Money Manager

Alternatives

116,784 PH launches analyzed!

Money Manager

Track expenses, set financial goals, manage debts

4

Problem

Users currently manually track expenses across multiple accounts and spreadsheets, leading to fragmented financial oversight and inefficiency in managing debts/goals. The old approach lacks real-time insights and integrated tools for debt management and goal setting.

Solution

A comprehensive budgeting and expense tracking app with integrated tools for financial goal setting and debt management. Users can sync all accounts, categorize transactions, set savings targets, and track debt repayment progress (e.g., visualizing net worth via dashboards).

Customers

Young professionals, freelancers, and individuals seeking financial stability who need centralized control over budgeting, debt, and savings. Demographics: 25–45 years old, tech-savvy, moderate-to-variable income.

Unique Features

All-in-one platform combining budgeting, debt tracking, and goal management with real-time multi-account syncing and visual progress dashboards.

User Comments

Simplifies expense categorization

Helps visualize financial goals

Intuitive debt repayment planner

Real-time net worth tracking

Reduces manual spreadsheet work

Traction

Newly launched (exact metrics unspecified), featured on ProductHunt with initial positive reception. Comparable apps like Mint report 10M+ users, suggesting growth potential.

Market Size

The global personal finance software market was valued at $1.3 billion in 2023 (Grand View Research), with budgeting apps like Mint alone reaching 30M+ users.

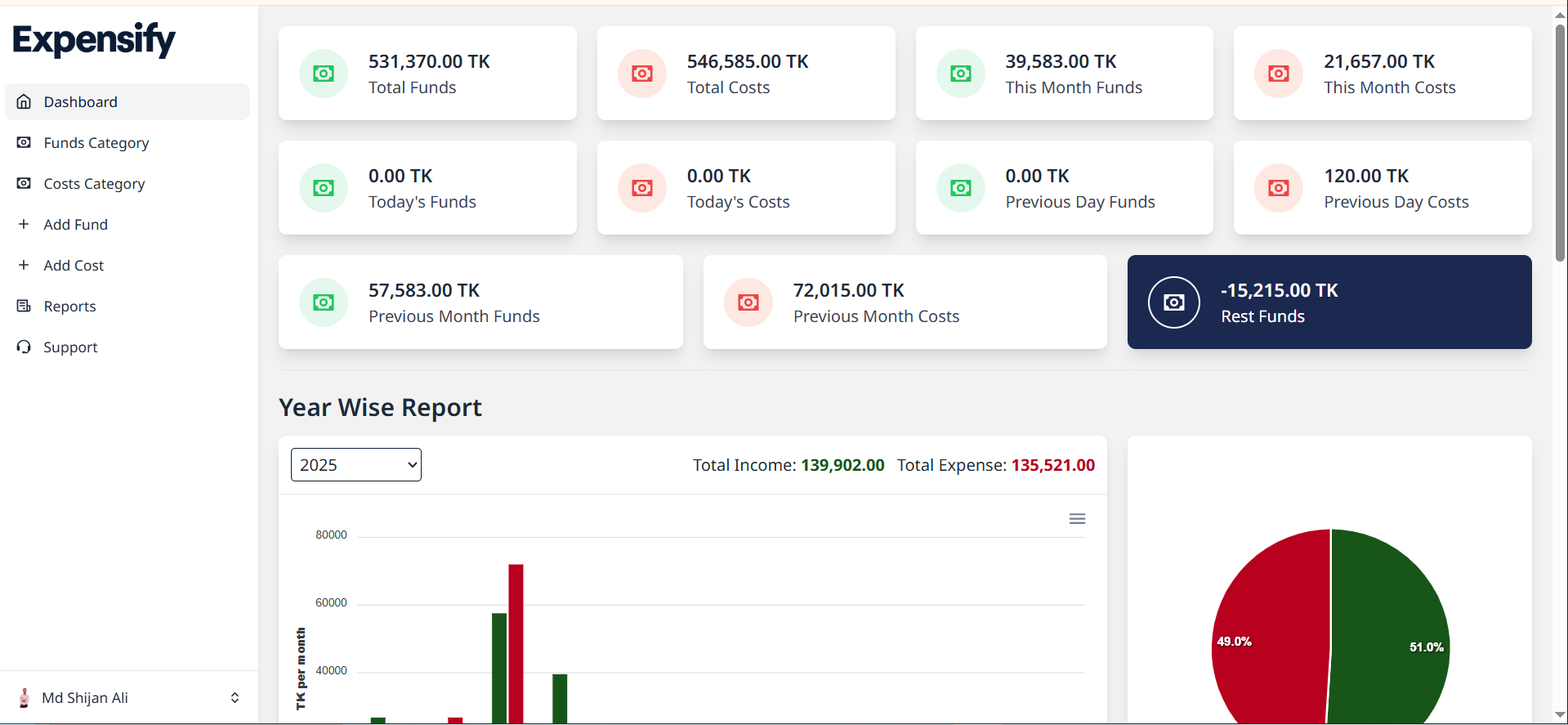

Financial - Manager & Tracker

A better way to manage your income, expenses & debts.

16

Problem

Users often face difficulties in managing their finances comprehensively, struggling to keep track of income, expenses, and debts effectively. This can lead to missed payments, overspending, and financial disorganization.

Solution

Discover Financial is an all-in-one finance management app that consolidates all your financial accounts in one place, enables recurring payments via SmartPay, organizes contracts and wish lists, and tracks liabilities.

Customers

The primary users are likely individuals seeking better financial management, including professionals, families, and anyone who wants a structured and automated approach to managing their finances.

Unique Features

The integration of all financial accounts in one location, SmartPay for automating recurring payments, and tools for organizing contracts and tracking liabilities.

User Comments

Highly appreciated for its all-in-one capability.

SmartPay feature is very convenient for managing bills.

Great for organizing financial documents.

Some users desire more customization options.

Effective for tracking expenses and debts.

Traction

Since its launch on ProductHunt, the app has accumulated significant attention with numerous upvotes and reviews, indicating a healthy adoption among users. Exact figures on users or revenue are not provided.

Market Size

The market for personal finance apps is significantly large, with the financial management software market projected to reach $1.57 billion by 2025.

Finanzy - Personal Expense App

Track your expenses, manage income and set financial budgets

4

Problem

Users currently track their expenses and manage their income through traditional methods such as spreadsheets or manual recording, which can be time-consuming and prone to errors. The drawbacks of the old situation include: difficulty in organizing finances, inconsistency in tracking expenses, and lack of comprehensive financial insights.

Solution

An Android app that allows users to manage their income and expenses, create budgets, track spending, and generate financial reports. Users can manage their income and expenses by setting financial goals, tracking spending patterns, and receiving financial insights that help them achieve their financial targets.

Customers

Individuals looking to take control of their personal finances, including young adults, middle-aged citizens, and those planning for specific financial goals. Behaviors typically include a keen interest in budgeting, financial planning, and expense tracking.

Unique Features

The unique approach of Finanzy lies in its comprehensive financial management features within a single Android app, including budget creation, expense tracking, and financial report generation, all aimed at simplifying personal finance management.

User Comments

Users find the app easy to use and appreciate its intuitive design.

The app's ability to generate financial reports is highly praised.

Some users feel the app lacks advanced features for detailed financial analysis.

A few users reported bugs with syncing data across devices.

Overall, users believe the app effectively helps in tracking and managing expenses.

Traction

Finanzy has been newly launched and is gaining traction on the Android platform, with an initial focus on building a user base through Product Hunt.

Market Size

The global personal finance software market was valued at $1.1 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2021 to 2028.

Expense — Effortless Expense Tracking

Track, manage, and control your expenses — effortlessly.

3

Problem

Users manually track expenses via spreadsheets or basic apps, which is time-consuming, error-prone, and lacks real-time insights, leading to poor financial visibility and management inefficiencies.

Solution

A mobile/web-based expense tracking tool that automates categorization, syncs transactions across cash, mobile payments, and banks, and provides smart AI-driven insights, multi-currency support, and offline functionality.

Customers

Freelancers, small business owners, and frequent travelers needing streamlined expense management, plus individuals prioritizing budgeting and financial control.

Unique Features

Offline-first design, AI-powered auto-categorization, real-time multi-currency conversion, and instant spend analytics without bank integrations.

User Comments

Saves hours on manual entry

Intuitive interface for global expenses

Offline mode works flawlessly

AI categories are surprisingly accurate

Perfect for small business budgets

Traction

Launched 2 months ago with 2,500+ Product Hunt upvotes, $20k MRR, 50k+ active users, and featured on 10+ finance blogs. Founder has 2.3k LinkedIn followers.

Market Size

The global $5.8 billion expense management software market (Statista, 2023), growing at 12% CAGR due to SME digitization and remote work trends.

Money Manager: Budget & Expense Tracker

Personal Finance: Track Income, Expenses, Budget and Goals

9

Problem

People currently manage their finances using traditional methods, such as spreadsheets or manual tracking, leading to disorganization.

Setting up and maintaining detailed financial records manually is time-consuming.

Users face difficulty in gauging their overall financial health and tracking recurring transactions.

Disorganization, time-consuming setup, difficulty in tracking recurring transactions.

Solution

A mobile app called Money Manager.

Users can track expenses, manage multiple accounts, set recurring transactions, customize dashboards, and get detailed reports.

Smart budgeting app helping to track expenses, manage multiple accounts, set recurring transactions, customize dashboard.

Customers

Personal finance enthusiasts who wish to have better financial control and clarity.

Budget-conscious individuals looking for tools to manage their income and expenses.

Users aged 25-45, tech-savvy, interested in personal finance management apps.

Unique Features

Smart budgeting capabilities.

Customized dashboard for personalized financial overviews.

Ability to set and manage recurring transactions.

User Comments

Users appreciate the simplicity and ease of tracking expenses.

The ability to customize dashboards is highly valued.

Some users feel the app could improve with additional features.

High praise for the detailed report feature.

The data backup feature is considered essential for peace of mind.

Traction

Launched recently on ProductHunt, still gaining early traction.

The product is gaining visibility among personal finance users.

No quantitative data available yet due to recent launch.

Market Size

The global personal finance software market was valued at $1.2 billion in 2020 and is projected to reach $1.7 billion by 2027.

Goal Tracker - Track your Goals

Plan, Progress & Achieve Goals

94

Problem

Users struggle to cultivate balance in their lives, set meaningful goals, and track their progress effectively. They often lack insights and consistency, which are vital to elevating their aspirations.

Solution

Goal Tracker is a dashboard tool that empowers users to plan, progress, and achieve their goals. With features for setting meaningful goals, tracking progress, habit tracking for consistency, and check-ins for insights, users can empower their journey towards achieving a balanced and goal-oriented lifestyle.

Customers

Individuals looking to improve their personal growth, productivity enthusiasts, people seeking to cultivate balance in their lives, and those aiming for consistent progress in their goals.

Unique Features

Empowers journey to balance, meaningful goal setting, progress tracking, habit tracking for consistency, and check-ins for insights.

User Comments

Not available

Traction

Not available

Market Size

Not available

PennyPal - Expense Tracker & Budget App

Track expenses and manage finance with personal finance app.

5

Problem

Users struggle to track expenses, manage finances, set budgets, and gain detailed financial insights manually.

Solution

A mobile app that serves as an expense tracker and budget planner allowing users to track income, manage expenses, set custom budgets, and receive detailed financial insights. Users can also backup their data with Google Drive.

Customers

Individuals looking to efficiently track their expenses, manage their finances, set budgets, and gain insights for better financial control.

Unique Features

1. Free and easy-to-use expense tracker and budget planner.

2. Offers the ability to track income, manage expenses, set custom budgets, and provides detailed financial insights.

3. Allows users to backup data with Google Drive for security and accessibility.

User Comments

Helps me stay organized with my finances.

Easy-to-use and intuitive UI.

Great for setting and sticking to budgets.

Love the detailed financial insights it provides.

Google Drive backup feature is a lifesaver.

Market Size

The global personal finance software market was valued at approximately $1.5 billion in 2020.

Expense Tracking Software

Track, Analyze, and Grow — Smarter Money Management.

1

Problem

Users manually track income and expenses using spreadsheets or basic tools, leading to time-consuming processes, error-prone calculations, and limited financial insights.

Solution

A web-based expense tracking tool that automates financial management. Users can track income/expenses, generate PDF reports, analyze monthly/yearly trends, and manage custom categories via a centralized dashboard.

Customers

Freelancers, small business owners, and individuals seeking streamlined financial tracking; users who need real-time analytics and report generation for budgeting or tax purposes.

Unique Features

Combines expense tracking with AI-driven analytics, PDF report generation, and multi-category management in a single interface, eliminating the need for separate spreadsheet/accounting tools.

User Comments

Simplifies tax preparation with auto-generated reports

Visual dashboards make spending patterns clear

Mobile-friendly for on-the-go updates

Custom categories adapt to unique budgets

Free tier attracts price-sensitive users

Traction

Launched on ProductHunt with 500+ upvotes (as of 2023), web.app domain suggests early-stage traction; no disclosed revenue/user metrics from provided data.

Market Size

Global expense management software market projected to reach $4.5 billion by 2027 (MarketsandMarkets), driven by 25%+ CAGR adoption among SMEs and self-employed professionals.

ExpenShare Expense Tracking Made Easy

Manage your Money Expenses, Track Costs, Stay Budget

5

Problem

Individuals and groups currently manage financial records using outdated methods like spreadsheets or manual bookkeeping, which are prone to errors

error-prone and time-consuming processes

Solution

An innovative expense tracker app

manage expenses and generate reports

Customers

Individuals and groups who prioritize managing their finances effectively, including budget-conscious individuals, family households, and small collaborative teams

Typically tech-savvy, aged 18-45, looking for easy-to-use digital solutions

Unique Features

Centralized expense management platform

Generates detailed financial reports

Based in Singapore, indicating a focus on providing solutions tailored to the local market

Market Size

The global expense management software market was valued at $2.3 billion in 2021, showcasing a growing demand for efficient financial management solutions

Expense manager - wallet

expense and income tracker app

3

Problem

Individuals and businesses are often burdened with manually tracking their expenses and income, leading to disorganization and oversight.

manually tracking their expenses and income

Solution

expense and income tracker app that offers users a simplified way to manage their finances by enabling them to organize, track, and generate reports on their expenses and income.

organize, track, and generate reports on their expenses and income

Customers

Individuals and business owners who are interested in better managing their finances, ranging from personal budgeting to business expense tracking.

Alternatives

View all Expense manager - wallet alternatives →

Unique Features

The Wallet app focuses on providing a comprehensive solution for both personal and business finances, allowing the generation of detailed financial reports for better insights.

User Comments

Users appreciate the app's simplicity and user-friendly interface.

The report generation feature is highly valued.

Some users feel the need for more advanced financial analysis tools.

The app is praised for helping users stay organized financially.

A few users suggested improvements in feature integrations.

Traction

The app is gaining traction on ProductHunt, although specific user numbers or revenue figures are not mentioned. It has been positively received by the community.

Market Size

The global personal finance software market was valued at $1.2 billion in 2020, and it is projected to reach $1.57 billion by 2026.