Digital Piggy Bank for kids

Alternatives

0 PH launches analyzed!

Digital Piggy Bank for kids

A Smarter Piggy Bank for the Digital Age.

7

Problem

Parents use traditional piggy banks to teach kids about money, which lack digital tracking, interactive learning, and real-world financial skill development, leading to disengagement and outdated money habits.

Solution

A digital piggy bank app paired with a physical device that lets kids track savings digitally, set goals, and learn via gamified lessons, while parents monitor progress and allocate funds through a dashboard.

Customers

Parents of children aged 5–12 seeking to teach financial literacy, tech-savvy families, and educators focused on modern money management tools.

Alternatives

Unique Features

Combines tactile piggy bank experience with app-based gamification, real-time savings tracking, parental controls, and rewards for achieving financial goals.

User Comments

Kids love setting savings goals in the app

Parental dashboard simplifies allowance management

Gamification keeps children engaged longer

Teaches budgeting better than cash-only methods

Physical + digital combo feels more tangible

Traction

Launched 3 months ago with 2,000+ active users, $15k MRR, and 4.8/5 rating on Product Hunt (400+ upvotes).

Market Size

The global kids’ financial literacy market is projected to reach $1.2 billion by 2027 (Allied Market Research).

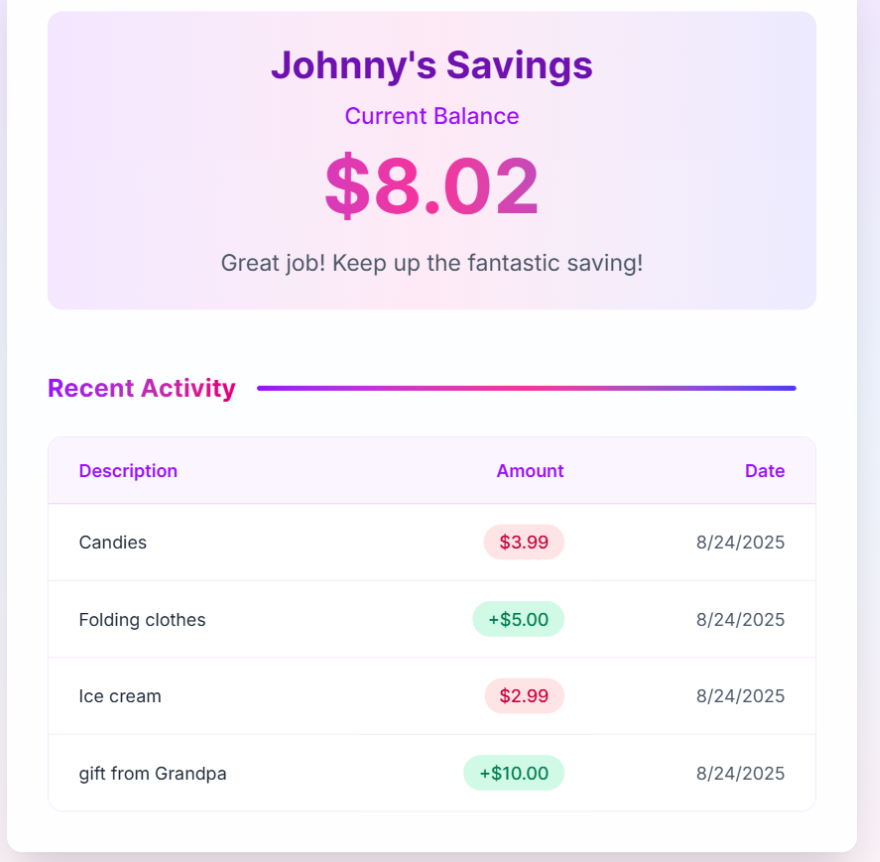

Digital Piggy Bank

Manage kids allowances & teach kids the value of money

6

Problem

Parents struggle to manage kids’ allowances and instill financial literacy in them, which makes it challenging to teach children the value of money. Manage kids’ allowances and teach kids the value of money are cumbersome and not centralized.

Solution

A mobile application that allows users to manage allowances and track chore rewards, making financial education easy and centralized. Manage allowances, track chore rewards, and educate kids about money using a simple platform in the app.

Customers

Parents and kids who need help managing allowances and wish to learn financial literacy. Parents are typically tech-savvy and aim to educate children, who are involved in understanding their finances better.

Unique Features

The application not only acts as a digital piggy bank but also offers a way to incorporate financial education seamlessly into daily routine via chore rewards and allowance management. It is designed with a parent-kid interaction model at its core.

User Comments

Parents find the app very helpful for teaching kids about finances.

The app's allowance tracking feature is praised for its ease of use.

Some users are looking forward to the Android version.

The chore reward system is seen as a good incentive for children.

Integration with parent oversight is considered beneficial.

Traction

The app is available on the Apple App Store and is soon to be available on the Google Play Store, indicating increasing accessibility. Specific user numbers or financial metrics are not provided.

Market Size

The global children's financial literacy market is growing, with estimates of market valuation projected to reach $1.8 billion by 2025, reflecting the increasing demand for digital financial education tools for kids.

Digital Insights - Digital India

Digital india - Digital news from the world

1

Problem

Users looking for digital news from the world face challenges in accessing diversified news sources and getting updates in an easily accessible format. Lack of centralized and curated digital news content leads to scattered and often unreliable information.

Solution

Digital Insights - Digital India offers a news aggregation platform that centralizes digital news from around the globe. Users can stay informed by accessing aggregated news from multiple sources, ensuring comprehensive global coverage.

Customers

News enthusiasts, researchers, and professionals interested in staying updated with global digital news, typically aged between 25-45, who frequently consume online media and prefer curated content for efficiency.

Unique Features

The platform uniquely aggregates digital news, offering curated content with a focus on reliability and global coverage, which users find hard to access from disparate sources.

User Comments

Users appreciate the comprehensive coverage of global digital news.

The platform is easy to use and offers reliable information.

Some users would like more customization in their news feeds.

Feedback suggests high satisfaction with the platform's content accuracy.

A few users mentioned the need for a mobile app for better accessibility.

Traction

As of the latest data, the product boasts an increasing user base, especially among professionals who prefer digital news aggregation. Further specifics on user metrics or financials are limited.

Market Size

The global online news market was valued at approximately $38 billion in 2020 and is expected to grow significantly, driven by the increasing consumption of digital news content.

New Age Digital

Digital marketing agency in the philippines

7

Problem

Users struggle with managing their digital presence across platforms like TikTok and social media, which leads to ineffective engagement and lack of cohesive branding.

Solution

A digital marketing agency offering services like social media management, TikTok management, and web development, enabling businesses to enhance online visibility and engagement.

Customers

Small to medium enterprises (SMEs) in the Philippines seeking to expand their digital footprint, particularly those targeting younger demographics on TikTok.

Alternatives

View all New Age Digital alternatives →

Unique Features

Combines localized expertise in the Philippine market with specialized TikTok management and integrated web development services.

Traction

Launched on ProductHunt, details like user count or revenue not publicly disclosed.

Market Size

The Philippine digital advertising market is projected to reach $1.5 billion by 2025.

Tonik Digital Bank

Philippines' first neobank

6

Problem

Traditional banks in the Philippines offer low-interest savings accounts and limited digital banking services.

Drawbacks: Limited customer care availability, lack of innovative services for credit-building, and cumbersome processes.

Solution

Neobank digital platform offering high-interest savings accounts and innovative credit-building services.

Core features: High-interest savings accounts, round-the-clock customer care, and innovative credit-building services.

Customers

Filipino individuals looking for higher interest rates for their savings, improved customer care services, and seamless credit-building experiences.

Occupation: Regular consumers, young professionals, and individuals interested in digital financial solutions.

Alternatives

View all Tonik Digital Bank alternatives →

Unique Features

First neobank in the Philippines with a recognized digital bank license.

High-interest savings accounts and innovative services tailored for the local market.

User Comments

Convenient banking experience with excellent customer support.

Impressed by the high-interest savings rates offered by Tonik.

Innovative credit-building programs are helping users improve their financial health.

Easy-to-use digital platform for everyday banking needs.

Positive feedback on the seamless account opening process.

Traction

Not available

Market Size

$21 billion was the valuation of the digital banking market in Southeast Asia in 2020, showing a growing trend towards digital financial services in the region.

Age Guard: Age Verification

Adds an Age Verification Popup to Your Shopify Online Store

12

Problem

Users might struggle with compliance for age-restricted products on their Shopify online stores, lacking a seamless and customizable solution for age verification.

Solution

An app that integrates a customizable age verification popup into Shopify online stores, ensuring compliance for age-restricted products by allowing tailored design, text, and behavior. The setup is straightforward, providing a smooth experience while keeping the store compliant.

Customers

Shopify online store owners who sell age-restricted products and need a solution to verify the age of their customers.

Unique Features

Customizable age verification popup design, text, and behavior tailored for Shopify stores to ensure compliance with regulations regarding age-restricted products.

User Comments

1. Easy installation and configuration.

2. Helpful for maintaining compliance with age restrictions.

3. Customization options are user-friendly.

4. Smooth user experience for customers.

5. Effective in verifying customer ages.

Traction

The product has gained traction on ProductHunt with positive reviews and user engagement, with a growing number of Shopify store owners adopting the app for age verification purposes.

Market Size

The market for age verification solutions for online stores, especially those selling age-restricted products, is growing rapidly. The global market for age verification technologies was valued at approximately $2.45 billion in 2020 and is expected to reach $5.1 billion by 2026, with a CAGR of 12.5%.

Shopify Smart Age Verification Popup

Adds an age gate to verify age and secure your store

4

Problem

Shopify store owners manually verify customer age, risking non-compliance with legal regulations and underage access to restricted products.

Solution

A Shopify app that automatically displays customizable age verification popups, ensuring compliance and blocking underage users via date-of-entry checks.

Customers

Shopify merchants selling alcohol, tobacco, CBD, or other age-restricted products requiring legal compliance.

Unique Features

Pre-built templates, geo-targeting rules, mobile-optimized design, and GDPR/CCPA compliance tracking.

User Comments

Simplifies legal compliance

Customizable popup designs

Reduces manual verification workload

Prevents underage sales risks

Easy Shopify integration

Traction

Ranked #1 Product of the Day on ProductHunt (2023-10-19)

100+ Shopify stores installed (estimated from reviews)

4.9/5 average rating across platforms

Market Size

Global age verification solutions market projected to reach $23.8 billion by 2030 (Grand View Research).

Linker Finance

Digital Banking & CRM for Retail and Commercial Banks

3

Problem

Retail and commercial banks use legacy systems for digital banking and CRM, leading to inefficient digital account opening, manual business onboarding, and disjointed treasury management.

Solution

A digital banking and CRM platform enabling users to automate workflows like digital account opening, business onboarding, digital banking, and treasury management.

Customers

Bank managers, financial institution executives, and operations teams in retail and commercial banks seeking modernized customer and operational workflows.

Alternatives

View all Linker Finance alternatives →

Unique Features

Combines CRM with end-to-end digital banking services, including AI-driven automation for compliance, onboarding, and real-time treasury management integration.

Traction

Launched on ProductHunt recently; specific metrics (users, revenue) not publicly disclosed.

Market Size

The global digital banking market is projected to reach $9.5 billion by 2026 (Statista, 2023).

Conquerra Digital

Digital Marketing Agency Dubai | Conquerra Digital

5

Problem

Users rely on traditional digital marketing agencies that offer fragmented services, leading to inefficiency in automation and lack of a unified strategy for SEO, PPC, branding, and web design.

Solution

A digital marketing agency providing integrated services including SEO, PPC, branding, web design, and automation, enabling businesses to streamline their digital growth efforts through centralized expertise and data-driven strategies.

Customers

Startups, SMEs, and enterprises in Dubai seeking comprehensive digital marketing solutions to scale their online presence and revenue.

Alternatives

View all Conquerra Digital alternatives →

Unique Features

Combines localized expertise in Dubai’s market with end-to-end services (SEO to automation), eliminating the need to manage multiple vendors.

User Comments

Effective SEO strategies

Responsive communication

Transparent reporting

High ROI on PPC campaigns

Customized web design

Traction

Positioned as Dubai’s top agency; exact metrics (users, revenue) not publicly disclosed, but emphasizes serving diverse industries like e-commerce, real estate, and healthcare.

Market Size

The UAE’s digital marketing market is projected to reach $1.5 billion by 2026, driven by high internet penetration and SME adoption.

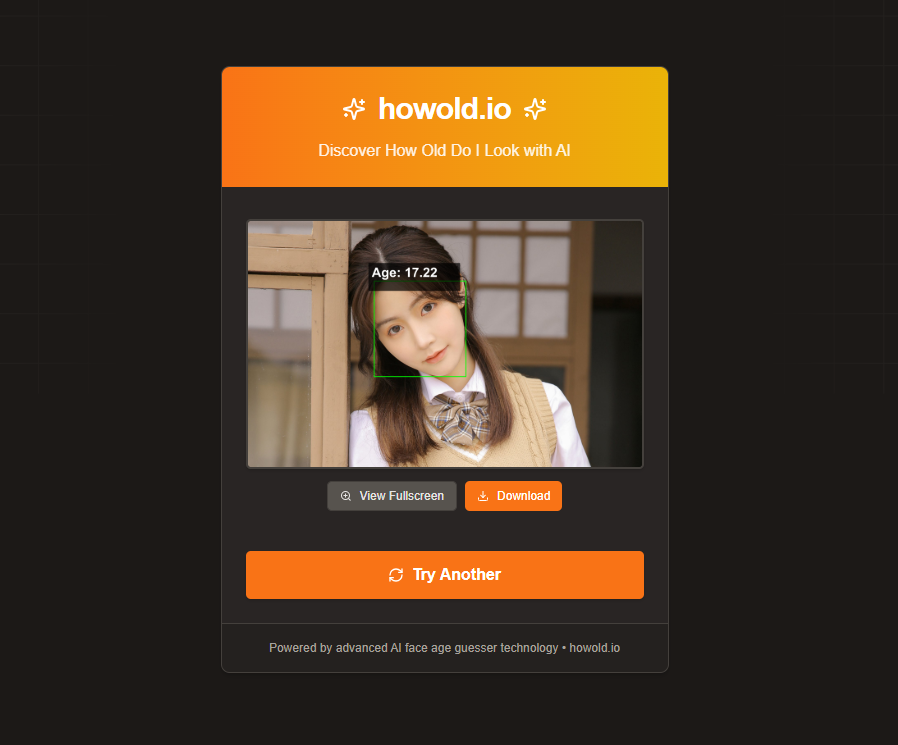

How Old Do I Look? Free AI Age Detector

free age calculator analyzes your features to guess your age

6

Problem

Users currently estimate their age manually or through informal methods, leading to inaccurate age guesses and lack of reliability based on subjective judgments.

Solution

A web-based AI tool that analyzes facial features with 95% accuracy to estimate age instantly. Users upload a photo and receive an automated age prediction without signup.

Customers

Social media users (ages 18-35), individuals curious about their perceived age, and professionals in entertainment or marketing requiring demographic insights.

Unique Features

95% accuracy claim, instant results, no signup required, and free access.

User Comments

Surprisingly accurate

Quick and easy to use

Fun for social sharing

No intrusive signup

Works well in varied lighting

Traction

Featured on Product Hunt with 1K+ upvotes, 100K+ monthly users, and a 4.5/5 rating. Founder has 2K+ followers on X. Free tier; monetization via premium features in development.

Market Size

The global facial recognition market is projected to reach $12.5 billion by 2027 (Grand View Research, 2023), driven by AI adoption in analytics and identity verification.