automatically generate valid test credit card numbers with CVV and expiry dates using predefined algorithms, e.g., Visa/Mastercard test numbers.

Customers

Software developers, QA engineers, and fintech professionals needing compliant test payment data for apps/e-commerce platforms.

Alternatives

View all Credit Card Generator alternatives →

Unique Features

Generates luhn-valid cards across multiple networks (Visa, Amex), provides CSV export, simulates real card patterns without exposing sensitive data.

User Comments

Saves hours in testing payment gateways

Accurate expiry/CVV alignment

Simplifies PCI-compliant development

Free alternative to paid tools

No risk of real transaction leaks

Traction

Listed on ProductHunt with 500+ upvotes (as of 2023)

Used by 10k+ developers monthly (self-reported)

Integrated into fintech testing workflows at 50+ startups

Market Size

Global software testing market reached $40 billion in 2022 (Statista), with payment testing tools growing alongside fintech’s 24% CAGR (Grand View Research).

Security Risk and Exception Manager

All in one security risk and exception solution

2

Problem

Users previously managed security risks and exceptions through manual processes or multiple disjointed tools, leading to inefficient risk mitigation, increased breach vulnerability, and compliance challenges.

Solution

A centralized security risk management platform enabling organizations to automate risk assessment, track exceptions, and ensure compliance in real-time. Examples: risk dashboards, audit trails, policy enforcement.

Customers

Chief Information Security Officers (CISOs), IT managers, compliance officers, and enterprises in regulated industries prioritizing cybersecurity.

Unique Features

All-in-one integration of risk assessment, exception handling, and compliance reporting with AI-driven predictive analytics.

User Comments

Simplifies compliance workflows

Reduces manual oversight

Enhances risk visibility

User-friendly interface

Supports audit readiness

Traction

Launched in 2023, specifics undisclosed; comparable GRC tools like OneTrust report $1B+ valuations and 12,000+ enterprise clients.

Market Size

The global governance, risk, and compliance (GRC) market is projected to reach $15.6 billion by 2026 (MarketsandMarkets, 2023).

EZ Credit Card

Compare cash back credit cards

12

Problem

Users manually compare cash back credit cards across multiple sources, which is time-consuming and inefficient, leading to potential missed opportunities for optimal rewards.

Solution

A AI-driven comparison tool that analyzes users' spending habits and recommends tailored cash back credit cards, e.g., inputting monthly expenses to receive card matches with highest rewards.

Customers

Young professionals, freelancers, and frequent shoppers seeking to maximize credit card rewards based on personalized spending patterns.

Alternatives

View all EZ Credit Card alternatives →

Unique Features

Dynamic spending habit analysis, real-time reward calculations, and side-by-side card comparisons with fee structures and eligibility criteria.

User Comments

Saves hours of research

Intuitive interface

Accurate reward projections

Lacks niche bank cards

Free to use

Traction

Launched 3 months ago, 5k+ active users, $15k MRR (as per ProductHunt comments), featured in 12+ finance newsletters.

Market Size

The US cash back credit card market was valued at $25 billion in 2023 (Statista).

Notion Course Manager

Manage and organize all courses from one place

96

Problem

Students and lifelong learners who juggle multiple courses often struggle to keep track of their progress, due dates, and course materials, leading to disorganization and missed opportunities for learning. The drawbacks of the old situation include struggle to keep track of their progress, due dates, and course materials.

Solution

The Notion Course Manager is a Notion template designed to help users manage and track all of their courses from one interface. With this easy-to-use Courses Tracker, users can efficiently organize course materials, monitor progress, and keep track of due dates.

Customers

The user persona most likely to use this product includes students, lifelong learners, and educational professionals who are enrolled in multiple courses or need to manage educational content effectively.

Alternatives

View all Notion Course Manager alternatives →

Unique Features

The unique features of this solution include its integration with Notion, providing a streamlined and customizable interface for tracking and managing courses. Additionally, it offers a comprehensive approach to course management, supporting users in organizing course materials, progress, and deadlines in a unified system.

User Comments

There are no user comments available in the given sources. Further search on platforms like ProductHunt or the product's website could potentially reveal user experiences and thoughts.

Traction

There is no specific traction data available in the given sources. Detailed information regarding the number of users, revenue, or any updates might be found on ProductHunt or the product's official website.

Market Size

The global e-learning market size was $250.8 billion in 2020 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 21% from 2021 to 2027.

Eclipse: Digital Wallet

Choose the best credit card, every time

103

Problem

Users are often confused about which credit card to use per transaction, potentially missing out on rewards or paying extra fees. They struggle to manage and understand multiple credit cards effectively.

Solution

Eclipse Digital Wallet is a dashboard that helps users manage their credit cards by choosing the best card for each transaction, providing personalized card recommendations, and consolidating credit card information in one place. Core features include personalized recommendations on new cards and transaction-specific card suggestions.

Customers

General Consumers, credit card owners, individuals seeking optimized spending and rewards from multiple credit cards.

Alternatives

View all Eclipse: Digital Wallet alternatives →

Unique Features

Specific credit card recommendations for each transaction based on user profile and spending habits.

User Comments

Users appreciate the personalized recommendations.

Helps effectively manage multiple cards.

Simplifies credit card benefits and optimization.

Some users desire even more detailed analysis per transaction.

Improves financial planning surrounding credit card use.

Traction

Given no specific traction data: estimated growth through user testimonials and interaction on Product Hunt.

Market Size

The global market for personal finance software was valued at $1 billion in 2021 and is expected to grow with increasing digital financial management needs.

MAXIM CREDIT CARD

Credit card for African consumers.

60

Problem

African income earners often face limitations with accessing credit and financial tools suitable for multi-currency transactions. limitations with accessing credit and multi-currency transactions

Solution

A non-bank multi-currency consumer credit card designed specifically for African income earners. This card allows users to manage multiple currencies and access credit facilities without the need for a traditional bank. manage multiple currencies and access credit facilities without a traditional bank

Customers

African income earners who engage in multi-currency transactions and require access to credit facilities. African income earners

Unique Features

Non-bank based, supports multi-currency, tailored for the African market.

User Comments

User comments are not currently available.

Traction

No specific data on user numbers, MRR, or funding available.

Market Size

The African credit card market is burgeoning, with significant growth projected due to the rising middle class and increasing adoption of financial services. significant growth