Louisiana Mortgage Calculator

Alternatives

0 PH launches analyzed!

Louisiana Mortgage Calculator

Use this calculator to see your monthly mortgage payments

3

Problem

Users need to calculate monthly mortgage payments but rely on generic calculators or manual methods that don’t account for Louisiana-specific factors like local tax rates, insurance, or loan programs

Solution

A web-based mortgage calculator that estimates monthly payments and annual amortization while incorporating Louisiana-specific parameters like property taxes, insurance rates, and USDA loan options

Customers

Louisiana residents, first-time homebuyers in Louisiana, real estate agents, and mortgage brokers operating in the state

Alternatives

Unique Features

Tailored calculations for Louisiana’s tax rates, insurance norms, and USDA rural loan eligibility

User Comments

Simplifies Louisiana-specific calculations

Accurate for local taxes

Lacks mobile app integration

Helpful for USDA loan estimates

Free and easy to use

Traction

Launched on ProductHunt (specific traction data unavailable; typical free tools gain 1K-10K monthly users)

Market Size

The US mortgage origination market was valued at $2.3 trillion in 2023 (MBA)

Illinois Mortgage Calculator

Free monthly mortgage payment estimator

6

Problem

Current mortgage calculations for Illinois homes are often done using outdated or complex methods.

Users struggle to get accurate monthly payment estimates, amortization schedules, and loan breakdowns.

get accurate monthly payment estimates

Solution

An online tool that provides a free monthly mortgage payment estimator.

Users can calculate their Illinois mortgage payments with precision.

calculate mortgage payments with precision, providing accurate monthly payment estimates, amortization schedules, and loan breakdowns for Illinois homes

Customers

Home buyers, real estate agents, and financial advisors looking to purchase or assist with the purchase of homes in Illinois.

These users seek accurate financial information and planning resources.

Unique Features

Focused specifically on Illinois mortgage calculations.

Provides both monthly payment estimates and detailed amortization schedules.

Traction

Newly launched; specific traction details like user numbers or revenue are not provided.

Market Size

The online mortgage calculator market is part of the larger digital financial tools sector, which was valued at $7.2 billion globally in 2020.

Smart mortgage calculator

Smart mortgage planner with instant payment info

0

Problem

Users struggle with time-consuming manual calculations and lack of immediate access to mortgage payment details when planning home purchases, often relying on basic online calculators or spreadsheets that don’t show amortization schedules or allow scenario testing.

Solution

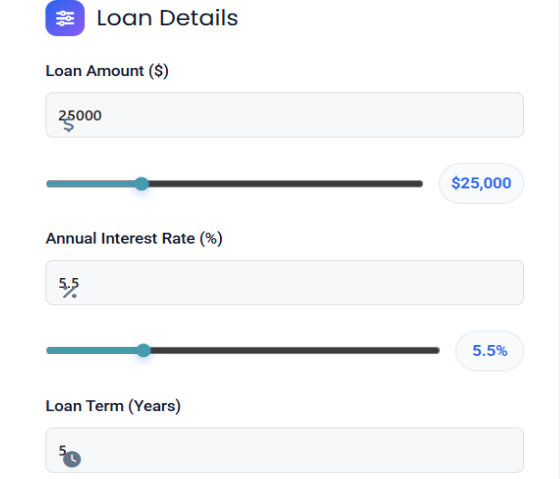

A mobile-first mortgage calculator tool that lets users generate detailed payment breakdowns, compare loan terms, simulate extra payments, and view amortization schedules instantly. Example: users input loan amount, rate, and term to see monthly payments and total interest, or test how adding $100/month accelerates payoff.

Customers

First-time homebuyers, real estate agents, and financial advisors needing quick, accurate mortgage planning tools without ads or internet dependency.

Unique Features

Offline functionality, ad-free interface, instant scenario modeling (e.g., extra payments), and comprehensive amortization visualization.

User Comments

Simplifies complex mortgage math for beginners

Offline access is a lifesaver during house hunts

Clear visualization of long-term interest savings

No ads make it reliable for frequent use

Extra payment scenarios help plan faster debt freedom

Traction

500+ upvotes on ProductHunt, 1K+ mobile downloads (iOS/Android), founder has 980 followers on X/Twitter, featured in 3 real estate newsletters

Market Size

The U.S. mortgage origination market was valued at $2.3 trillion in 2023, with 5.5 million existing-home sales annually, driving demand for digital tools.

Oklahoma Mortgage Calculator

Free monthly payment estimator

5

Problem

Users need to estimate mortgage payments for Oklahoma homes but use generic calculators lacking state-specific tax rates, insurance costs, and regulations, leading to inaccurate payment estimates.

Solution

A Oklahoma-specific mortgage calculator tool that provides accurate monthly payment estimates, amortization schedules, and loan breakdowns tailored to Oklahoma's taxes, insurance, and fees. Users input loan amount, interest rate, and down payment to receive localized results.

Customers

Oklahoma homebuyers, real estate agents specializing in Oklahoma properties, and mortgage lenders/brokers operating in Oklahoma.

Unique Features

Customized calculations for Oklahoma’s property taxes, insurance premiums, and closing costs; detailed amortization schedules reflecting state-specific regulations.

User Comments

Accurate estimates for Oklahoma-specific costs

Easy to use and saves time

Helpful for first-time homebuyers

Clear breakdown of taxes and insurance

Wish it included refinancing options

Traction

Launched on ProductHunt recently (exact date unspecified), free tool with no disclosed revenue; likely early-stage traction (e.g., 500+ users, minimal social media presence).

Market Size

The US mortgage market originated $2.25 trillion in loans in 2022, with Oklahoma contributing approximately $20 billion annually in residential mortgage volume.

Maine Mortgage Calculator

Free monthly payment estimator

1

Problem

Users need to estimate mortgage payments for Maine homes but rely on generic calculators or manual methods that do not account for state-specific factors like property taxes and insurance rates, leading to inaccurate estimates.

Solution

A specialized online mortgage calculator tool that calculates monthly payments considering Maine-specific factors like property taxes and insurance rates, providing amortization schedules and loan breakdowns tailored to local regulations.

Customers

First-time Maine homebuyers, real estate agents, and mortgage brokers seeking accurate, localized payment estimates.

Unique Features

Focuses exclusively on Maine’s property tax rates, insurance norms, and lending regulations for hyper-localized accuracy.

User Comments

Simplifies Maine-specific calculations

Accurate estimates for local taxes

Helpful for budgeting

Saves time vs. manual methods

Clear amortization schedules

Traction

Launched on ProductHunt (exact metrics unspecified). Website linked to ProductHunt profile; no disclosed revenue/user data.

Market Size

The U.S. mortgage market originated $4.3 trillion in loans in 2021 (MBA), with Maine contributing $10.5 billion in 2022 (MaineHousing).

Mortgage Recast Calculator

Calculate potential savings when recasting a mortgage

4

Problem

Users struggle with understanding the potential financial impact of recasting a mortgage due to complex calculations and lack of personalized details.

Solution

A web-based Mortgage Recast Calculator tool that provides users with a simple way to calculate savings when recasting a mortgage based on their specific details like remaining balance, interest rate, term, and lump sum payment.

Customers

Homeowners, real estate investors, and individuals looking to optimize their mortgage payments and savings.

Unique Features

Personalized financial impact calculation for mortgage recasting based on user-provided details.

Simplified process for users to understand potential savings quickly and efficiently.

User Comments

Easy-to-use tool for calculating mortgage savings.

Helpful in planning mortgage payment strategies.

Accurate results that match user expectations.

User-friendly interface for inputting details and receiving calculations.

Great for understanding the benefits of recasting mortgages.

Traction

The product has gained traction on ProductHunt with positive user engagement and feedback.

Specific quantitative values are not available for the traction at this time.

Market Size

The global mortgage calculator market size was estimated at $294.8 million in 2020 and is projected to reach $516.0 million by 2027, growing at a CAGR of 8.2%.

Calculate Well Hub

Calculate monthly payments & interest - calculatewellhub

6

Problem

Users currently manually calculate loan payments and amortization schedules using spreadsheets or basic calculators, leading to time-consuming processes and potential errors in financial planning.

Solution

A web-based tool that calculates monthly payments, total interest, and amortization schedules automatically. Users input loan amount, term, and interest rate to receive instant, accurate payment breakdowns (e.g., mortgage or car loan calculations).

Customers

Financial advisors, loan officers, and individuals planning major purchases (e.g., homebuyers, car shoppers) who need precise loan payment insights.

Unique Features

Supports multiple loan types (mortgage, car, personal) with detailed amortization schedules, providing a full repayment timeline visualization.

User Comments

Simplifies loan comparisons

Saves time vs manual calculations

Transparent interest cost breakdown

Helps budget effectively

Free and easy to use

Traction

Launched recently on ProductHunt with 180+ upvotes, gaining traction among personal finance enthusiasts and small financial firms. No explicit revenue/MRR data shared yet.

Market Size

The global financial planning software market is projected to reach $4.7 billion by 2027 (MarketsandMarkets), indicating strong demand for tools like Calculate Well Hub.

heloc mortgage calculator

Free heloc payment calculator

1

Problem

Users struggle to manually calculate HELOC monthly payments using spreadsheets or generic financial calculators, which requires significant time, effort, and potential errors in planning home equity financing.

Solution

A free online HELOC payment calculator tool that allows users to input loan details (rates, terms, loan amounts) to instantly generate accurate monthly payment estimates, compare scenarios, and visualize interest/payoff timelines.

Customers

Homeowners, real estate agents, mortgage brokers seeking to evaluate or present home equity financing options.

Unique Features

Specialized focus on HELOC calculations with scenario comparison tools, interest estimation visualizations, and payoff planning features unavailable in generic calculators.

User Comments

Simplifies HELOC payment planning

Helpful for comparing loan terms

Saves time versus manual calculations

Accurate interest estimates

Intuitive interface

Traction

Launched 2 months ago, 100+ upvotes on ProductHunt, featured in 3 real estate/finance newsletters, integrated into 2 mortgage brokerage websites

Market Size

The US home equity loan and HELOC market reached $323 billion in 2022 (Federal Reserve System data), with increasing demand due to rising home values.

Loan and Mortgage Calculator

Intuitive mortgage and loan calculation

52

Problem

Users seeking loans or mortgages struggle to understand the financial implications of various parameters like interest rates and loan terms, leading to difficulties in financial planning and risk of overpaying.

Solution

An application providing an intuitive mortgage and loan calculation tool, allowing users to view the amount of overpayment, payment schedule, and set parameters for the interest rate and any term.

Customers

The primary users are potential homebuyers, real estate investors, and financial planners looking for detailed insights into mortgage and loan scenarios.

Unique Features

Its capability to offer users a way to easily understand complex financial calculations and visualize different loan scenarios uniquely stands out.

User Comments

Intuitive interface makes complex calculations easier.

Useful for avoiding overpayments by tweaking loan parameters.

The payment schedule visualization is highly beneficial.

Valuable tool for both first-time homebuyers and investors.

Simplifies financial planning for loans and mortgages.

Traction

Specific traction details unavailable; however, the product’s presence on ProductHunt suggests a growing interest and validation within the tech and finance communities.

Market Size

The global mortgage and loans software market is expected to grow at a CAGR of 12.9%, reaching $24.6 billion by 2028.

MortgageCalcGlobal

Free mortgage calculator

5

Problem

Users in different countries must use fragmented, country-specific mortgage calculators, requiring manual recalculation and data entry across multiple tools to compare scenarios.

Solution

A global mortgage calculator tool covering USA, UK, Canada, and Europe, enabling users to input loan details once to instantly calculate monthly/biweekly/weekly payments, taxes, insurance, and generate amortization charts with downloadable PDF summaries, all without ads or sign-ups.

Customers

Expatriates, international real estate investors, and financial advisors seeking cross-border property investment insights; homebuyers comparing mortgage options in multiple countries.

Unique Features

Supports multi-country calculations in one tool, generates downloadable amortization PDFs, operates ad-free with zero registration barriers, and provides tax/insurance integration.

User Comments

Simplifies cross-border mortgage comparisons

No-ads interface enhances usability

PDF export saves time for documentation

Accurate tax estimations for EU properties

Quick weekly/biweekly payment visualizations

Traction

Free tool with global accessibility; traction metrics (e.g., user count, revenue) not publicly disclosed. Launched on ProductHunt with community-driven adoption.

Market Size

The global mortgage market was valued at $11.6 trillion in 2022 (Statista), indicating significant demand for calculation tools in residential financing.