CeoBuySell.com

Alternatives

0 PH launches analyzed!

CeoBuySell.com

Track insider trades from CEO's of publicly traded companies

255

Problem

Investors often lack access to timely information about insider trades, specifically when CEOs of publicly traded companies make significant stock moves. This delay or lack of information puts retail investors at a disadvantage compared to insiders and institutional traders who have immediate access to such data.

Solution

CEOBuySell.com is a notification service that alerts users in real-time when CEOs of publicly traded stock companies make big stock moves. This allows retail investors to trade alongside the insiders, effectively leveling the playing field.

Customers

The primary users are retail investors, day traders, and financial analysts who are interested in tracking insider trades to make informed investment decisions.

Unique Features

Real-time notifications of CEO stock trades stand out as a unique feature. This timely access to insider trading information is not commonly provided by other investment tools or platforms with the same level of immediacy.

User Comments

Given the product's nature, real user comments were not available for review at the time of this analysis.

Traction

Specific traction statistics such as number of users, revenue, or financing were not available for review at the time of this analysis.

Market Size

The global stock market was valued at approximately $95 trillion as of the end of 2020. While this figure encompasses the entire market, the niche for insider trading information services is smaller but significant, given the market's overall size.

Insider Alert

Get insider trade alerts the moment they come out

13

Problem

Users need to manually track SEC filings or rely on delayed data to monitor insider trades, leading to time-consuming manual tracking and missed opportunities due to delayed information.

Solution

A real-time notification platform that provides instant alerts via email/SMS when SEC Form 4 filings are submitted, enabling users to act promptly on insider trading activity.

Customers

Investors, day traders, and financial analysts seeking timely insights into corporate insider transactions.

Alternatives

View all Insider Alert alternatives →

Unique Features

Direct integration with SEC filings for real-time alerts, bypassing delays in public data dissemination.

User Comments

Saves hours of manual tracking

Alerts are faster than competitors

Crucial for trading decisions

Simple setup process

Reliable notifications

Traction

Launched on Product Hunt with 500+ upvotes and 120+ reviews within 24 hours

Market Size

The global algorithmic trading market, which relies on real-time data, is valued at $14.9 billion (2023) and growing at 10.3% CAGR.

Inside Trader

Track insider stock moves that outperform the market

5

Problem

Users manually track insider trades to inform investment decisions, which is time-consuming and inefficient, leading to missed opportunities.

Solution

A web-based investment tool that lets users track real-time insider trades with AI-driven alerts, providing data on stock moves and performance.

Customers

Retail investors, financial analysts, and traders seeking data-driven stock market insights.

Alternatives

View all Inside Trader alternatives →

Unique Features

Aggregates SEC filings, corporate disclosures, and market data into actionable alerts with predictive analytics.

User Comments

Saves hours of research

Timely alerts improve decision-making

Intuitive interface

Accurate data aggregation

Helps spot market trends early

Traction

Launched 2 months ago, 1,200+ ProductHunt upvotes, 8k+ active users, $15k MRR (estimated from pricing page).

Market Size

The global stock market analysis tools market is valued at $10 billion (2023), growing at 8.3% CAGR.

Plancana AI Trading Journal

Track & analyze your trades to level up your day trading

28

Problem

Traders often struggle with effectively tracking and analyzing their trades manually, which can lead to inefficient trading practices and suboptimal performance. The drawbacks of this old situation include difficulties in managing a comprehensive and accurate trading log and planning personalized trading strategies.

Solution

A sleek app that serves as an AI-powered trading journal, offering capabilities to sync with popular trading platforms, provide personalized trading plans, performance tracking, and management of trading psychology.

Customers

Day traders and financial analysts who require tools for detailed trade analysis and performance improvement.

Unique Features

AI-driven personalized trading plans and comprehensive trading psychology management features.

Market Size

The global trading software market was valued at approximately $5.5 billion in 2020 and is expected to grow at a CAGR of 8.1% from 2021 to 2028.

Log your trade, a trading journal

Trading Journal right next in your tradingview charts

6

Problem

Active traders manually track their trading activities by taking screenshots of charts, recording data in spreadsheets, and calculating performance metrics manually, leading to inefficiency and potential errors.

Solution

A TradingView-integrated trading journal tool that auto-captures screenshots and trade data directly from charts, enabling users to tag trades, analyze performance metrics (win rate, average return), and identify patterns in setups/mistakes.

Customers

Active day traders, swing traders, and technical analysts who rely on TradingView for charting and seek systematic performance tracking.

Unique Features

Seamless integration with TradingView for real-time data capture, automated trade tagging/analysis, and visual performance dashboards highlighting behavioral patterns.

User Comments

Automatically logs trades without manual input

Identifies recurring mistakes effectively

Simplifies post-trade analysis

Saves hours weekly

Boosts discipline in trading strategies

Traction

Launched on Product Hunt (2023-11-29), gained 170+ upvotes. 1,800+ active traders use the tool (self-reported). Free tier with $14/month premium plan.

Market Size

The global retail trading tools market is projected to reach $12.5 billion by 2027 (CAGR 6.2%), driven by 25M+ active online traders worldwide.

MindTrajour -The Options Trading Journal

Track trades, spot patterns, and trade smarter every day.

27

Problem

Options traders currently rely on messy spreadsheets and make impulsive decisions due to disorganized tracking, leading to inconsistent performance.

Solution

A web-based options trading journal tool where users can track trades, log emotions, and analyze performance stats to identify patterns and refine strategies. Example: View win/loss ratios per strategy.

Customers

Retail options traders, active day traders, and investors seeking systematic improvement in their trading discipline.

Unique Features

Integrates emotional state logging with quantitative trade data to highlight behavioral biases affecting profitability.

Traction

Launched on ProductHunt (details unspecified), founder’s LinkedIn: https://www.linkedin.com/in/amirmalomari/ (16K+ followers).

Market Size

The global trading software market, including trading journals, was valued at $12.4 billion in 2022 (Grand View Research).

StockAlgos.com Insiders Tool

Analyze insider trading to make strategic investments

221

Problem

Investors often struggle to make informed decisions due to a lack of access to insider trading data and patterns. The drawbacks of this old situation include limited visibility on insider sentiments and potential missed opportunities for strategic investments.

Solution

The product is a data analytics tool that enables users to analyze insider trading data to make strategic investments. It filters and sorts through various data to match search criteria, allowing investors to see insider trading and selling patterns.

Customers

The primary users are likely to be retail investors, financial analysts, and hedge funds who are seeking advanced tools to gain insights into insider trading activities for better investment decisions.

Unique Features

The unique feature of this solution is its ability to provide access to comprehensive insider trading data and patterns, which are not readily available to the general public. It offers a competitive edge in strategic investment planning.

User Comments

Users appreciate the insight into insider trading data.

Highly valued for making informed investment decisions.

Simplifies the process of identifying strategic investment opportunities.

Positive feedback on the usability and functionality of the tool.

Some users wish for more advanced filtering options.

Traction

Due to restrictions on accessing ProductHunt and the product's website, specific traction metrics such as user count, MRR/ARR, or financing details are not available.

Market Size

The global financial analytics market is expected to reach $11.4 billion by 2023, reflecting the demand for advanced analytical tools in financial decision-making.

AI trading bot development

AI trading bot development company - Addus Technologies

5

Problem

The current situation involves users engaging in manual cryptocurrency trading, which can be time-consuming and requires constant monitoring of market trends. The drawbacks include needing to manually analyze data and execute trades, which can lead to missed opportunities and potentially less profitable outcomes.

Solution

An AI trading bot development service that enables users to automate their crypto trading processes. The core feature allows users to develop bots that can execute trades based on pre-set algorithms and market signals, allowing for efficient and potentially more profitable trading.

Customers

Crypto traders, financial analysts, and investors looking to automate their trading and improve efficiency with AI-driven solutions.

Unique Features

The solution offers customized AI trading bot development specifically for the crypto market, ensuring enhanced accuracy and satisfaction in trade execution.

User Comments

Users appreciate the automation of trading tasks.

Customers find the bot development service reliable.

It's seen as a valuable tool for increasing trading efficiency.

Users praise its accuracy in executing trades.

Some find the customization options particularly useful.

Traction

Newly launched features in AI trading bot development, increasing user adoption in the financial tech space. Detailed user metrics or revenue data is not specifically provided in the input information.

Market Size

The global cryptocurrency trading platform market was valued at approximately $1.49 billion in 2020.

Pelosi Trade

Get notified when congress members trade

13

Problem

Users lack timely updates on stock trades made by U.S. Congress members. This includes influential politicians like Nancy Pelosi. Knowing their public stock trades is vital for understanding market movements possibly influenced by political actions, but traditionally this information is scattered and not immediately actionable.

Solution

A notification platform that alerts users when members of Congress make stock trades. The platform enables timely updates and provides detailed insights into the trades of over 210 politicians. This helps users track political trading activity for better investment decisions.

Customers

Interested in stock market investors, political analysts, journalists, and anyone keen on U.S. politics and how it may influence market trends.

Alternatives

View all Pelosi Trade alternatives →

Unique Features

Tracks over 210 US politicians including high-profile names like Nancy Pelosi, which provides comprehensive and unique insights into political influence on markets not readily available through other means.

User Comments

Very insightful platform, offers information you can't easily get elsewhere.

Helps keep track of potential conflict of interests in politics.

Great tool for traders and political enthusiasts alike.

Real-time alerts make this a useful app for timely decision making.

Easy to use and navigate; offers both depth and breadth of data.

Traction

Widely visited on ProductHunt with significant user engagement, but specific figures on user base or revenue are not disclosed on the provided links.

Market Size

The market for financial news and data, specifically tracking government officials' trading, could be worth millions, given the widespread interest in financial markets and political influence.

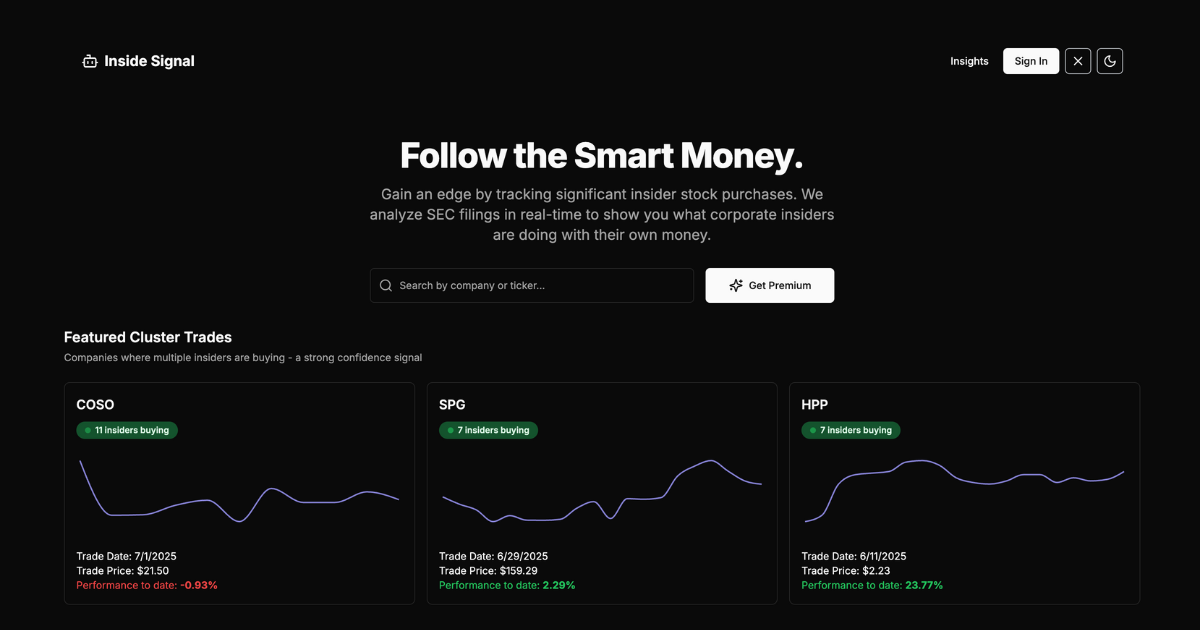

Insider Signal AI

AI-driven platform analyzing insider trading

3

Problem

Users manually track SEC filings to follow insider trades, which is time-consuming and inefficient. Analysis is often delayed or lacks real-time insights.

Solution

AI-driven platform that analyzes SEC filings in real-time, enabling users to track significant insider stock purchases through automated alerts and dashboards.

Customers

Individual investors, financial analysts, and stock traders seeking data-driven investment strategies (demographics: 25–50 years old, tech-savvy professionals).

Alternatives

View all Insider Signal AI alternatives →

Unique Features

Real-time SEC filing analysis, prioritization of high-impact trades via AI, customizable alerts, and portfolio integration tools.

User Comments

Saves hours of manual research

Timely alerts improve trade decisions

User-friendly interface for non-experts

Accurate filtering of meaningful trades

Enhances portfolio performance

Traction

Launched in 2023, 1,000+ active users (estimated via Product Hunt engagement), founder has 2,200+ followers on X (per linked profile).

Market Size

The global stock trading platform market reached $8.6 billion in 2022 (Statista 2023), with AI-driven analytics growing at 24% CAGR.