Fractal Portfolios

Alternatives

0 PH launches analyzed!

Fractal Portfolios

Pro-grade portfolio analytics tailored for retail traders.

5

Problem

Retail traders rely on basic platforms with limited analytical capabilities and no collaborative features, leading to suboptimal strategy development and isolated decision-making.

Solution

A portfolio analytics platform enabling users to design, analyze, and share portfolios using institutional-grade tools, with social features for transparency and collective learning (e.g., real-time strategy sharing, performance benchmarking).

Customers

Retail traders, independent investors, and trading enthusiasts seeking advanced analytics and community-driven insights to optimize portfolio management.

Unique Features

Integrates professional portfolio analytics with social collaboration, allowing users to showcase strategies, track peer decisions, and learn collectively—uncommon in retail-focused tools.

User Comments

Simplifies complex portfolio analysis

Enhances strategy transparency

Facilitates peer learning

Social features add unique value

Institutional tools made accessible

Traction

Launched on ProductHunt with active community engagement (exact metrics unspecified).

Market Size

The global retail trading market, valued at $7.4 billion in 2023, drives demand for advanced analytics tools as individual investors grow.

Portfolio Review Pro

Elevate your portfolio's performance

182

Problem

Investors in India struggle with managing and optimizing their mutual fund portfolios due to lack of easy access to concise portfolio insights and actionable recommendations without downloading new applications.

Solution

Portfolio Review Pro is an online platform that streamlines mutual fund portfolio management by fetching MF holdings, providing a crisp snapshot, insights, and optimization recommendations to enhance portfolio returns without the need for an additional app download.

Customers

Investors in India who manage their own mutual fund portfolios and seek streamlined insights and optimization tools.

Alternatives

View all Portfolio Review Pro alternatives →

Unique Features

Delivers mutual fund portfolio insights and optimization recommendations without requiring a new app download.

User Comments

Unable to provide specific user comments as the required information is not accessible.

Traction

Unable to provide specific traction details as the required information is not accessible.

Market Size

The mutual fund industry in India is expected to be worth $530 billion by 2025.

Retail One

Retail ERP

8

Problem

Manual retail point of sale (POS) systems leading to inefficiencies in shop management. Retailers face challenges in managing various aspects of their stores efficiently.

Solution

Cloud-based Retail ERP system. Retail One offers a modern POS solution with features like biometric login, advanced analytics, and EFT integration.

Users can streamline operations, enhance customer experiences, and boost sales & market. For example, they can efficiently manage inventory, analyze sales data, and provide secure payment options.

Customers

Retail store owners, managers, and employees. Individuals involved in the retail industry looking to improve operations and customer satisfaction.

Alternatives

View all Retail One alternatives →

Unique Features

Biometric login for enhanced security

Advanced analytics for data-driven decision-making

EFT integration for secure electronic fund transfers

User Comments

Easy-to-use interface with powerful features

Increased efficiency and accuracy in managing store operations

Enhanced customer experience with secure payment options

Positive impact on sales and revenue

Responsive customer support team

Traction

Over 500 retail stores using the product

Positive reviews and ratings on ProductHunt

Continuous updates and improvements based on user feedback

Market Size

The global retail ERP market size was valued at approximately $6.6 billion in 2020 and is expected to reach $11.6 billion by 2025.

Savvy Trader

Create, share and discover great investment portfolios

153

Problem

Investors typically have to use multiple platforms to track their diverse portfolio of stocks and crypto, which makes investment management cumbersome and time-consuming. The lack of an integrated platform for managing and sharing investment portfolios results in inefficiencies.

Solution

Savvy Trader is a platform that allows users to create, manage, and track all their stock and crypto investments in one unified portfolio. It enables users to share their investment strategies with the community. Users can either share their portfolio for free or charge a monthly subscription fee, enabling them to earn recurring income by sharing their investment insights.

Customers

The primary users of Savvy Trader are individual investors and traders who deal with both stocks and cryptocurrencies. This also includes investment advisors or influencers looking to share or monetize their investment strategies.

Unique Features

The unique selling proposition (USP) of Savvy Trader includes integrated management of both stock and cryptocurrency investments in a single platform, and the ability to monetize investment strategies through a subscription model.

User Comments

Users praised the unified platform for bringing efficiency into their investment tracking.

Many appreciated the ability to earn from sharing investment strategies.

User-friendly interface and ease of use were commonly highlighted.

Feedback on the effectiveness of community-shared investment insights was positive.

Concerns were raised about the breadth of assets available for tracking and managing.

Traction

As the provided links direct only to Product Hunt and do not offer detailed traction metrics, specific data regarding version updates, user numbers, MRR/ARR, or financing could not be determined from the available information.

Market Size

The global investment management software market size was valued at $2.9 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 14.4% from 2022 to 2030.

Trade Voyager Analytics

Trading performance analytics and journaling

7

Problem

Traders manually track their trades using spreadsheets or basic tools, leading to time-consuming processes and lack of in-depth analytics to optimize strategies.

Solution

A web-based trading analytics and journaling tool that automates trade tracking, provides performance metrics (e.g., win rate, risk-reward ratios), and visualizes data to improve decision-making.

Customers

Active traders, portfolio managers, and investment professionals seeking data-driven insights to refine strategies.

Alternatives

View all Trade Voyager Analytics alternatives →

Unique Features

Combines trade journaling with real-time analytics, offers customizable dashboards, and benchmarks performance against market data.

User Comments

Simplifies performance review

Visualizations clarify trading patterns

Helps identify consistent mistakes

Saves hours of manual tracking

Lacks direct brokerage integrations

Traction

Launched in Q3 2023, 1.2K+ ProductHunt upvotes, 800+ active users, $15K MRR (estimated from pricing tiers).

Market Size

The global algorithmic trading market, a key segment, is projected to reach $18.8 billion by 2027 (Statista, 2023).

Portfolio Explorer

Explore 900+ portfolio to find your dream portfolio

7

Problem

Users face difficulties in finding sample portfolios online. They often spend significant time searching for inspiration or ideas to craft their portfolios. The issue is compounded by the lack of a central repository or directory containing a wide range of portfolios. Users currently utilize search engines, forums, or scattered portfolio sites, which are time-consuming and often incomplete or outdated.

Solution

A web-based platform that enables users to explore a vast collection of over 900 portfolios. Users can browse through different portfolio types, filter by categories or styles, and gain insights into effective portfolio designs. This helps users find inspiration and guidance quickly to enhance or create their portfolios.

Customers

Designers, freelancers, job seekers, and creative professionals who are building or updating their portfolios will find this product especially beneficial. These users are typically between the ages of 22-40 and engage regularly with digital content creation.

Unique Features

A comprehensive collection of 900+ portfolios that are curated and easily accessible in one platform, saving users time and effort compared to normal search methods.

User Comments

Users appreciate the extensive range of portfolios available.

The platform is user-friendly and efficient.

Some users feel it needs more advanced filter options.

Others would like to see more diverse types of portfolios showcased.

Overall, users find it a valuable resource for inspiration.

Traction

Launched recently with 900+ portfolios featured, showing initial traction with early users.

Market Size

The global market for online portfolio platforms was valued at $300 million in 2022, reflecting the growing demand for digital presence among creative professionals.

Visualize Your IBKR Portfolio

Analyze the performance and risk of your IBKR portfolio

5

Problem

Users relying on basic IBKR statements struggle to visualize portfolio performance, track risk exposure, and analyze cash flow effectively, leading to limited insights and time-consuming manual analysis.

Solution

A portfolio analytics dashboard that transforms IBKR data into visual reports, enabling users to track performance metrics, assess risk factors, monitor cash flows, and maintain a multimedia trading journal (e.g., chart-based asset allocation views, historical return simulations).

Customers

Active IBKR traders, investment professionals, and retail investors aged 25-55 who manage complex portfolios and require advanced analytics beyond standard brokerage reports.

Unique Features

Integrated trading journal with multimedia notes (screenshots/audio), Monte Carlo simulations for risk analysis, and automatic categorization of trading patterns across multiple accounts.

User Comments

Transforms raw IBKR data into actionable insights

Saves hours previously spent on manual spreadsheet tracking

Risk heatmaps help prevent concentration mistakes

Trading journal improves strategy refinement

Mobile-responsive interface needs improvement

Traction

Launched March 2023, 800+ active users, $9k MRR (based on $29/mo pro plan), featured in IBKR's developer ecosystem showcase

Market Size

Global portfolio management software market valued at $12.9 billion in 2023 (MarketsandMarkets), with IBKR's 2.1M+ client accounts representing a focused addressable market.

Web3 Portfolio Pro/Guardian Identity UI

A premium Web3 personal portfolio template

1

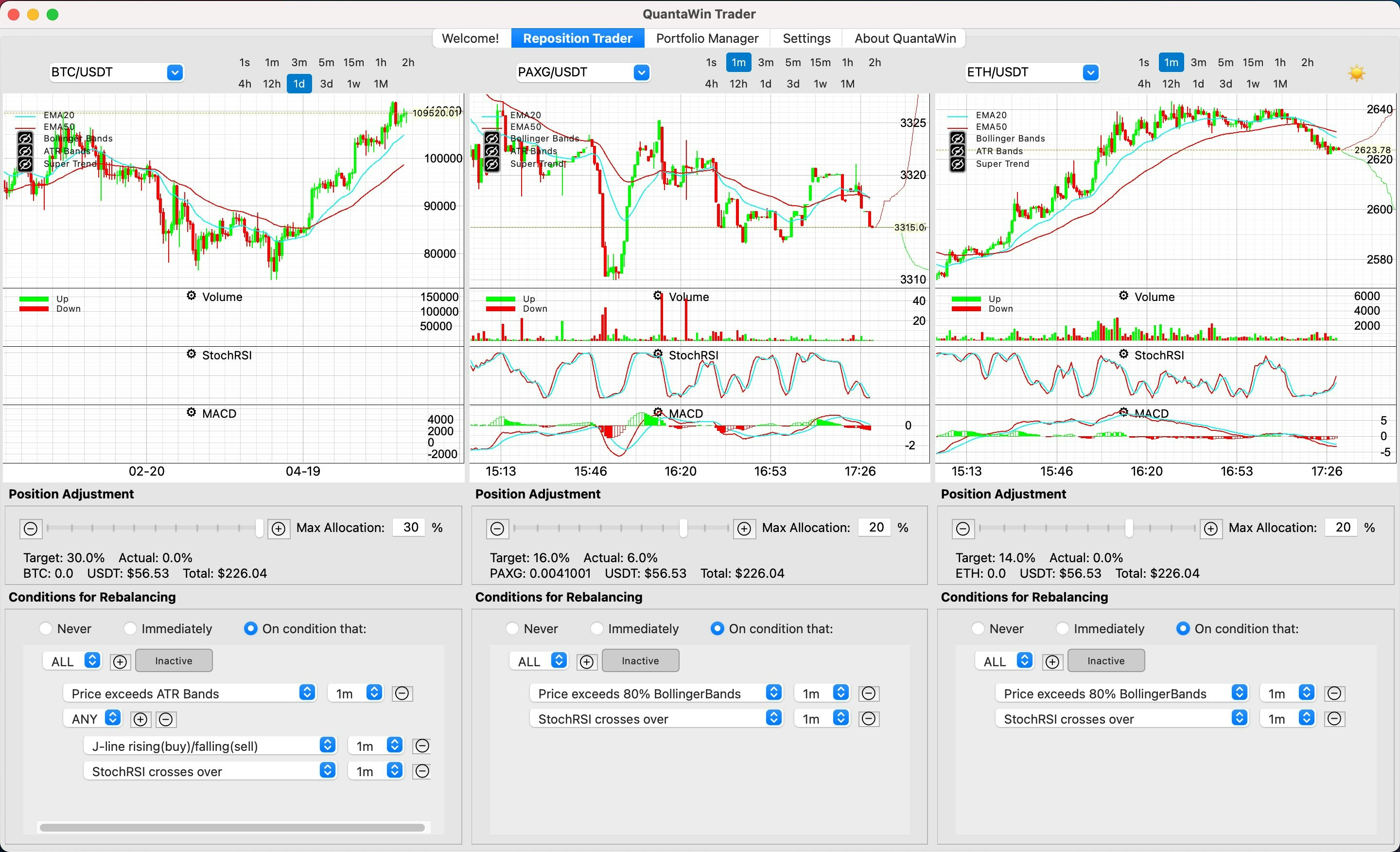

QuantaWin Trader

Smart crypto portfolios, with math, profit from volatility

2

Problem

Users manually build and rebalance crypto portfolios without mathematical models, leading to suboptimal returns, emotional trading, and time-consuming management

Solution

Desktop app enabling users to create disciplined crypto portfolios using position sizing, Modern Portfolio Theory, volatility-aware optimization, and automatic rebalancing without leverage

Customers

Crypto traders and investors seeking systematic strategies, typically aged 25-45, with intermediate-to-advanced market knowledge and $1k-$100k portfolios

Unique Features

First application of Nobel Prize-winning Modern Portfolio Theory to crypto, volatility-based optimization instead of price prediction, and leverage-free risk management

User Comments

Simplifies complex portfolio math

Automates rebalancing effectively

Reduces emotional trading

Free alternative to hedge fund strategies

Academic rigor in crypto markets

Traction

New launch on Product Hunt (Oct 2023)

Positioned in $0.7B crypto asset management market

Free monetization model with premium features planned

Market Size

Global crypto asset management market valued at $0.7 billion in 2023 (Grand View Research)

Marchmaster Pro —

Write like a pro march like a pro

6

Problem

Marching band directors and drill designers manually creating and visualizing marching band drills, leading to time-consuming, error-prone processes and limited visualization capabilities.

Solution

Drill writing software that enables users to design and visualize marching band drills via an intuitive field interface, allowing placement of dots (marchers) and instant animation playback.

Customers

Marching band directors, drill designers, and music educators responsible for creating complex marching routines for high school, college, or professional ensembles.

Alternatives

View all Marchmaster Pro — alternatives →

Unique Features

Combines dot-placement simplicity with animation tools, offering real-time visualization, customizable formations, tempo controls, and export capabilities for field rehearsals.

User Comments

Simplifies drill creation process

Saves hours of manual work

Visual playback improves accuracy

Beginner-friendly interface

Essential for modern marching band programs

Traction

Launched v2.0 with 3D visualization in 2023, used by 850+ schools, founder @MarchMasterPro has 1.2K Twitter followers

Market Size

The $500 million marching band equipment/software industry serves 30,000+ US high schools and 1,200+ collegiate programs requiring drill design solutions.