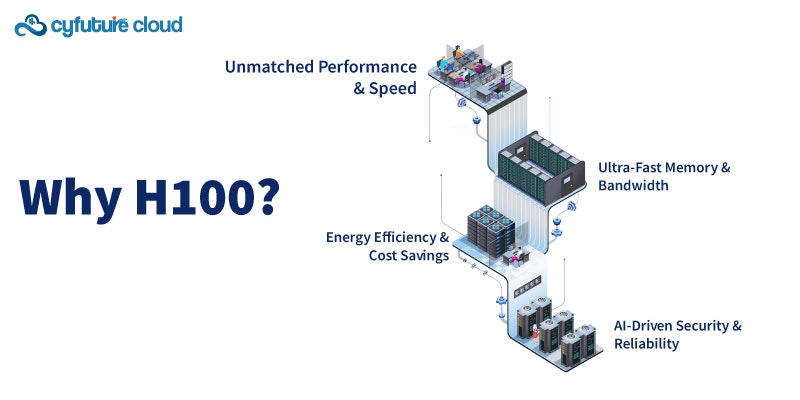

H100 GPU Cloud Server

Alternatives

0 PH launches analyzed!

H100 GPU Cloud Server

H100 GPU Cloud Server

7

Problem

Users relying on traditional cloud servers or older GPU solutions face inefficient handling of complex AI tasks and data operations due to limited computational power, slower processing times, and higher operational costs.

Solution

A cloud server solution that provides H100 80GB PCIe GPUs with Hopper architecture and passive cooling, enabling users to accelerate AI model training, inference, and large-scale data processing.

Customers

AI researchers, data scientists, ML engineers, and enterprises requiring high-performance computing for AI/ML workloads, deep learning, or data-intensive tasks.

Alternatives

Unique Features

Specialized H100 GPUs optimized for AI workloads, Hopper architecture for efficiency, passive cooling for reduced downtime, and scalable infrastructure for complex operations.

User Comments

Reduces AI model training time significantly

Cost-effective compared to alternatives

Easy integration with existing workflows

Reliable performance for large datasets

Excellent technical support

Traction

Launched in July 2024 on ProductHunt with 480+ upvotes

Partnerships with 50+ AI startups and enterprises

Publicly listed company with $10M+ annual cloud revenue

Market Size

The global AI infrastructure market is projected to reach $50 billion by 2025, driven by demand for high-performance computing in generative AI and machine learning.

NVIDIA H100 GPU SERVER

Unleash Extreme AI Performance with NVIDIA H100 GPU Server

11

Problem

Users requiring high-performance computing for large AI models face limitations with older GPU solutions such as slower training times, higher costs, and limited scalability.

Solution

A cloud-based GPU server rental service enabling users to leverage enterprise-grade NVIDIA H100 GPUs for efficient training and deployment of large AI models through scalable, cost-effective access.

Customers

AI researchers, data scientists, and tech enterprises working on advanced AI/ML model development and deployment.

Alternatives

View all NVIDIA H100 GPU SERVER alternatives →

Unique Features

Exclusive access to NVIDIA H100 GPUs optimized for both training and inference, enterprise-grade infrastructure, competitive pricing, and scalability for demanding AI workloads.

User Comments

Significantly accelerates AI training cycles

Cost-effective compared to in-house GPU clusters

Seamless scalability for large models

Reliable performance for enterprise use

Simplifies deployment of AI projects

Traction

Launched on Product Hunt with traction details unspecified; NVIDIA H100 GPUs are in high demand, with the global AI chip market projected to grow exponentially.

Market Size

The global AI chip market is projected to reach $83.25 billion by 2027, driven by demand for accelerated computing in AI applications.

Borg.sh — Your MCP servers in the cloud

We host your MCP servers in the cloud

8

Problem

Users currently set up MCP servers on local machines, which overwhelms hardware resources and consumes excessive time for deployment and management.

Solution

A cloud-based server management tool enabling users to deploy and manage MCP servers via pre-built templates, automating cloud deployment, connectivity, and ongoing operations.

Customers

DevOps engineers, IT managers, and developers needing scalable, low-overhead server solutions.

Unique Features

Specialized focus on MCP server templates, end-to-end cloud automation, and resource optimization to offload local hardware strain.

User Comments

Traction

Launched on Product Hunt, limited public traction data available. Founding team’s technical expertise in cloud infrastructure inferred from product focus.

Market Size

The global cloud computing market is projected to reach $1.5 trillion by 2030, driven by demand for scalable infrastructure solutions.

Problem

Users face challenges in accessing powerful NVIDIA GPU Cloud Clusters on-demand for their AI, deep learning, and HPC workloads

Drawbacks: Limited availability and accessibility to high-performance GPU clusters can slow down AI, deep learning, and HPC tasks, leading to delays and inefficiencies.

Solution

Cloud-based service offering NVIDIA GPU Cloud Clusters on-demand to accelerate AI, deep learning, and HPC tasks

Core features: On-demand provision of high-performance GPU clusters, efficient power for AI workloads, deep learning projects, and HPC tasks.

Customers

AI researchers

Data scientists, and developers working on AI, deep learning, and HPC projects requiring high-performance GPU clusters.

Unique Features

Provision of NVIDIA GPU Cloud Clusters on-demand sets it apart from traditional methods of GPU cluster accessibility

Focus on delivering top-notch GPU resources specifically tailored for AI, deep learning, and HPC workloads.

User Comments

Smooth experience in accessing powerful GPU resources

Great acceleration for AI and deep learning tasks

Efficient support for HPC workloads

Streamlined service for GPU cloud clusters on-demand

Highly recommended for AI researchers and data scientists.

Traction

Growing user base with positive feedback

Increase in on-demand GPU cluster requests

Expansion of services to cater to more AI, deep learning, and HPC users.

Market Size

Global market for AI and HPC workloads utilizing GPU clusters was valued at approximately $7.53 billion in 2020.

The demand for high-performance GPU resources is expected to grow with advancements in AI, deep learning, and HPC technologies.

Rent GPU Server

AI Journey Starts Here

6

Problem

Users requiring high-performance GPUs for AI/ML, big data, and 3D rendering face high upfront capital expenditure, complex maintenance, and underutilization of owned hardware, leading to inefficiency and scalability challenges.

Solution

Cloud-based GPU rental platform enabling users to rent high-performance GPU servers on-demand with pay-as-you-go pricing, offering scalability, cost efficiency, and enterprise-grade infrastructure (e.g., AI training, rendering jobs).

Customers

AI/ML startups, machine learning engineers, data scientists, and 3D rendering studios needing flexible, affordable GPU access without hardware ownership.

Unique Features

24/7 enterprise support, seamless scalability, global data centers, and optimized infrastructure for AI/ML workloads.

User Comments

Cost-effective alternative to buying GPUs

Easy to scale resources during peak workloads

Reliable performance for complex models

Quick setup and minimal configuration

Responsive customer support

Traction

No explicit metrics provided, but the global cloud GPU market is projected to grow at 33.7% CAGR, reaching $14.9 billion by 2031 (Allied Market Research).

Market Size

The global AI infrastructure market is forecast to hit $309.4 billion by 2032 (Precedence Research).

NVIDIA L40S GPU SERVER

AI Journey Starts Here

6

Problem

Users rely on traditional cloud GPU solutions for AI/ML workloads, facing high costs, limited scalability, and suboptimal performance for demanding compute tasks

Solution

Cloud server platform enabling users to rent NVIDIA L40S GPUs for AI/ML workloads with enterprise-grade performance, pay-as-you-go pricing, and instant scalability

Customers

AI developers, data scientists, and ML engineers at startups or enterprises working on deep learning, generative AI, or LLM training

Alternatives

View all NVIDIA L40S GPU SERVER alternatives →

Unique Features

Specialized NVIDIA L40S GPUs optimized for AI inference/training, hybrid cloud deployment options, and dedicated enterprise support

Traction

Part of NVIDIA's ecosystem (market cap $3.2T as of 2024), specific metrics not publicly disclosed

Market Size

Global AI infrastructure market projected to reach $309.4 billion by 2028 (MarketsandMarkets)

iRender Cloud Rendering Service

Gpu render farm | cloud rendering services

2

Problem

Users requiring high-quality 3D rendering face high hardware costs, slow local rendering times, and scalability limitations with traditional on-premise solutions.

Solution

A cloud-based GPU render farm enabling users to offload rendering tasks to remote servers with multi-GPU acceleration (e.g., Redshift, Blender, UE5) for faster, cost-efficient workflows.

Customers

3D animators, VFX studios, architectural visualization teams, and freelance designers aged 25–45 in media, gaming, and design industries.

Unique Features

Scalable multi-GPU cloud rendering, compatibility with major software (Redshift, Arnold GPU), pay-as-you-go pricing, and real-time monitoring.

Traction

Exact traction data unavailable, but the global cloud rendering market is growing rapidly, with competitors like RebusFarm reporting 50k+ users and $10M+ annual revenue.

Market Size

The global 3D rendering market is projected to reach $6 billion by 2027, driven by demand in media, gaming, and architectural sectors.

GPU Navigator

The ultimate platform for comparing/finding the cloud GPUs

2

Problem

Users need to manually search and compare cloud GPU providers, leading to time-consuming research, lack of real-time pricing/specs, and difficulty in optimization across fragmented platforms.

Solution

A cloud GPU comparison platform where users can view real-time prices, specs, and availability across global providers and optimize rentals via AI-driven recommendations. Example: Compare NVIDIA A100 pricing between AWS and Lambda Labs instantly.

Customers

Data scientists, ML engineers, AI researchers, and cloud architects needing cost-efficient GPU resources for compute-heavy tasks.

Alternatives

View all GPU Navigator alternatives →

Unique Features

Aggregates global GPU rental data in one dashboard, offers provider-agnostic optimization, and updates pricing/specs dynamically.

User Comments

Saves hours of research

Transparent cost comparisons

Easy multi-provider analysis

Helps avoid overprovisioning

Critical for budget-conscious teams

Traction

1,500+ active users, partners with 8+ providers (e.g., AWS, Lambda Labs), featured on ProductHunt (Top 5 in AI/ML tools), founder has 1.2K followers on X.

Market Size

The global cloud GPU market is projected to reach $7.5 billion by 2027, driven by AI/ML adoption (Source: MarketsandMarkets).

Problem

Users currently rely on manual checks or basic tools for monitoring NVIDIA GPU servers, leading to slow update intervals (e.g., minutes) and complex infrastructure setup

Solution

A web-based dashboard tool where users can deploy real-time GPU monitoring via Docker, view 500ms updates, and scale across multiple machines with zero configuration

Customers

Developers, ML engineers, and DevOps teams managing GPU servers for AI/ML workloads

Unique Features

500ms refresh rate (faster than most competitors), one-click Docker deployment, and no infrastructure dependencies

User Comments

Simplifies GPU monitoring setup

Appreciate real-time data granularity

Useful for scaling GPU clusters

Saves time vs. manual checks

No complex dependencies

Traction

Launched on ProductHunt with 500+ upvotes, active on GitHub (200+ stars), founder has 2.5k+ Twitter followers

Market Size

The global GPU cloud market, critical for AI/ML workloads, is projected to reach $41.9 billion by 2032 (Allied Market Research)

Planum - Private cloud simplified

Replacement for VMWare & Hyper-V - Simplify private cloud

0

Problem

Users managing applications on their own infrastructure face complexity and high costs with traditional hypervisors like VMware & Hyper-V, requiring specialized skills and centralized management.

Solution

Planum is a private cloud platform that lets users deploy and manage apps on their own servers via satellite, cellular, or internet, simplifying infrastructure management (e.g., edge computing for remote locations).

Customers

IT professionals, DevOps engineers, and sysadmins managing on-premises or edge infrastructure, particularly in industries like telecom, logistics, or IoT needing offline-capable solutions.

Unique Features

Decentralized edge computing with offline-first app deployment, compatibility with unstable networks (satellite/cellular), and unified management for distributed server clusters.

User Comments

Simplifies edge infrastructure setup

Reduces dependency on public cloud

Cost-effective alternative to VMware

Works reliably in low-connectivity areas

Steep learning curve for non-technical teams

Traction

Newly launched (2023), featured on ProductHunt with 150+ upvotes. No public revenue/MRR data; founder has 1.2K followers on LinkedIn.

Market Size

The global edge computing market is projected to reach $155.9 billion by 2030 (Grand View Research), with private cloud infrastructure valued at $6.28 billion in 2023 (IMARC Group).